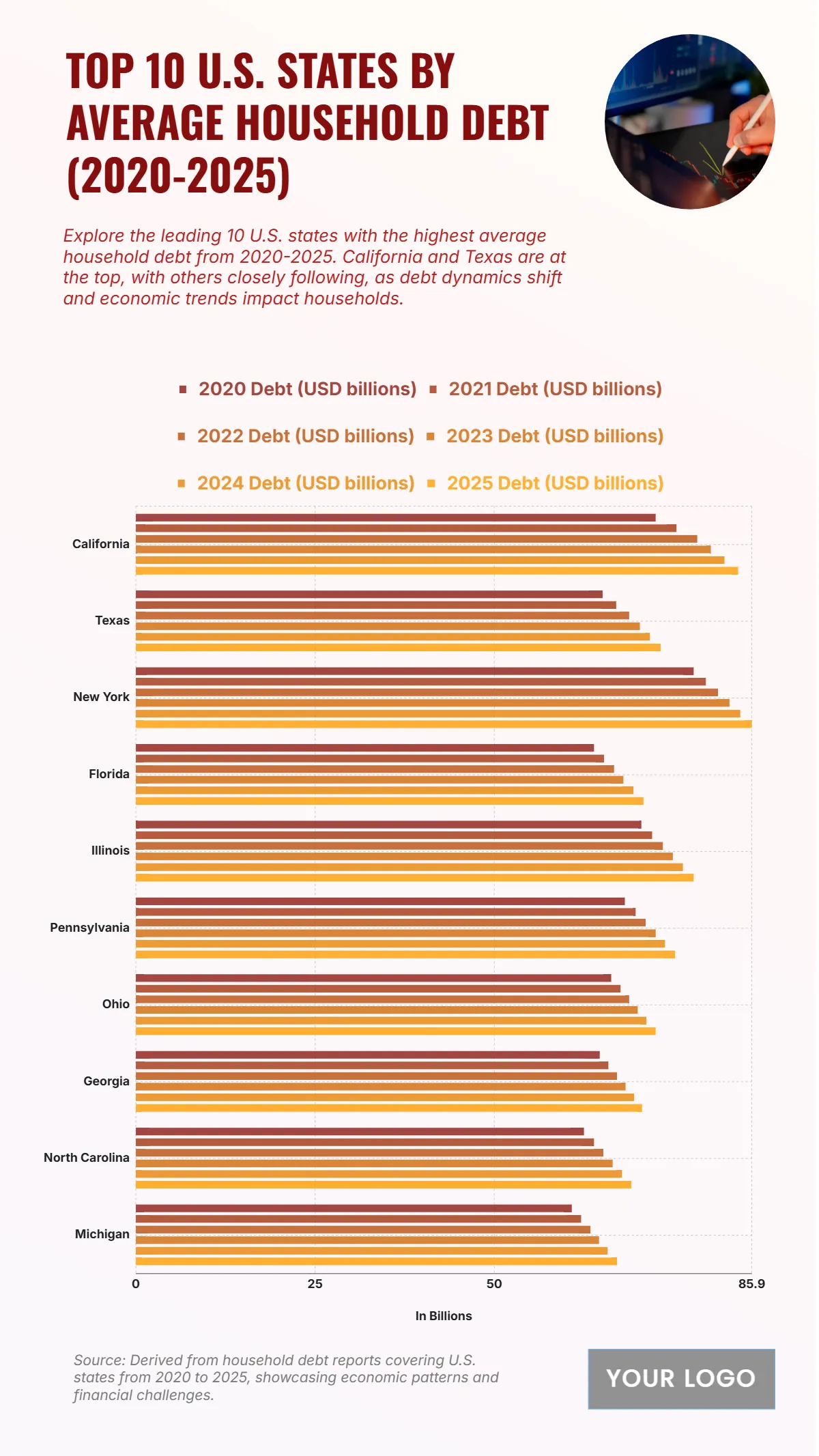

Free Top 10 U.S. States by Average Household Debt (2020–2025) Chart

The chart titled “Top 10 U.S. States by Average Household Debt (2020–2025)” presents the states with the highest accumulated household debt over this six-year period, revealing consistent growth across all regions. California leads the list, with household debt increasing from roughly USD 70 billion in 2020 to about USD 85.9 billion by 2025, indicating the highest borrowing levels nationwide. Texas follows closely, reaching around USD 80 billion by 2025, showing significant financial strain among households. New York holds the third position, climbing from approximately USD 65 billion in 2020 to nearly USD 78 billion in 2025. Florida and Illinois also exhibit notable increases, both surpassing USD 70 billion by the end of the period. Pennsylvania, Ohio, and Georgia record household debts between USD 60 and 68 billion, reflecting steady but moderate growth. North Carolina and Michigan complete the top ten, each approaching the USD 60 billion mark by 2025. Overall, the data highlights a widespread rise in household debt across the nation, with California, Texas, and New York experiencing the most pronounced increases, underscoring ongoing economic pressures affecting American families.

| State | Change (%) | Debt (USD billions) 2020 | Debt (USD billions) 2021 | Debt (USD billions) 2022 |

Debt (USD billions) 2023 |

| Virginia | 13 | 45 | 48 | 51 | 54 |

| Arizona | 11.8 | 42 | 45 | 48 | 51 |

| Pennsylvania | 11.1 | 38 | 41 | 44 | 47 |

| Florida | 10 | 35 | 38 | 41 | 44 |

| Georgia | 10 | 33 | 36 | 39 | 42 |

| Texas | 10 | 31 | 34 | 37 | 40 |

| North Carolina | 7.1 | 28 | 31 | 34 | 37 |

| Maryland | 5.7 | 26 | 29 | 32 | 35 |

| Michigan | 3.8 | 24 | 27 | 30 | 33 |

| Missouri | 2.2 | 22 | 25 | 28 | 31 |

| Indiana | 2.1 | 20 | 23 | 26 | 29 |

| Tennessee | 2 | 19 | 22 | 25 | 28 |

| Colorado | -1.2 | 18 | 21 | 24 | 27 |

| Wisconsin | -1.2 | 17 | 20 | 23 | 26 |

| New Jersey | -4 | 16 | 19 | 22 | 25 |

| Illinois | -4.5 | 15 | 18 | 21 | 24 |

| New York | -5 | 14 | 17 | 20 | 23 |

| Massachusetts | -5.7 | 13 | 16 | 19 | 22 |

| Ohio | -9.4 | 12 | 15 | 18 | 21 |

| California | -10 | 11 | 14 | 17 | 20 |