Free Top 20 U.S. States by Corporate Tax Contributions per Capita (2020-2025) Chart

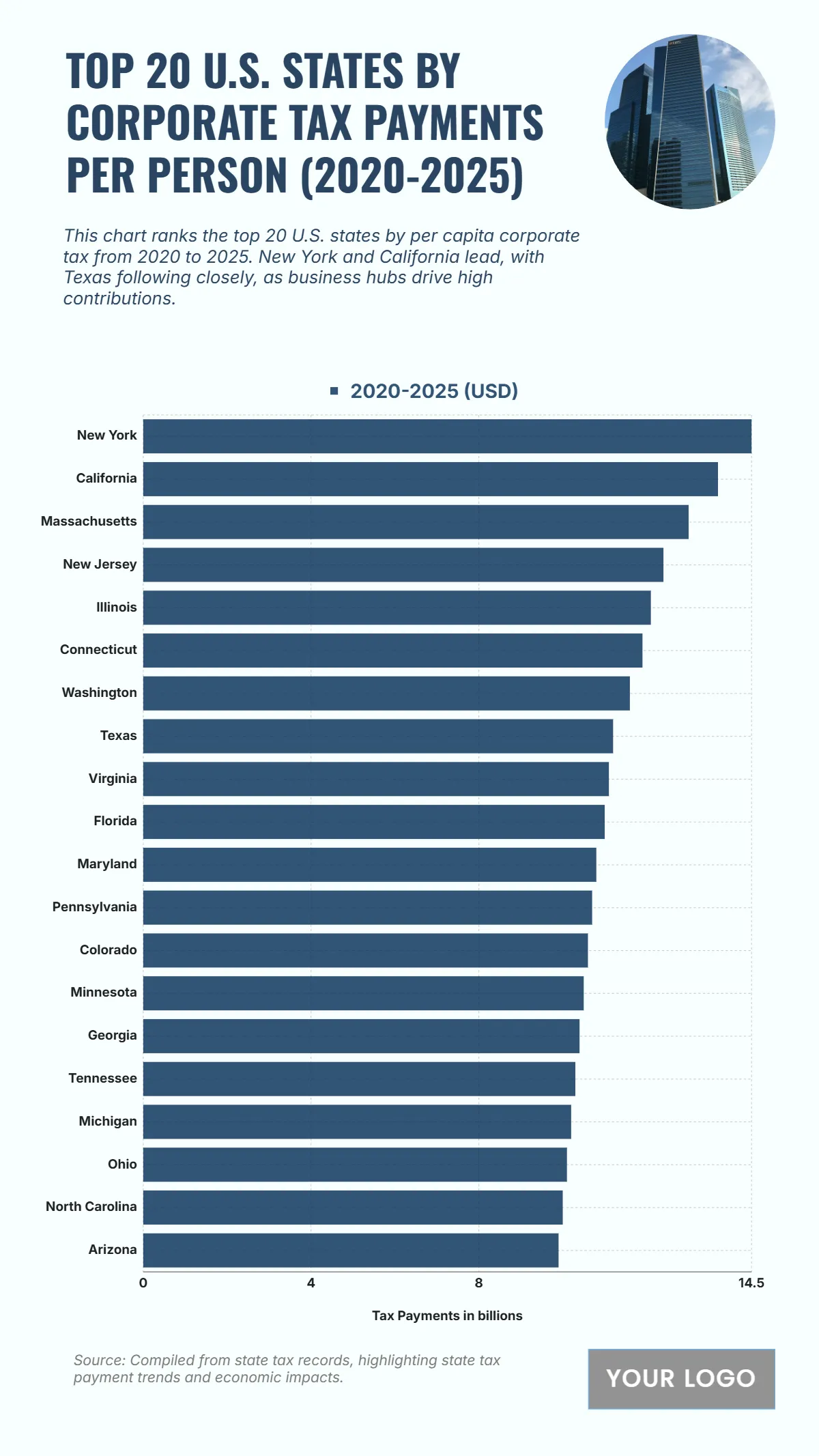

The chart shows the states generating the highest per capita corporate tax payments between 2020 and 2025, highlighting the dominance of major economic hubs. New York leads the list with $14.5 billion, demonstrating its strong corporate base and business activity. California follows closely with $13.7 billion, while Massachusetts ranks third at $13 billion. New Jersey reports $12.4 billion, Illinois reaches $12.1 billion, and Connecticut contributes $11.9 billion. Washington stands at $11.6 billion, followed by Texas at $11.2 billion and Virginia at $11.1 billion. States like Florida ($11 billion) and Maryland ($10.8 billion) also maintain high corporate tax revenues. The bottom five of the top twenty include Pennsylvania ($10.7 billion), Colorado ($10.6 billion), Minnesota ($10.5 billion), Georgia ($10.4 billion), Tennessee ($10.3 billion), Michigan ($10.2 billion), Ohio ($10.1 billion), North Carolina ($10 billion), and Arizona with $9.9 billion, reflecting broad-based corporate contributions across key states.

| Labels | 2020–2025 (USD) |

|---|---|

| New York | 14.5 |

| California | 13.7 |

| Massachusetts | 13.0 |

| New Jersey | 12.4 |

| Illinois | 12.1 |

| Connecticut | 11.9 |

| Washington | 11.6 |

| Texas | 11.2 |

| Virginia | 11.1 |

| Florida | 11.0 |

| Maryland | 10.8 |

| Pennsylvania | 10.7 |

| Colorado | 10.6 |

| Minnesota | 10.5 |

| Georgia | 10.4 |

| Tennessee | 10.3 |

| Michigan | 10.2 |

| Ohio | 10.1 |

| North Carolina | 10.0 |

| Arizona | 9.9 |