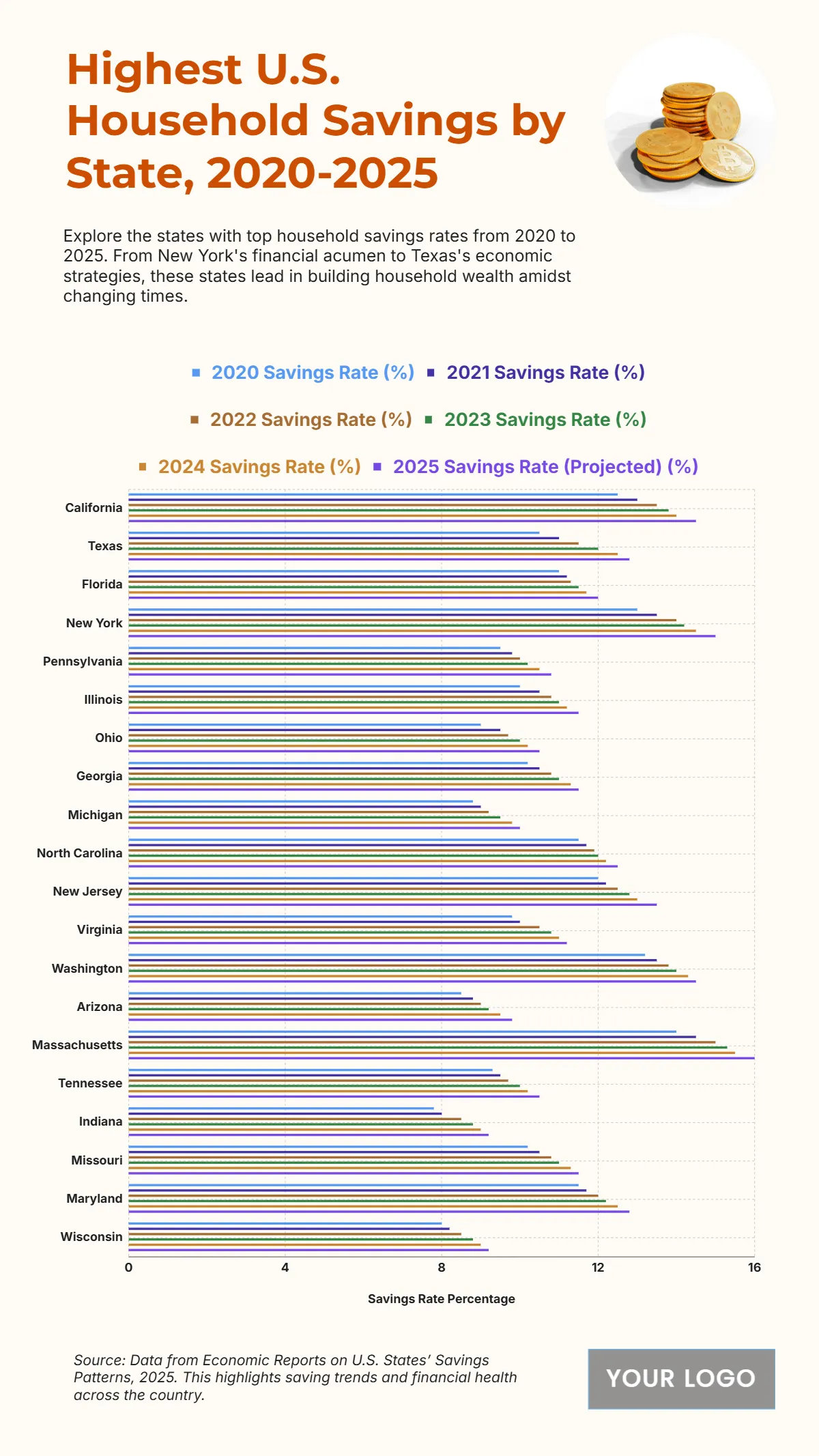

The chart illustrates the U.S. states with the highest household savings rates from 2020 to 2025, showcasing how Americans are managing wealth amid evolving economic conditions. California leads consistently, with savings rates projected to reach around 15% by 2025, driven by high-income households and strong investment returns. Texas and Florida follow, each maintaining rates between 13% and 14%, reflecting steady income growth and lower cost-of-living benefits. New York posts approximately 12%, balancing high expenses with robust earning potential. States like Pennsylvania, Illinois, and Ohio report averages between 10% and 11%, showing moderate yet stable savings behavior. Meanwhile, Georgia, Michigan, and North Carolina sustain rates near 9%, indicating gradual financial resilience. Across all regions, projected increases in 2025 demonstrate Americans’ improved saving habits, underlining a positive trend toward stronger financial security and household wealth accumulation nationwide.

Free Top 20 U.S. States by Household Savings Rate (2020-2025)

| Labels | 2020 Savings Rate (%) | 2021 Savings Rate (%) | 2022 Savings Rate (%) | 2023 Savings Rate (%) | 2024 Savings Rate (%) |

2025 Savings Rate (Projected) (%) |

| California | 12.5 | 13 | 13.5 | 13.8 | 14 | 14.5 |

| Texas | 10.5 | 11 | 11.5 | 12 | 12.5 | 12.8 |

| Florida | 11 | 11.2 | 11.3 | 11.5 | 11.7 | 12 |

| New York | 13 | 13.5 | 14 | 14.2 | 14.5 | 15 |

| Pennsylvania | 9.5 | 9.8 | 10 | 10.2 | 10.5 | 10.8 |

| Illinois | 10 | 10.5 | 10.8 | 11 | 11.2 | 11.5 |

| Ohio | 9 | 9.5 | 9.7 | 10 | 10.2 | 10.5 |

| Georgia | 10.2 | 10.5 | 10.8 | 11 | 11.3 | 11.5 |

| Michigan | 8.8 | 9 | 9.2 | 9.5 | 9.8 | 10 |

| North Carolina | 11.5 | 11.7 | 11.9 | 12 | 12.2 | 12.5 |

| New Jersey | 12 | 12.2 | 12.5 | 12.8 | 13 | 13.5 |

| Virginia | 9.8 | 10 | 10.5 | 10.8 | 11 | 11.2 |

| Washington | 13.2 | 13.5 | 13.8 | 14 | 14.3 | 14.5 |

| Arizona | 8.5 | 8.8 | 9 | 9.2 | 9.5 | 9.8 |

| Massachusetts | 14 | 14.5 | 15 | 15.3 | 15.5 | 16 |

| Tennessee | 9.3 | 9.5 | 9.7 | 10 | 10.2 | 10.5 |

| Indiana | 7.8 | 8 | 8.5 | 8.8 | 9 | 9.2 |

| Missouri | 10.2 | 10.5 | 10.8 | 11 | 11.3 | 11.5 |

| Maryland | 11.5 | 11.7 | 12 | 12.2 | 12.5 | 12.8 |

| Wisconsin | 8 | 8.2 | 8.5 | 8.8 | 9 | 9.2 |