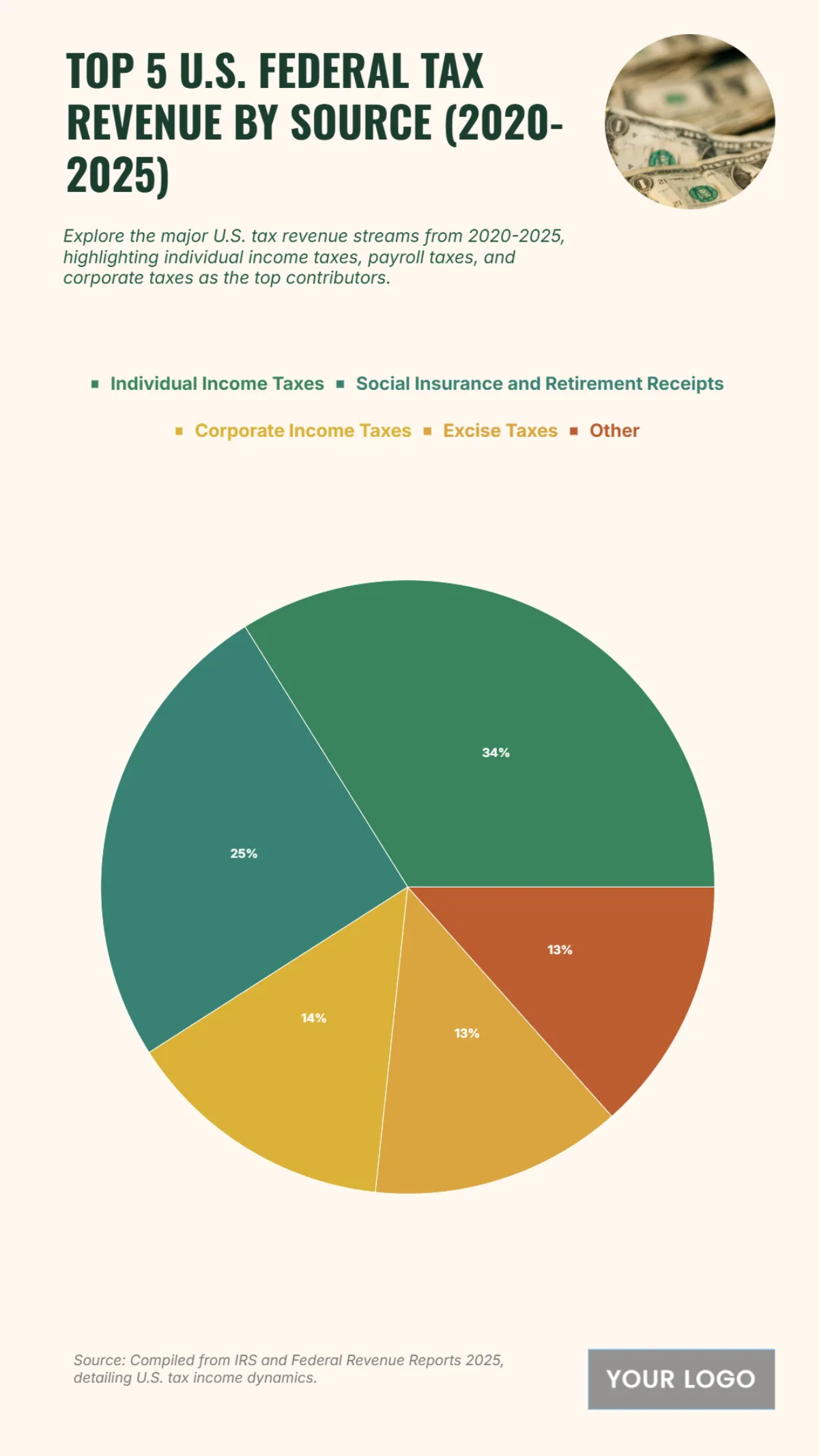

Free Top 5 U.S. Federal Tax Revenue by Source (2020-2025) Chart

Between 2020 and 2025, U.S. federal tax revenue was primarily generated by five key sources: Individual Income Taxes, Social Insurance and Retirement Receipts, Corporate Income Taxes, Excise Taxes, and Other sources. Individual Income Taxes were the largest contributor, accounting for 34% of the total revenue. This was followed by Social Insurance and Retirement Receipts, which made up 25% of the total. A significant portion of the remaining revenue came from Corporate Income Taxes at 14%. The remaining two categories, Excise Taxes and Other, each contributed 13% to the total revenue. This distribution highlights the reliance of the U.S. government on individual and payroll taxes as its primary income streams. The chart shows a clear breakdown of the financial contributions from each sector, providing a snapshot of the major revenue sources for the U.S. government during this five-year period.