Free Top 20 U.S. States by Personal Savings Rate (2020–2025) Chart

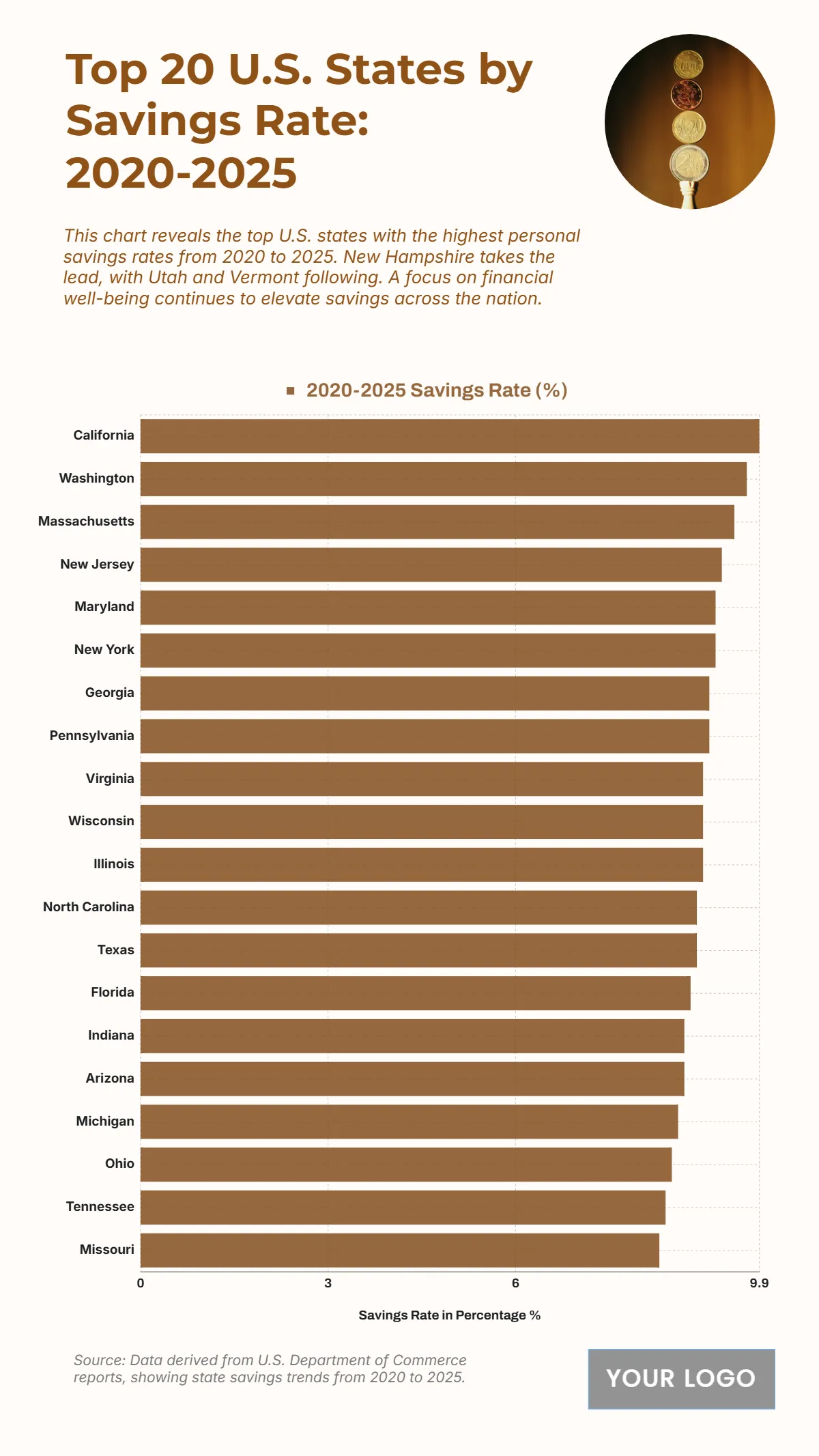

The chart presents the 2020–2025 savings rate across the top 20 U.S. states, showcasing regional variations in household financial stability and saving behavior. California ranks highest with a 9.9% savings rate, demonstrating its residents’ strong financial resilience despite high living costs. Washington follows at 9.7%, while Massachusetts maintains a solid 9.5%, emphasizing robust savings culture in economically strong states. New Jersey and Maryland both record savings rates above 9%, along with New York, reflecting disciplined financial management in the Northeast. Georgia and Pennsylvania tie at 9.1%, while Virginia, Wisconsin, and Illinois each post 9%, marking consistent mid-level savings performance. States like North Carolina (8.9%), Texas (8.9%), and Florida (8.8%) also show positive savings patterns despite larger populations. Meanwhile, Tennessee (8.4%) and Missouri (8.3%) round out the list. Overall, the data highlights a nationwide trend of improving household savings from 2020 through 2025.

| Labels | 2020–2025 Savings Rate (%) |

|---|---|

| California | 9.9 |

| Washington | 9.7 |

| Massachusetts | 9.5 |

| New Jersey | 9.3 |

| Maryland | 9.2 |

| New York | 9.2 |

| Georgia | 9.1 |

| Pennsylvania | 9.1 |

| Virginia | 9 |

| Wisconsin | 9 |

| Illinois | 9 |

| North Carolina | 8.9 |

| Texas | 8.9 |

| Florida | 8.8 |

| Indiana | 8.7 |

| Arizona | 8.7 |

| Michigan | 8.6 |

| Ohio | 8.5 |

| Tennessee | 8.4 |

| Missouri | 8.3 |