Bring your Financial Agreements to life with Promissory Note Templates from Template.net

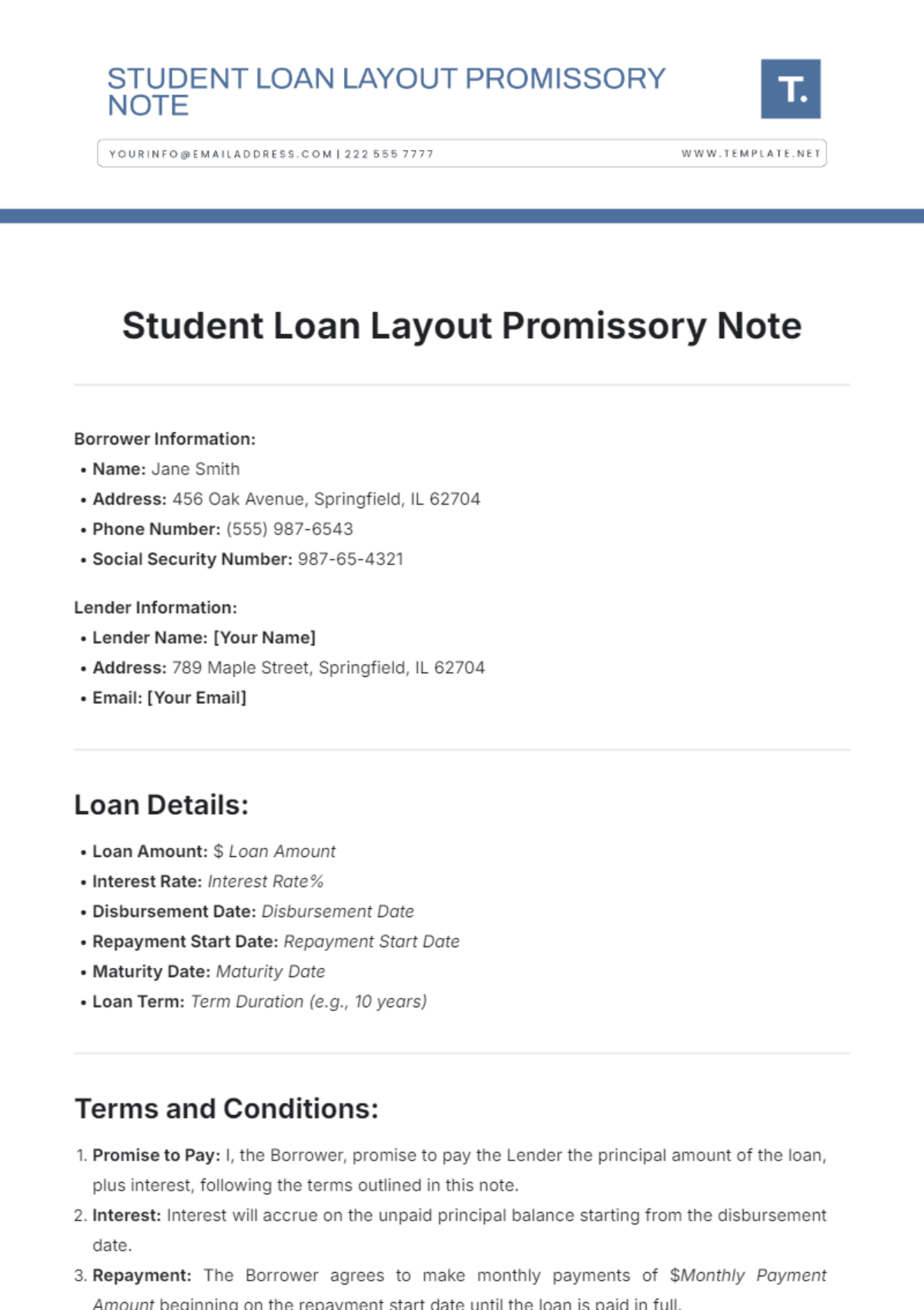

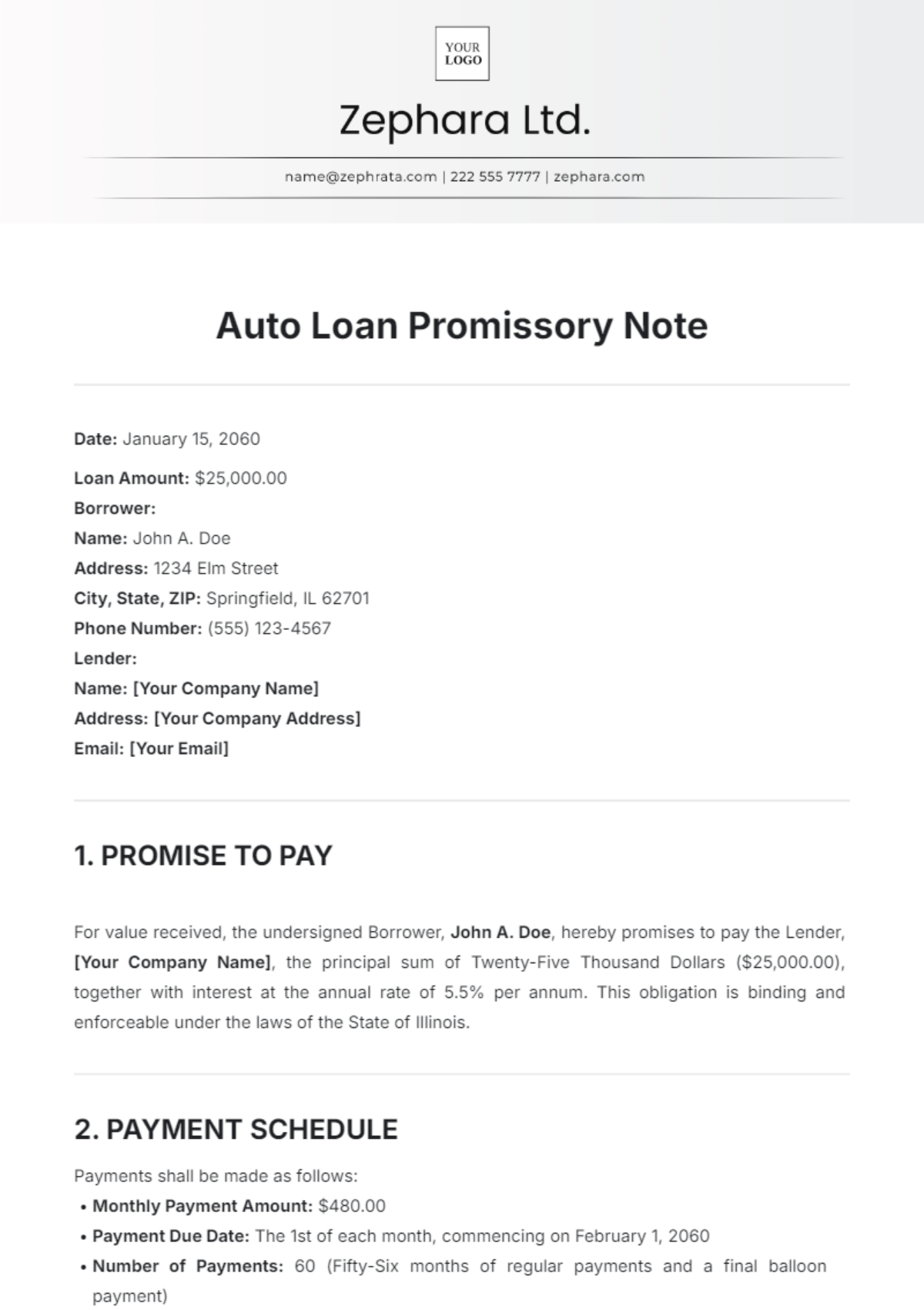

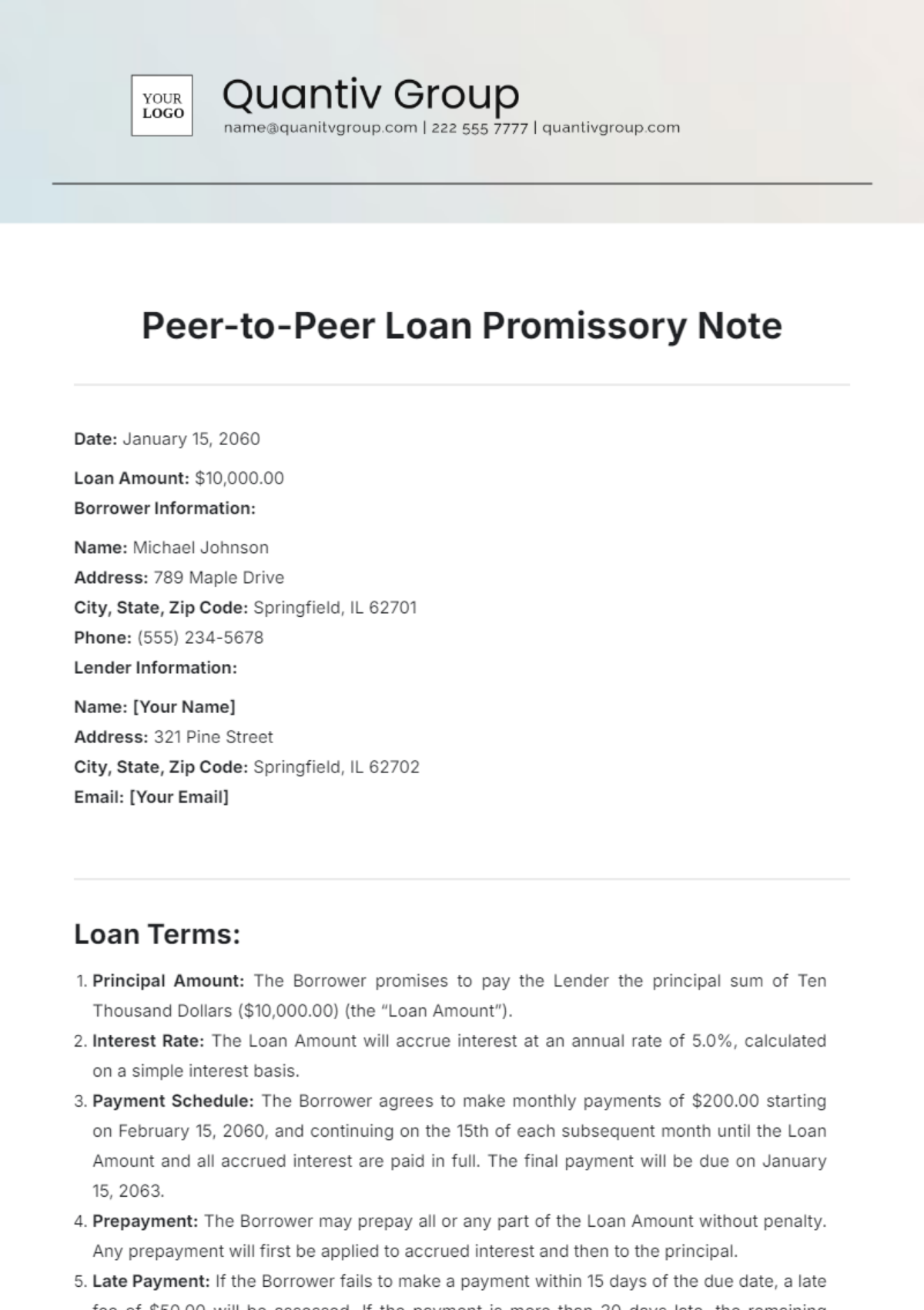

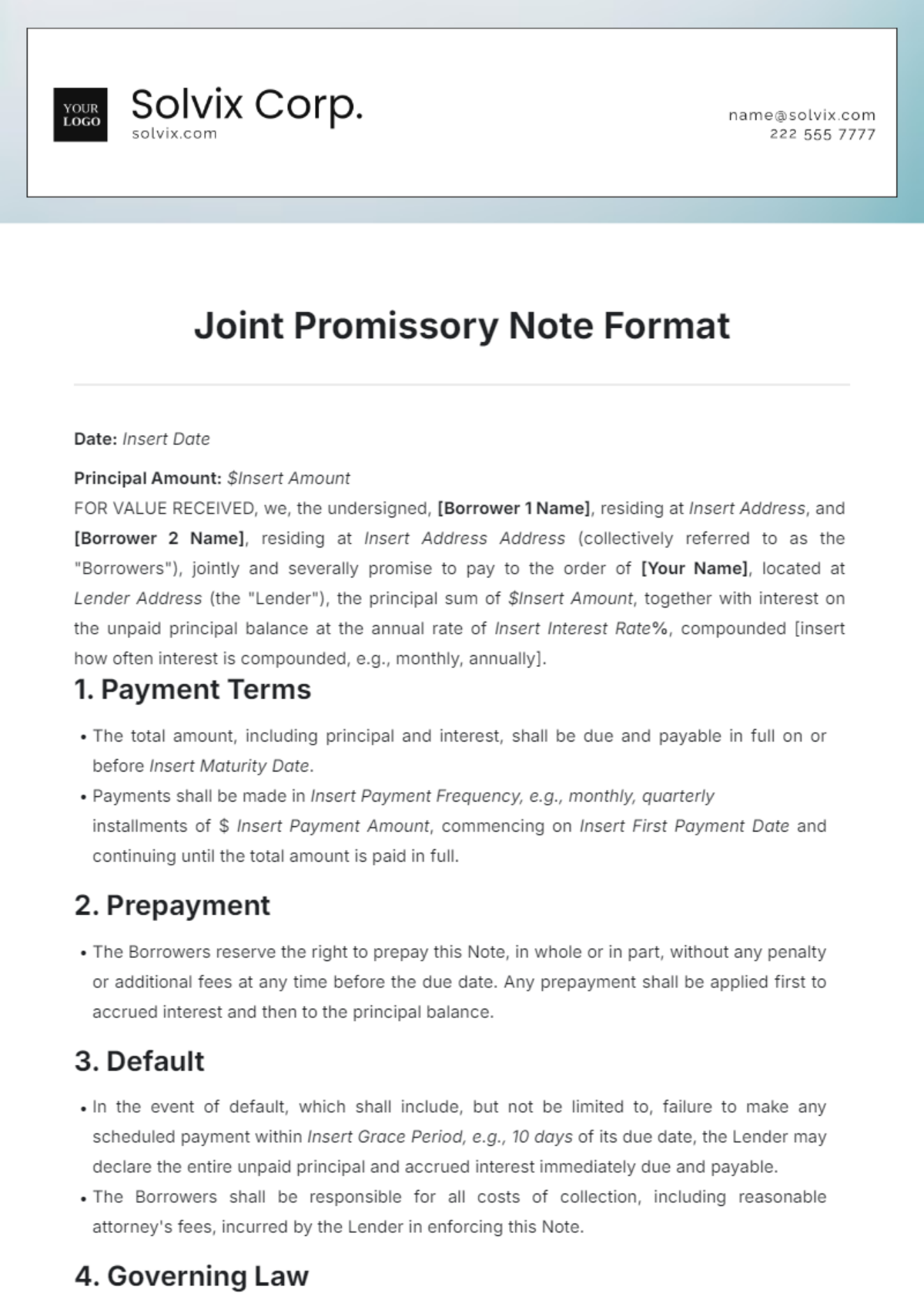

Keep your legal and finance professionals engaged, streamline your documentation process, and enhance your credibility with our expertly crafted Promissory Note Templates. Instantly Promissory Note Maker designed for seamless business transactions and personal loans. Whether you need to formalize a family loan agreement or protect your business interests with detailed terms, our templates provide clarity and legal reinforcement. Each template includes essential details, such as borrower information, payment schedules, and interest rates, ensuring comprehensive and professional-grade documents. Effortlessly customize each template to suit your specific needs, no legal expertise required, and start saving time with easy printing or digital distribution options.

Discover the many Promissory Note Templates we have on hand, specifically tailored for various industries and personal use. Select a template that looks perfect for your needs, swap in your own text or logo, and tweak the colors and fonts to match your brand. With drag-and-drop ease, you can add icons, graphics, and even animated effects to make your document stand out. The possibilities are truly endless, and you don't need any special skills to create a professional document. Stay tuned for regularly updated templates that keep your documents fresh and current. When you're finished, download or share via email or publish directly to social media for instant access.