Free Top 20 U.S. States by Total Corporate Tax Revenue (2020-2025) Chart

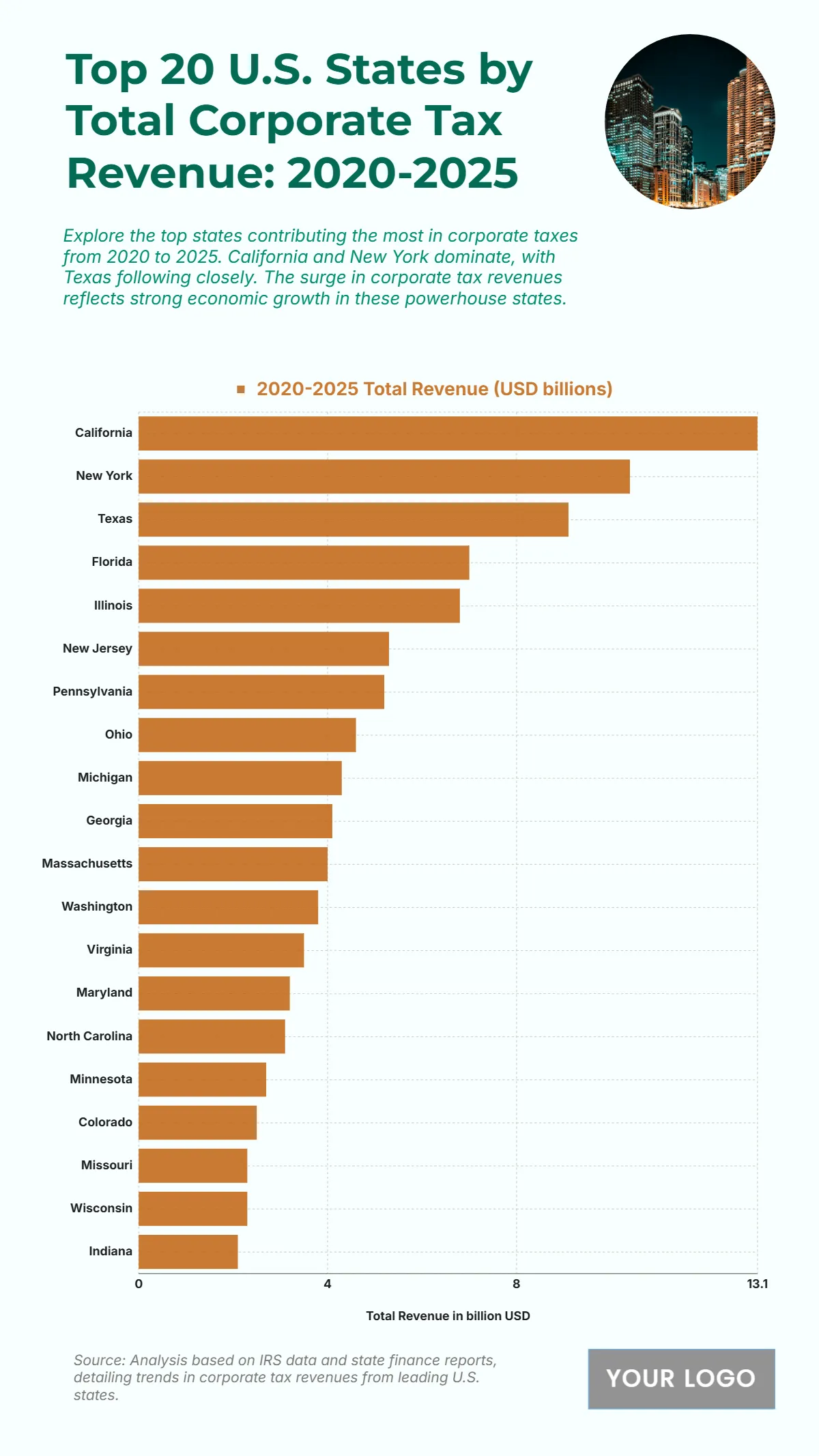

The chart shows that California leads all states in total corporate tax revenue between 2020 and 2025, reaching 13.1 billion USD, indicating its strong corporate sector and economic dominance. New York follows with 10.4 billion USD, reflecting its status as a major business and financial hub. Texas ranks third at 9.1 billion USD, supported by its rapid economic expansion. Florida and Illinois record 7.0 and 6.8 billion USD, respectively, showing steady contributions from diverse industries. Other high-earning states include New Jersey (5.3), Pennsylvania (5.2), Ohio (4.6), Michigan (4.3), and Georgia (4.1) billion USD. The lower end of the top 20 includes Minnesota (2.7), Colorado (2.5), Missouri (2.3), Wisconsin (2.3), and Indiana (2.1) billion USD. This distribution reflects how corporate tax contributions are concentrated in states with strong business ecosystems, major urban centers, and diversified economic bases.

| Labels | 2020–2025 Total Revenue (USD billions) |

|---|---|

| California | 13.1 |

| New York | 10.4 |

| Texas | 9.1 |

| Florida | 7.0 |

| Illinois | 6.8 |

| New Jersey | 5.3 |

| Pennsylvania | 5.2 |

| Ohio | 4.6 |

| Michigan | 4.3 |

| Georgia | 4.1 |

| Massachusetts | 4.0 |

| Washington | 3.8 |

| Virginia | 3.5 |

| Maryland | 3.2 |

| North Carolina | 3.1 |

| Minnesota | 2.7 |

| Colorado | 2.5 |

| Missouri | 2.3 |

| Wisconsin | 2.3 |

| Indiana | 2.1 |