Free Top 20 U.S. States by Average Income Tax Rate (2020–2025)

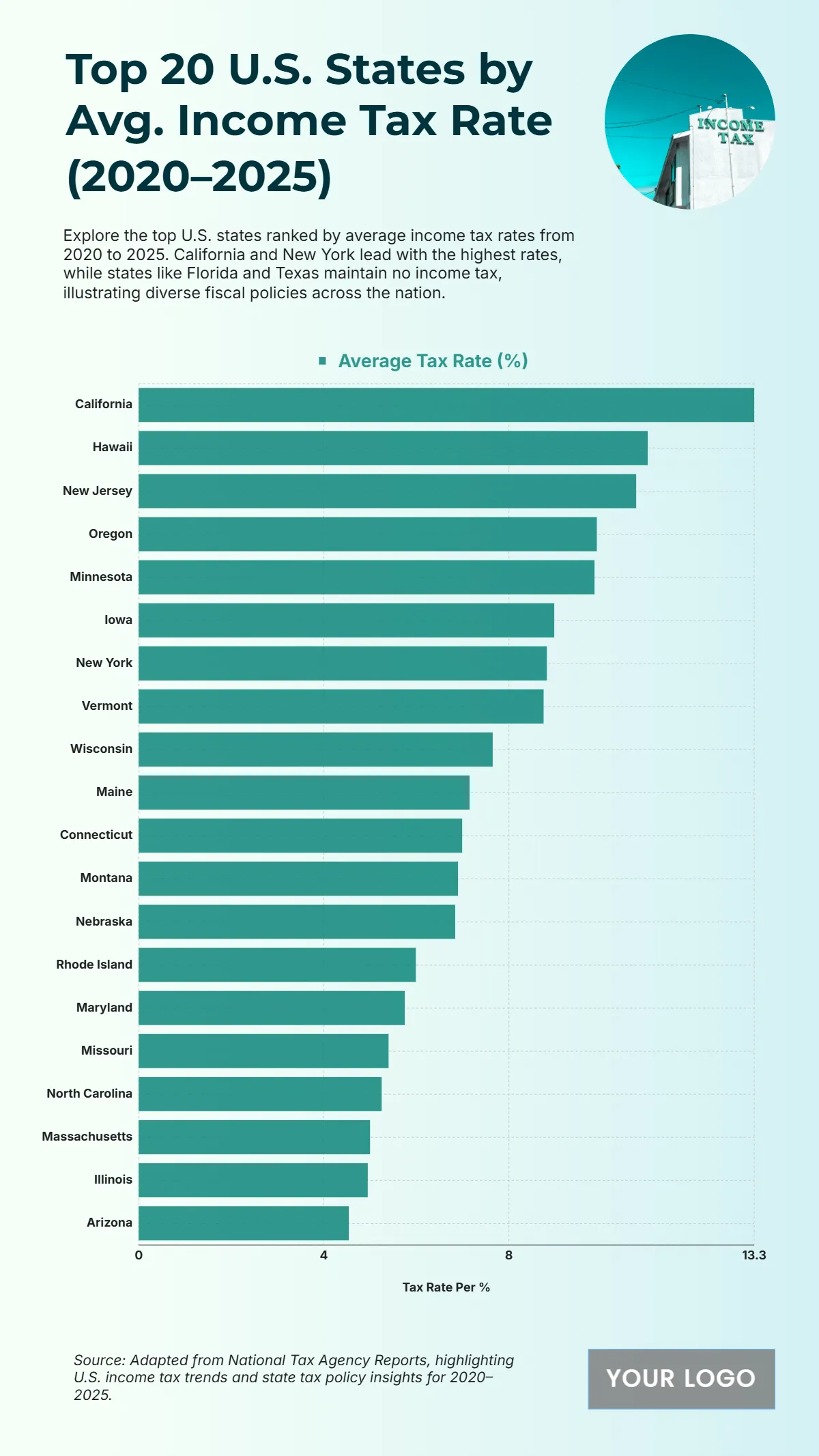

The chart illustrates the average income tax rates across U.S. states from 2020 to 2025, showcasing how fiscal policies differ regionally. California holds the highest average tax rate at 13.3%, reflecting its progressive taxation structure. Hawaii follows with 11%, while New Jersey registers 10.75%, highlighting its strong state-level tax collection. Oregon stands at 9.9%, with Minnesota slightly lower at 9.85%. States like Iowa (8.98%) and New York (8.82%) maintain upper-tier tax rates, aligning with their robust state-funded programs. Vermont follows with 8.75%, and Wisconsin stands at 7.65%, while Maine records 7.15%. Connecticut and Montana remain moderate at 6.99% and 6.9%, respectively. Nebraska is at 6.84%, and several states like Rhode Island, Maryland, and Missouri show rates between 5.99%–5.4%. The lowest among the top 20 are Massachusetts (5%), Illinois (4.95%), and Arizona (4.54%), indicating more lenient tax structures compared to higher-tax states.

| Labels | Average Tax Rate (%) |

|---|---|

| California | 13.3 |

| Hawaii | 11 |

| New Jersey | 10.75 |

| Oregon | 9.9 |

| Minnesota | 9.85 |

| Iowa | 8.98 |

| New York | 8.82 |

| Vermont | 8.75 |

| Wisconsin | 7.65 |

| Maine | 7.15 |

| Connecticut | 6.99 |

| Montana | 6.9 |

| Nebraska | 6.84 |

| Rhode Island | 5.99 |

| Maryland | 5.75 |

| Missouri | 5.4 |

| North Carolina | 5.25 |

| Massachusetts | 5 |

| Illinois | 4.95 |

| Arizona | 4.54 |