Free US Household Savings vs Debt Ratio from 2015 to 2025 Chart

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

AI AI Chart and Graph Generator

Generate my free AI Chart and Graph Text or voice to generate a free AI Chart and Graph

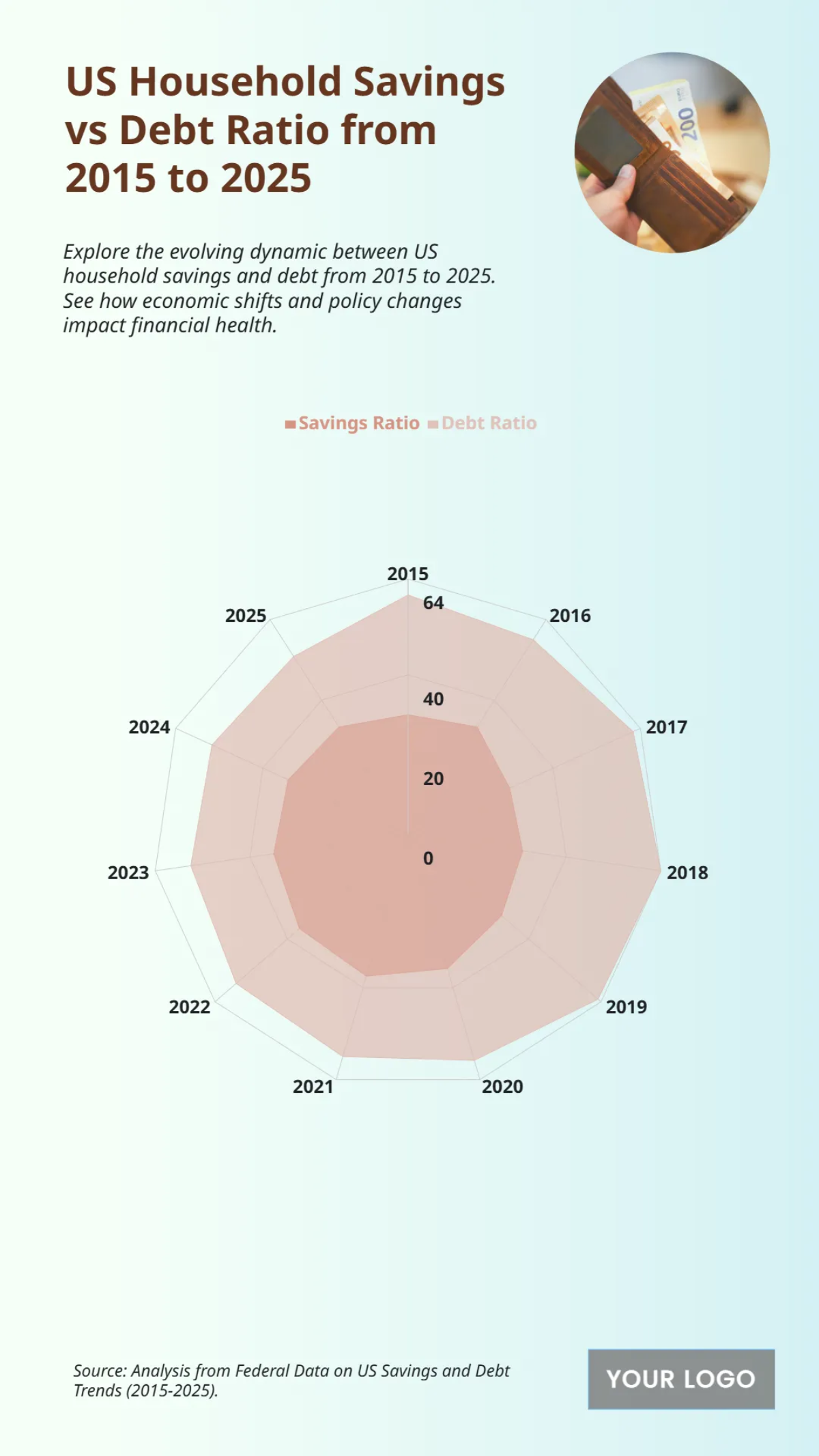

The chart provides an overview of the US household savings and debt ratio from 2015 to 2025, revealing a clear inverse relationship between the two financial indicators. From 2015 to 2019, the debt ratio increased from approximately 55 to 60, while the savings ratio steadily declined from about 48 to 30. This trend was dramatically reversed in 2020, as the savings ratio surged to a peak of around 55, and the debt ratio fell to 50. Following that reversal, the pre-pandemic trend largely resumed. The chart demonstrates that by 2025, the debt ratio is projected to reach its highest point at 64, while the savings ratio returns to approximately 48.

You may also like

- Bar Graph Chart

- Line Graph Chart

- Pie Graph Chart

- Table Graph Chart

- Scatter Graph Chart

- Area Graph Chart

- Tree Graph Chart

- Birth Chart

- Chore Chart

- Time Table Chart

- Dress Size Chart

- Football Depth Chart

- Color Chart

- Color Wheel Chart

- Color Mix Chart

- Classroom Seating Chart

- Church Organizational Chart

- Hierarchy Organizational Chart

- Tree Organizational Chart

- Organization Chart

- Time Chart

- Blood Pressure Chart

- Behavior Chart

- Process Flowchart

- Process Flow Chart

- Baby Feeding Chart

- BMI Chart

- Ring Size Chart

- Height Chart

- Number Chart

- Food Chart

- Baby Milestones Chart

- Blood Sugar Chart

- Body Temperature Chart

- Diet Chart

- Metric Chart

- Pregnancy Weight Gain Chart

- HCG Levels Chart

- Astrology Chart

- Blood Oxygen Level Chart

- Gauge Chart

- Sales Chart

- Marketing Chart

- Military Time Chart

- Pregnancy Food Chart

- Medical Chart

- Wedding Seating Chart

- Guitar Chord Chart

- Pedigree Chart

- Natal Chart

- Team Organizational Chart

- Feelings Chart

- Piano Chord Chart

- Shoe Size Chart

- Activity Chart

- Height Weight

- Eye Chart

- Chakra Chart

- Reflexology Chart

- Hospital Organizational Chart

- Radar Chart

- College Organizational Chart

- Column Chart

- Roman Numerals Chart

- Weather Chart

- Height Conversion Chart

- Food Calorie Chart

- Fundraising Chart

- Kids Chore Chart

- Donut Chart

- Incident Flow Chart

- Patient Chart

- Body Measurement Chart

- Synastry Chart

- Funnel Chart

- Goal Chart

- Weight Loss Chart

- Money Chart

- Research FlowChart

- Medical Organizational Chart

- Protein Chart

- Retail Organizational Chart

- Sports Organizational Chart

- Vitamin Chart

- Research Gantt Chart

- To Do Chart

- Tooth Chart

- Conjugation Chart

- Drug Chart

- Event FlowChart

- Gildan Size Chart

- Logistics Organizational Chart

- Production FlowChart

- Bank Organizational Chart

- Dental Chart

- Dissertation Gantt Chart

- Training Gantt Chart

- Warehouse Organizational Chart

- Army Weight Chart

- Communication FlowChart

- Face Chart

- Pharma Organizational Chart

- Travel Gantt Chart

- Gaming FlowChart

- Insurance Organizational Chart

- Manufacturing Chart

- Progress Chart

- Travel Organizational Chart

- Charity FlowChart

- Design Firm/Company Organizational Chart

- Hospital Gantt Chart

- Manufacturing Gantt Chart

- Recruitment Gantt Chart

- Website Gantt Chart

- Environment Organizational Chart

- Fire Organizational Chart