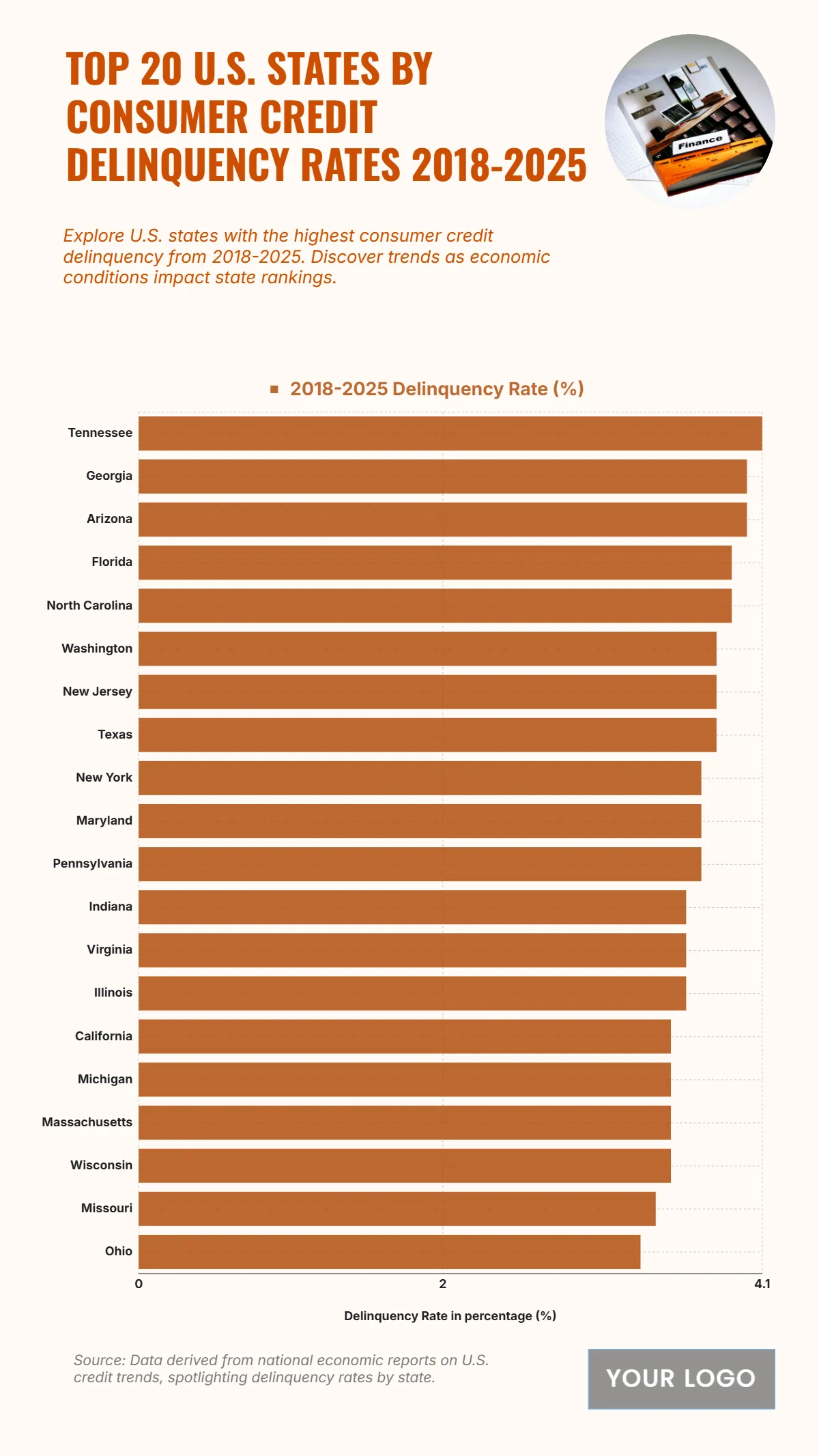

Free Top 20 U.S. States by Consumer Credit Delinquency Rates (2018-2025) Chart

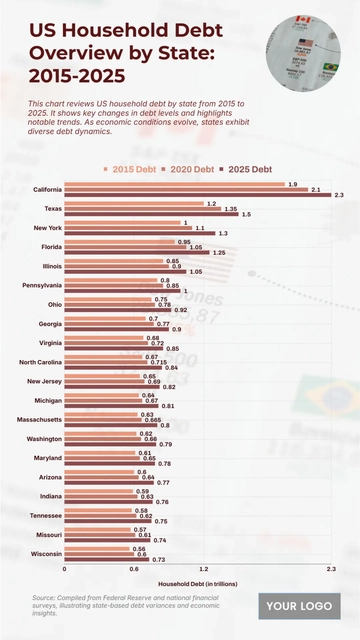

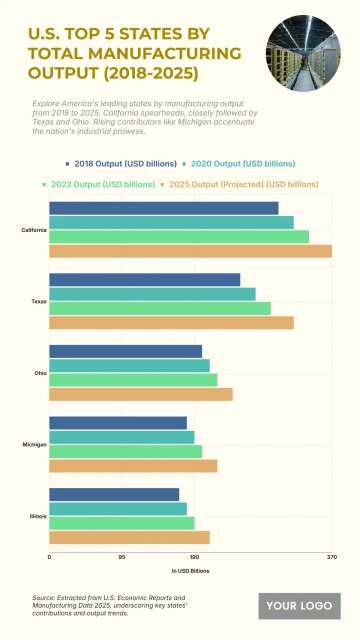

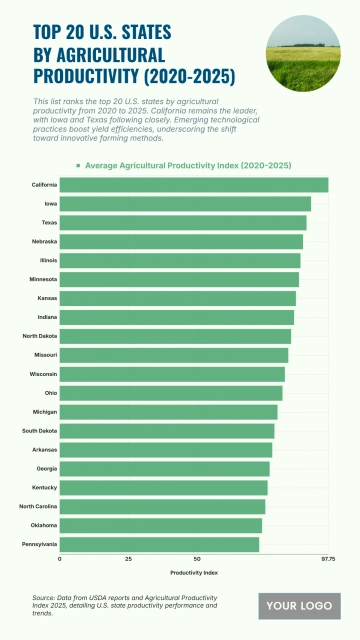

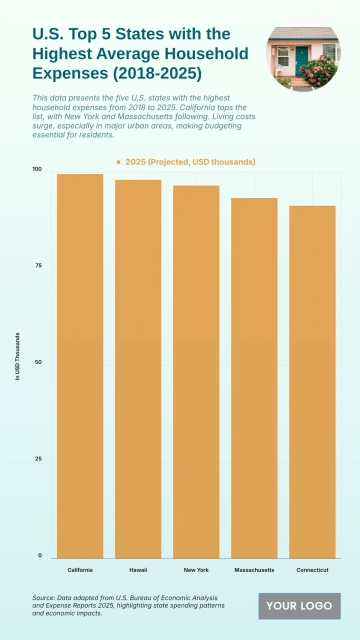

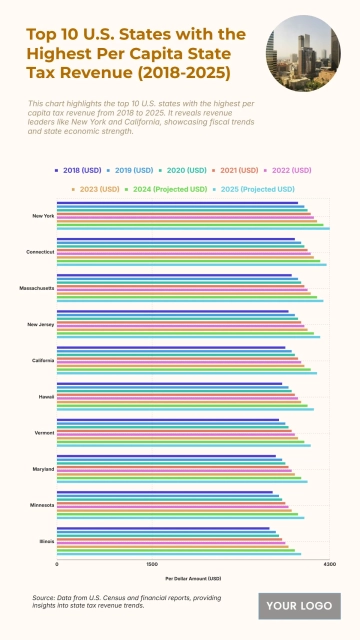

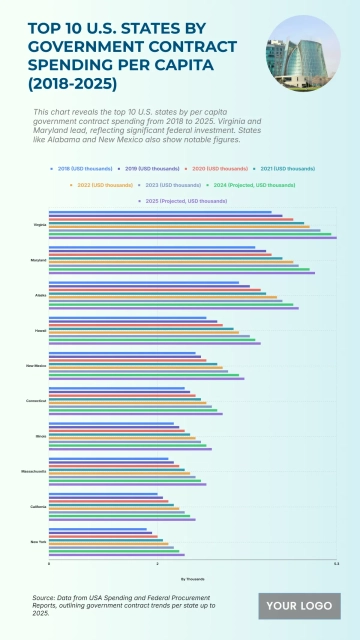

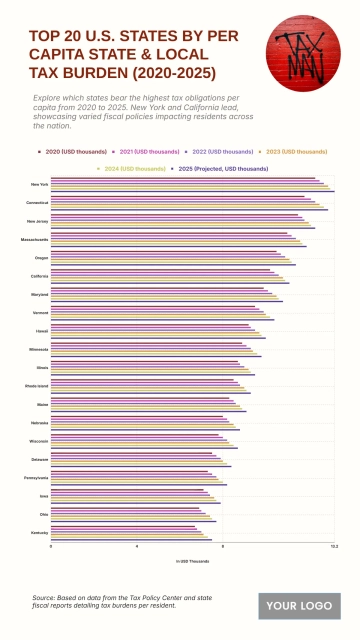

“Top 20 U.S. States by Consumer Credit Delinquency Rates (2018–2025)” outlines states with the highest levels of overdue credit accounts during the period. Tennessee ranks first, recording the highest delinquency rate at around 4.1%, reflecting increased financial strain among households. Georgia and Arizona follow closely, both maintaining rates just under 4%. Florida and North Carolina also experience elevated delinquency levels, averaging around 3.8%. States such as Washington, New Jersey, and Texas remain near the national average at 3.6–3.7%. Meanwhile, northeastern states including New York, Maryland, and Pennsylvania display moderate rates close to 3.5%. The remaining states, such as California, Illinois, and Ohio, maintain slightly lower figures under 3.4%. Overall, the chart highlights rising consumer debt challenges and economic disparities across the nation, underscoring how regional cost pressures and inflation have influenced credit repayment behaviors from 2018 to 2025.

| Labels |

2018–2025 Delinquency Rate (%) |

| Tennessee | 4.1 |

| Georgia | 4 |

| Arizona | 4 |

| Florida | 3.9 |

| North Carolina | 3.9 |

| Washington | 3.8 |

| New Jersey | 3.8 |

| Texas | 3.8 |

| New York | 3.7 |

| Maryland | 3.7 |

| Pennsylvania | 3.7 |

| Indiana | 3.6 |

| Virginia | 3.6 |

| Illinois | 3.6 |

| California | 3.5 |

| Michigan | 3.5 |

| Massachusetts | 3.5 |

| Wisconsin | 3.5 |

| Missouri | 3.4 |

| Ohio | 3.3 |