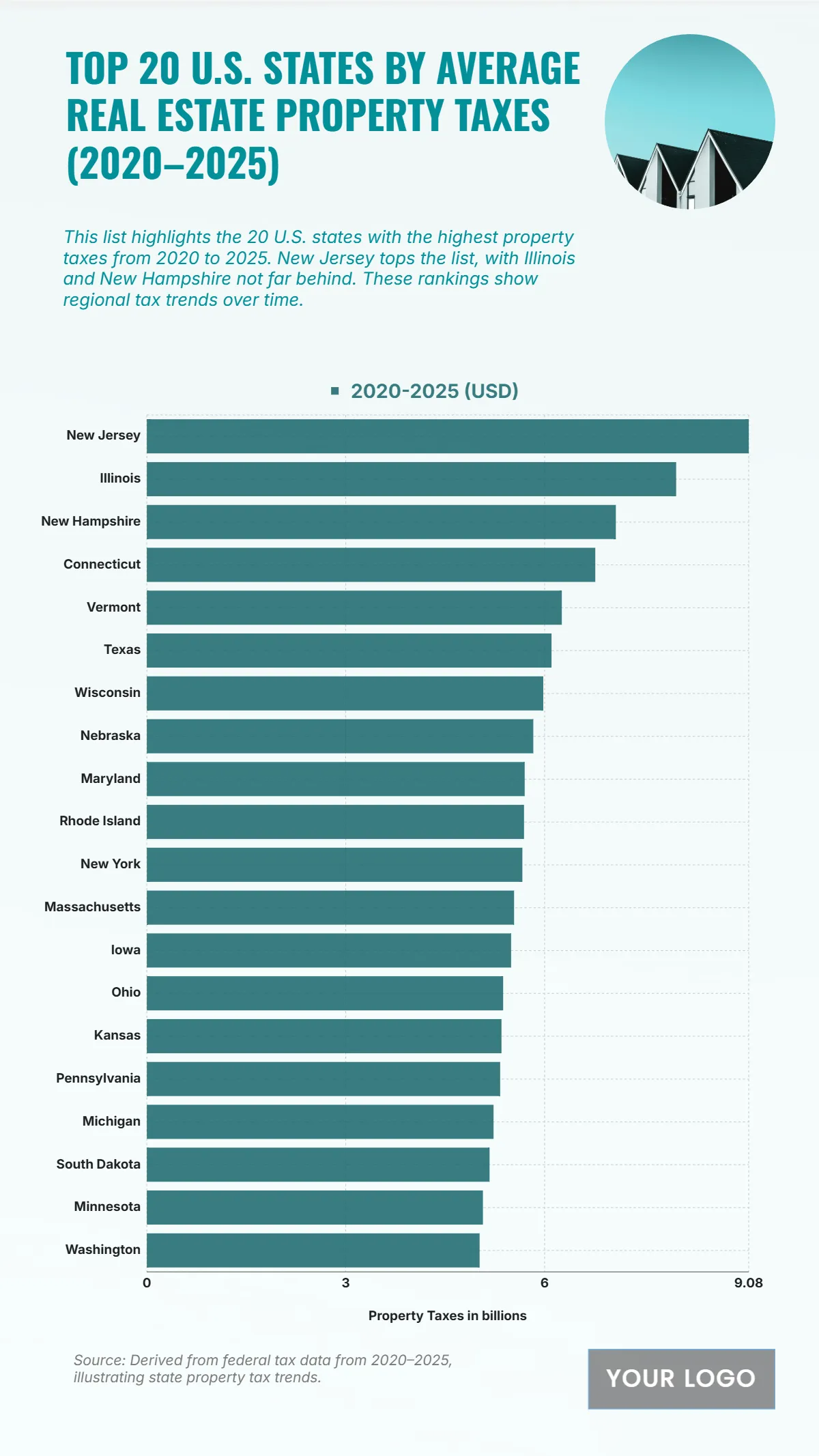

Free Top 20 U.S. States by Average Real Estate Property Taxes (2020–2025) Chart

The chart highlights the states with the highest average real estate property taxes in the U.S. between 2020 and 2025, reflecting significant regional tax disparities. New Jersey leads the list with an average of $9.08 billion, followed by Illinois at $7.985 billion and New Hampshire at $7.075 billion. Connecticut and Vermont record $6.765 billion and $6.26 billion, respectively. Texas, despite its population size, ranks mid-tier at $6.105 billion, along with Wisconsin at $5.98 billion and Nebraska at $5.83 billion. Maryland, Rhode Island, and New York hover between $5.6–5.7 billion, showing relatively stable but high tax levels. The lower half of the ranking includes Massachusetts, Iowa, Ohio, Kansas, and Pennsylvania, with figures around $5.3–5.5 billion. Michigan, South Dakota, Minnesota, and Washington close the list, all slightly above $5 billion, underscoring notable but lower tax burdens compared to the top states.

| Labels | 2020–2025 (USD) |

|---|---|

| New Jersey | 9.08 |

| Illinois | 7.985 |

| New Hampshire | 7.075 |

| Connecticut | 6.765 |

| Vermont | 6.26 |

| Texas | 6.105 |

| Wisconsin | 5.98 |

| Nebraska | 5.83 |

| Maryland | 5.7 |

| Rhode Island | 5.69 |

| New York | 5.665 |

| Massachusetts | 5.54 |

| Iowa | 5.495 |

| Ohio | 5.375 |

| Kansas | 5.35 |

| Pennsylvania | 5.33 |

| Michigan | 5.23 |

| South Dakota | 5.17 |

| Minnesota | 5.07 |

| Washington | 5.02 |