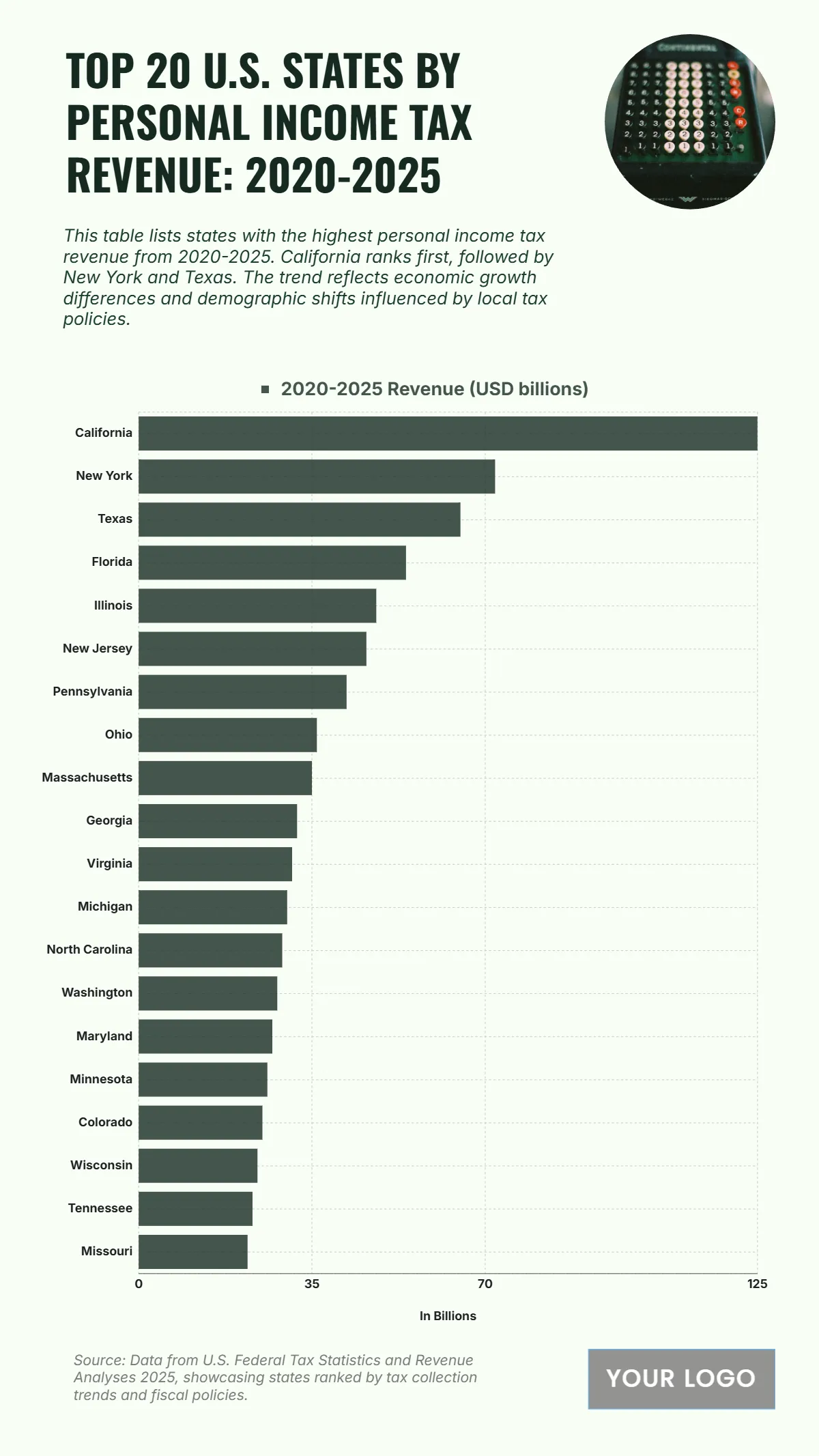

The chart titled “Top 20 U.S. States by Personal Income Tax Revenue: 2020–2025” illustrates the states generating the highest personal income tax revenues during this five-year period, revealing strong fiscal performance concentrated in major economic centers. California leads decisively, with total revenue reaching around USD 120 billion, underscoring its position as the nation’s largest contributor to income tax collections. New York follows with approximately USD 95 billion, driven by its dense population and high-income earners, while Texas ranks third with about USD 85 billion despite having a differing tax structure that influences overall revenue. Florida and Illinois follow, recording roughly USD 70 billion and USD 65 billion, respectively. States such as New Jersey, Pennsylvania, and Ohio each generate around USD 55 to 60 billion, showing steady fiscal output. Massachusetts, Georgia, and Virginia maintain similar levels near USD 50 billion, reflecting robust income bases. The remaining states—Michigan, North Carolina, Washington, Maryland, Minnesota, Colorado, Wisconsin, Tennessee, and Missouri—each report revenues ranging between USD 35 and 45 billion. Collectively, the data highlights how economic growth, population density, and state tax policies shape revenue outcomes, with California, New York, and Texas firmly leading the nation’s tax collection landscape.

Free Top 20 U.S. States by Personal Income Tax Revenue (2020–2025) Chart

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

AI AI Chart and Graph Generator

Generate my free AI Chart and Graph Text or voice to generate a free AI Chart and Graph

| State |

2020-2025 Revenue (USD billions) |

| California | 125 |

| New York | 72 |

| Texas | 65 |

| Florida | 54 |

| Illinois | 48 |

| New Jersey | 46 |

| Pennsylvania | 42 |

| Ohio | 36 |

| Massachusetts | 35 |

| Georgia | 32 |

| Virginia | 31 |

| Michigan | 30 |

| North Carolina | 29 |

| Washington | 28 |

| Maryland | 27 |

| Minnesota | 26 |

| Colorado | 25 |

| Wisconsin | 24 |

| Tennessee | 23 |

| Missouri | 22 |

You may also like

- Bar Graph Chart

- Line Graph Chart

- Pie Graph Chart

- Table Graph Chart

- Scatter Graph Chart

- Area Graph Chart

- Tree Graph Chart

- Birth Chart

- Chore Chart

- Time Table Chart

- Dress Size Chart

- Football Depth Chart

- Color Chart

- Color Wheel Chart

- Color Mix Chart

- Classroom Seating Chart

- Church Organizational Chart

- Hierarchy Organizational Chart

- Tree Organizational Chart

- Organization Chart

- Time Chart

- Blood Pressure Chart

- Behavior Chart

- Process Flowchart

- Process Flow Chart

- Baby Feeding Chart

- BMI Chart

- Ring Size Chart

- Height Chart

- Number Chart

- Food Chart

- Baby Milestones Chart

- Blood Sugar Chart

- Body Temperature Chart

- Diet Chart

- Metric Chart

- Pregnancy Weight Gain Chart

- HCG Levels Chart

- Astrology Chart

- Blood Oxygen Level Chart

- Gauge Chart

- Sales Chart

- Marketing Chart

- Military Time Chart

- Pregnancy Food Chart

- Medical Chart

- Wedding Seating Chart

- Guitar Chord Chart

- Pedigree Chart

- Natal Chart

- Team Organizational Chart

- Feelings Chart

- Piano Chord Chart

- Shoe Size Chart

- Activity Chart

- Height Weight

- Eye Chart

- Chakra Chart

- Reflexology Chart

- Hospital Organizational Chart

- Radar Chart

- College Organizational Chart

- Column Chart

- Roman Numerals Chart

- Weather Chart

- Height Conversion Chart

- Food Calorie Chart

- Fundraising Chart

- Kids Chore Chart

- Donut Chart

- Incident Flow Chart

- Patient Chart

- Body Measurement Chart

- Synastry Chart

- Funnel Chart

- Goal Chart

- Weight Loss Chart

- Money Chart

- Research FlowChart

- Medical Organizational Chart

- Protein Chart

- Retail Organizational Chart

- Sports Organizational Chart

- Vitamin Chart

- Research Gantt Chart

- To Do Chart

- Tooth Chart

- Conjugation Chart

- Drug Chart

- Event FlowChart

- Gildan Size Chart

- Logistics Organizational Chart

- Production FlowChart

- Bank Organizational Chart

- Dental Chart

- Dissertation Gantt Chart

- Training Gantt Chart

- Warehouse Organizational Chart

- Army Weight Chart

- Communication FlowChart

- Face Chart

- Pharma Organizational Chart

- Travel Gantt Chart

- Gaming FlowChart

- Insurance Organizational Chart

- Manufacturing Chart

- Progress Chart

- Travel Organizational Chart

- Charity FlowChart

- Design Firm/Company Organizational Chart

- Hospital Gantt Chart

- Manufacturing Gantt Chart

- Recruitment Gantt Chart

- Website Gantt Chart

- Environment Organizational Chart

- Fire Organizational Chart