Free U.S. Consumer Credit Utilization by Income Bracket (2015-2025) Chart

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

AI AI Chart and Graph Generator

Generate my free AI Chart and Graph Text or voice to generate a free AI Chart and Graph

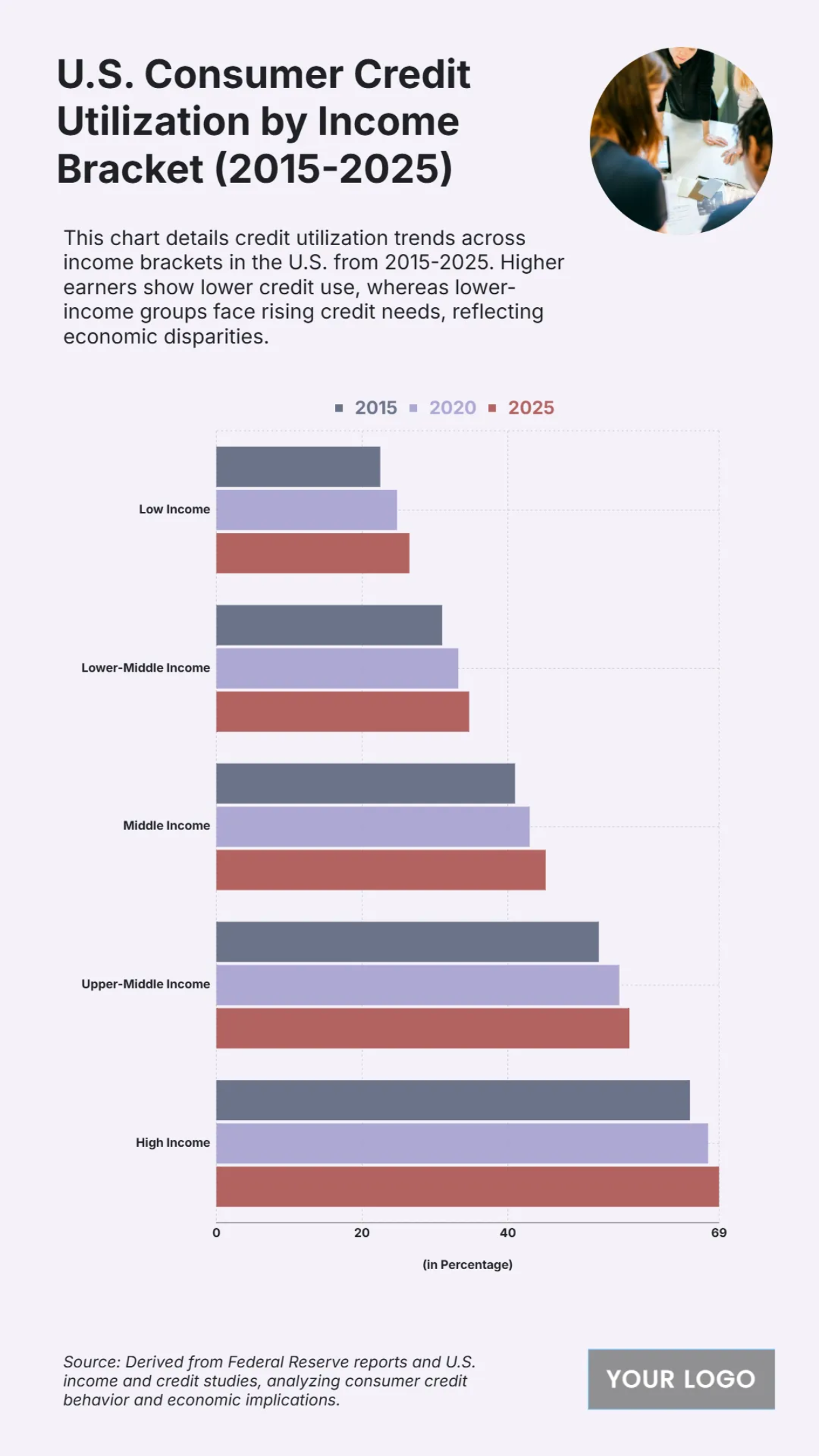

The chart provides an overview of U.S. consumer credit utilization by income bracket from 2015 to 2025, revealing a clear pattern of higher credit use among lower-income groups. High-income households consistently have the lowest utilization rate, with their use decreasing from approximately 49% in 2015 to 45% in 2025. In contrast, lower-income households' credit utilization has grown from around 25% to 32% over the same period. The data shows that the gap in credit utilization between the highest and lowest income brackets is narrowing due to the rising credit needs of lower-income consumers, reflecting economic disparities.

You may also like

- Bar Graph Chart

- Line Graph Chart

- Pie Graph Chart

- Table Graph Chart

- Scatter Graph Chart

- Area Graph Chart

- Tree Graph Chart

- Birth Chart

- Chore Chart

- Time Table Chart

- Dress Size Chart

- Football Depth Chart

- Color Chart

- Color Wheel Chart

- Color Mix Chart

- Classroom Seating Chart

- Church Organizational Chart

- Hierarchy Organizational Chart

- Tree Organizational Chart

- Organization Chart

- Time Chart

- Blood Pressure Chart

- Behavior Chart

- Process Flowchart

- Process Flow Chart

- Baby Feeding Chart

- BMI Chart

- Ring Size Chart

- Height Chart

- Number Chart

- Food Chart

- Baby Milestones Chart

- Blood Sugar Chart

- Body Temperature Chart

- Diet Chart

- Metric Chart

- Pregnancy Weight Gain Chart

- HCG Levels Chart

- Astrology Chart

- Blood Oxygen Level Chart

- Gauge Chart

- Sales Chart

- Marketing Chart

- Military Time Chart

- Pregnancy Food Chart

- Medical Chart

- Wedding Seating Chart

- Guitar Chord Chart

- Pedigree Chart

- Natal Chart

- Team Organizational Chart

- Feelings Chart

- Piano Chord Chart

- Shoe Size Chart

- Activity Chart

- Height Weight

- Eye Chart

- Chakra Chart

- Reflexology Chart

- Hospital Organizational Chart

- Radar Chart

- College Organizational Chart

- Column Chart

- Roman Numerals Chart

- Weather Chart

- Height Conversion Chart

- Food Calorie Chart

- Fundraising Chart

- Kids Chore Chart

- Donut Chart

- Incident Flow Chart

- Patient Chart

- Body Measurement Chart

- Synastry Chart

- Funnel Chart

- Goal Chart

- Weight Loss Chart

- Money Chart

- Research FlowChart

- Medical Organizational Chart

- Protein Chart

- Retail Organizational Chart

- Sports Organizational Chart

- Vitamin Chart

- Research Gantt Chart

- To Do Chart

- Tooth Chart

- Conjugation Chart

- Drug Chart

- Event FlowChart

- Gildan Size Chart

- Logistics Organizational Chart

- Production FlowChart

- Bank Organizational Chart

- Dental Chart

- Dissertation Gantt Chart

- Training Gantt Chart

- Warehouse Organizational Chart

- Army Weight Chart

- Communication FlowChart

- Face Chart

- Pharma Organizational Chart

- Travel Gantt Chart

- Gaming FlowChart

- Insurance Organizational Chart

- Manufacturing Chart

- Progress Chart

- Travel Organizational Chart

- Charity FlowChart

- Design Firm/Company Organizational Chart

- Hospital Gantt Chart

- Manufacturing Gantt Chart

- Recruitment Gantt Chart

- Website Gantt Chart

- Environment Organizational Chart

- Fire Organizational Chart