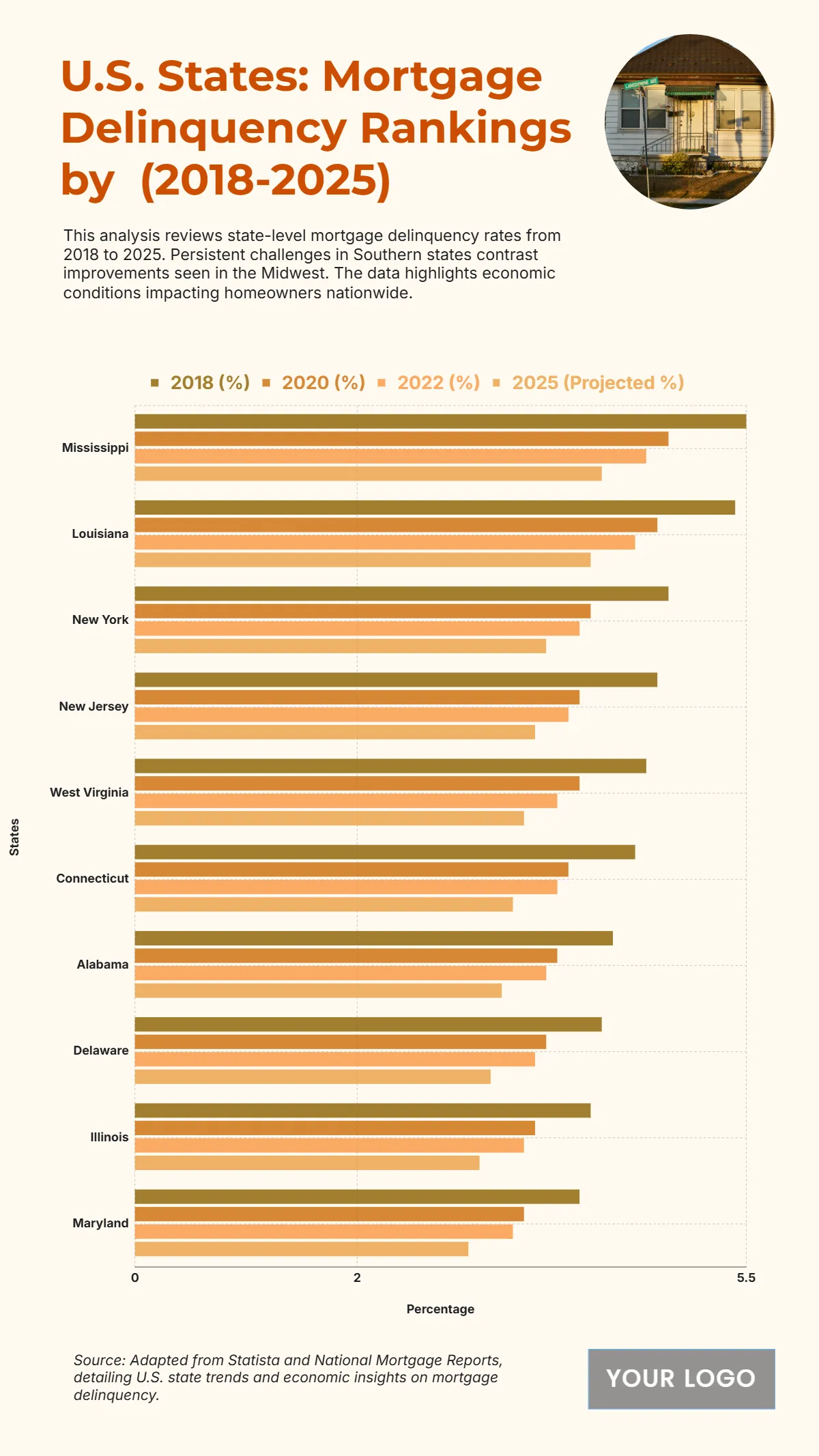

Free Top 10 States by Mortgage Delinquency Rates (2018–2025)

The chart shows the declining trend in mortgage delinquency rates across U.S. states from 2018 to 2025, reflecting gradual improvements in economic and housing stability. Mississippi starts with the highest delinquency rate of 5.5% in 2018, steadily dropping to 4.2% projected for 2025. Louisiana follows closely, decreasing from 5.4% to 4.1% over the same period. New York and New Jersey both show significant declines, from 4.8% to 3.7% and from 4.7% to 3.6%, respectively. West Virginia moves from 4.6% to 3.5%, and Connecticut from 4.5% to 3.4%, indicating steady recovery. Meanwhile, Alabama, Delaware, Illinois, and Maryland record their lowest projected delinquency rates in 2025 at 3.3%, 3.2%, 3.1%, and 3.0% respectively. The overall downward trend across all states highlights improved loan repayment performance and economic resilience in the housing market.

| Labels | 2018 (%) | 2020 (%) | 2022 (%) | 2025 (Projected %) |

|---|---|---|---|---|

| Mississippi | 5.5 | 4.8 | 4.6 | 4.2 |

| Louisiana | 5.4 | 4.7 | 4.5 | 4.1 |

| New York | 4.8 | 4.1 | 4.0 | 3.7 |

| New Jersey | 4.7 | 4.0 | 3.9 | 3.6 |

| West Virginia | 4.6 | 4.0 | 3.8 | 3.5 |

| Connecticut | 4.5 | 3.9 | 3.8 | 3.4 |

| Alabama | 4.3 | 3.8 | 3.7 | 3.3 |

| Delaware | 4.2 | 3.7 | 3.6 | 3.2 |

| Illinois | 4.1 | 3.6 | 3.5 | 3.1 |

| Maryland | 4.0 | 3.5 | 3.4 | 3.0 |