Bring Your Creative Marketing Plans to Life with Insurance Agency Templates from Template.net

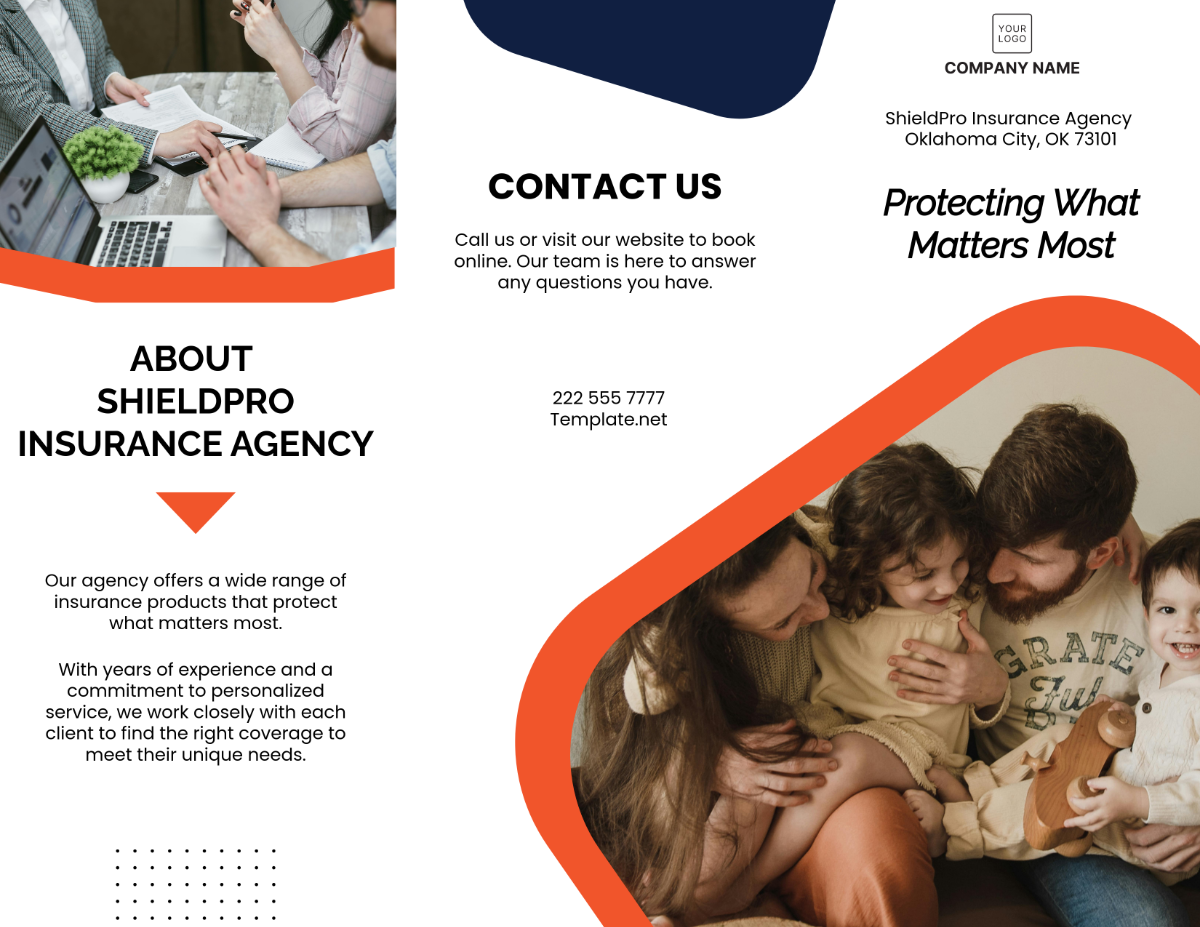

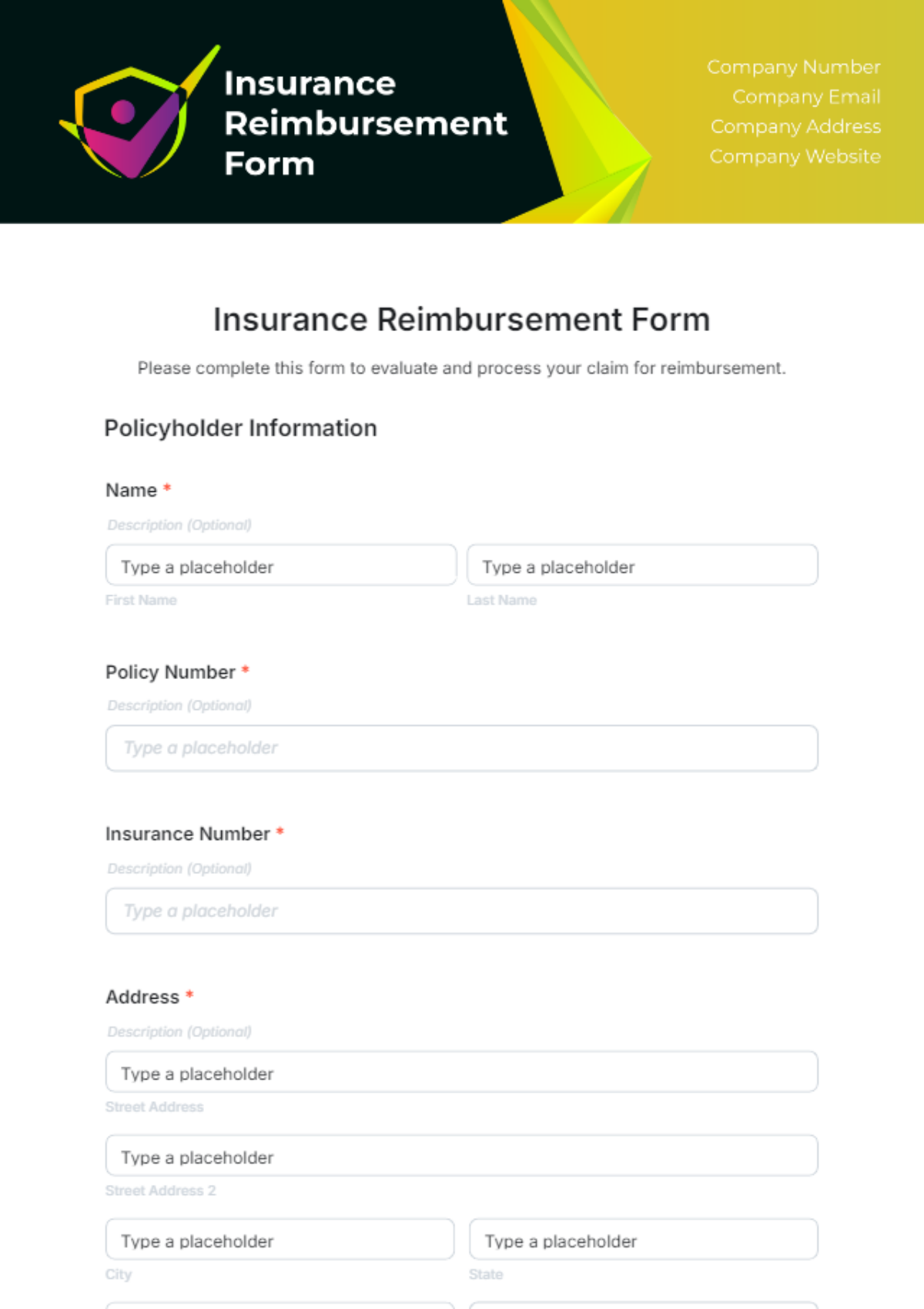

Keep your marketing team engaged, boost client outreach, and enhance brand visibility with our Insurance Agency Templates from Template.net. Designed specifically for insurance businesses, these templates enable you to elevate your brand with ease and professionalism. Promote your latest insurance plans or send out personalized invitations to corporate events seamlessly. Our templates come equipped with essential details like customizable contact info and options to add QR codes for easy access to information. No design skills are required, as each template is crafted with a professional-grade layout and can be printed or distributed digitally, offering flexibility and saving you time and resources.

Discover the many template designs we have on hand that cater to various needs and aesthetics of insurance agencies. Select the perfect template, effortlessly swap in your company's assets, and adjust colors and fonts to match your brand identity. For an extra polished look, drag and drop icons, integrate graphics, or add animated effects to captivate your audience. Thanks to AI-powered text tools, the possibilities are endless and skill-free, ensuring a smooth design experience. Our library is packed with regularly updated templates to keep your marketing materials fresh and engaging. When you're finished, choose to download or share your completed masterpiece via email, print, or export to other digital platforms.