Free U.S. Top 10 States with the Lowest State Sales Tax Revenue (2020-2025) Chart

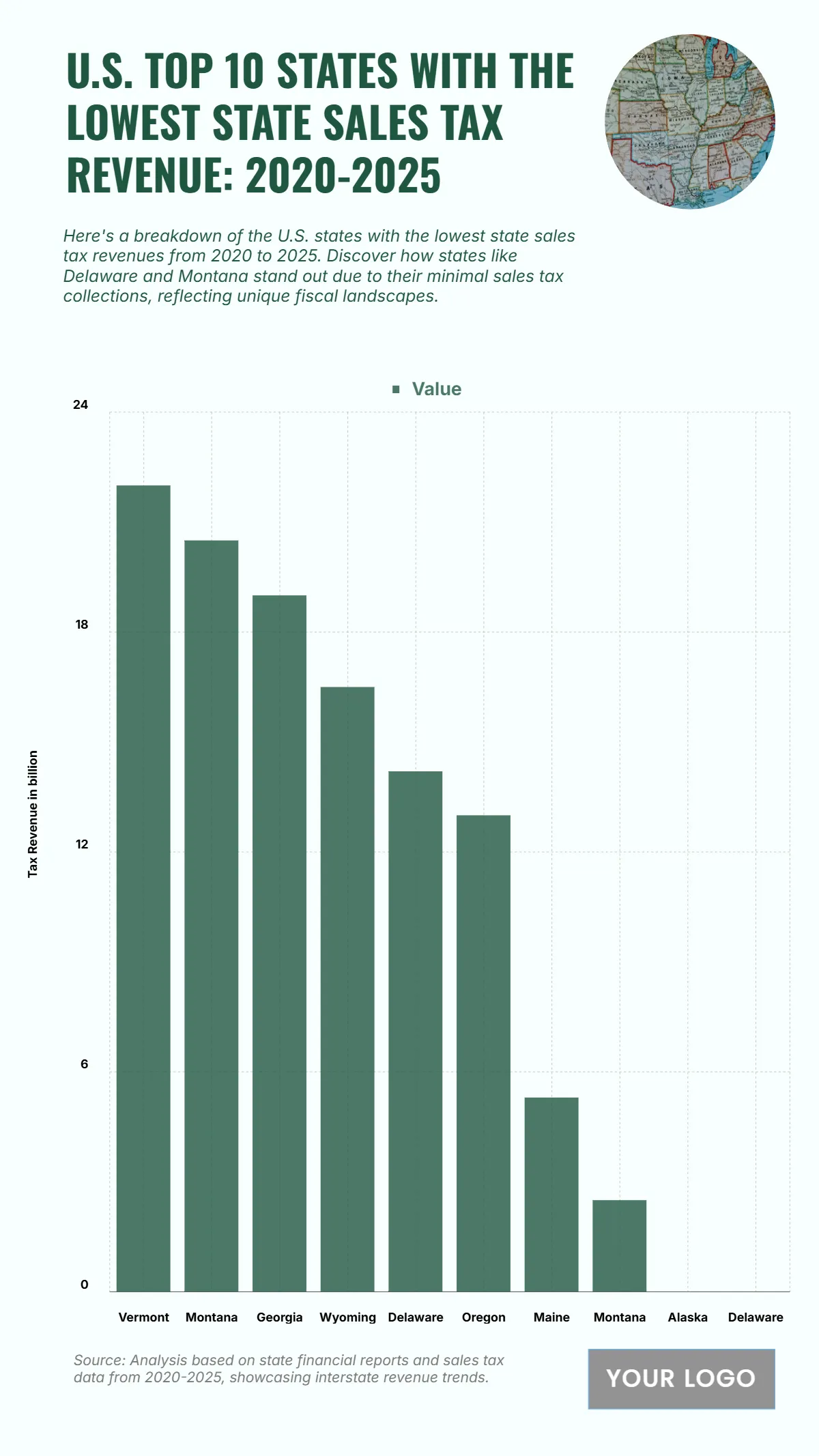

The chart titled “U.S. Top 10 States with the Lowest State Sales Tax Revenue: 2020–2025” highlights states generating the least income from sales tax collections. Vermont records the highest among the low-revenue states at approximately USD 23 million, followed by Montana with around USD 20 million. Georgia and Wyoming rank next, collecting between USD 16 and 18 million during the same period. Delaware and Oregon follow closely, earning about USD 14 and 13 million, respectively, due to their limited or no state-level sales taxes. Maine, Montana, Alaska, and Delaware rank at the bottom, each below USD 10 million. The chart underscores the fiscal diversity among states, reflecting how different tax structures and policy choices contribute to varying levels of revenue dependence between 2020 and 2025.

| Labels | Value |

| Vermont | 22 |

| Montana | 20.5 |

| Georgia | 19 |

| Wyoming | 16.5 |

| Delaware | 14.2 |

| Oregon | 13 |

| Maine | 5.3 |

| Montana | 2.5 |

| Alaska | 0 |

| Delaware | 0 |