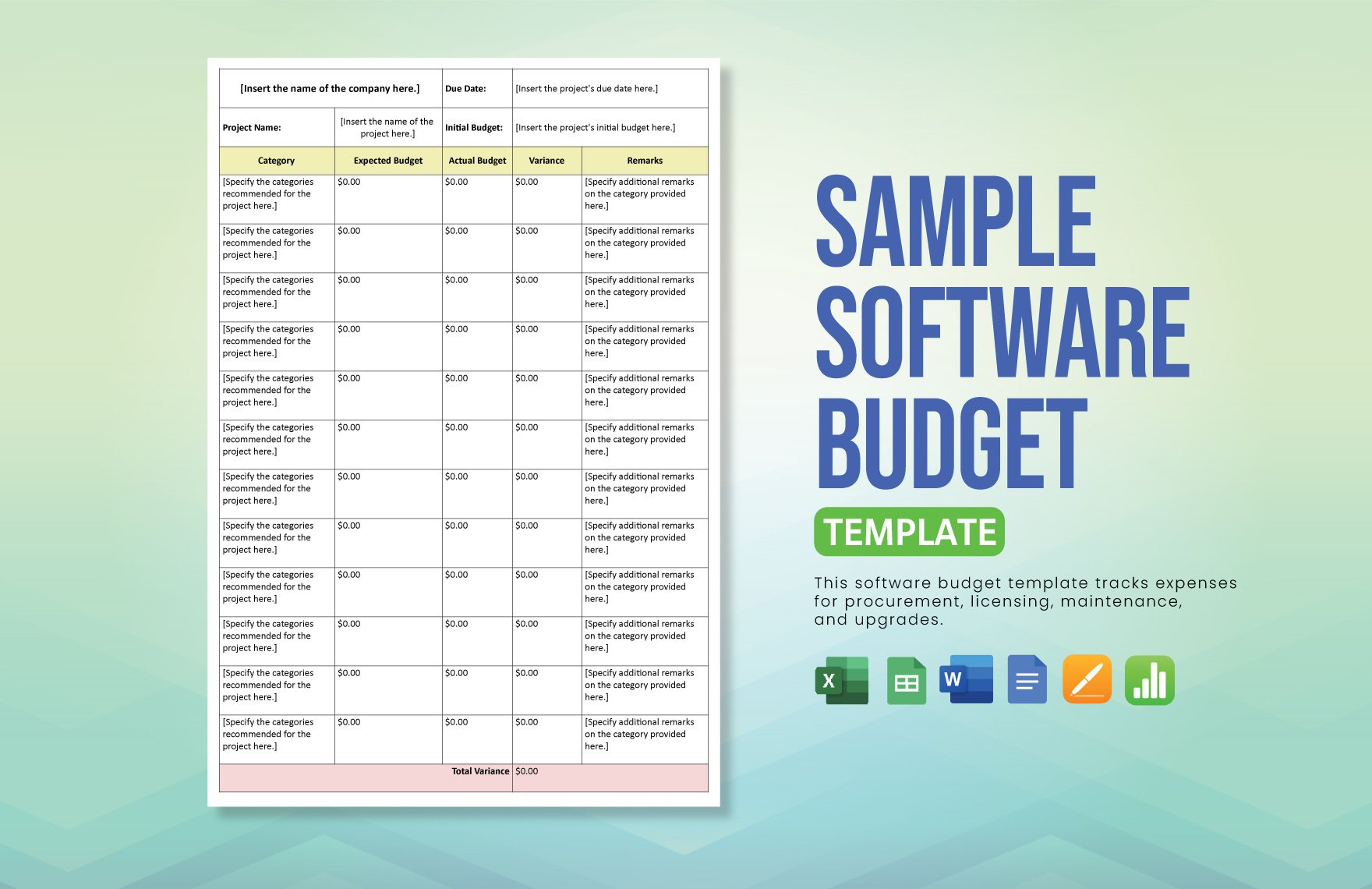

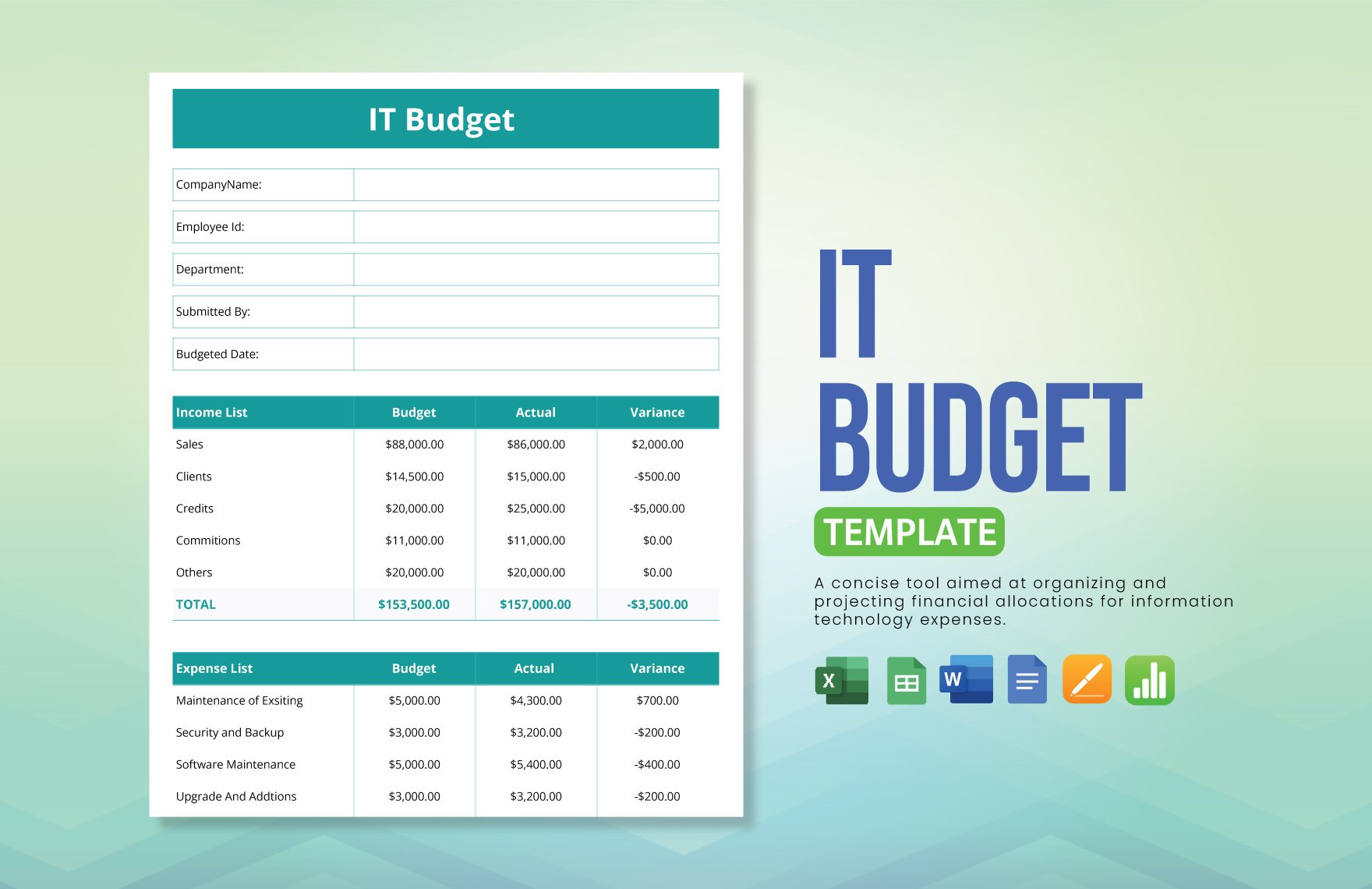

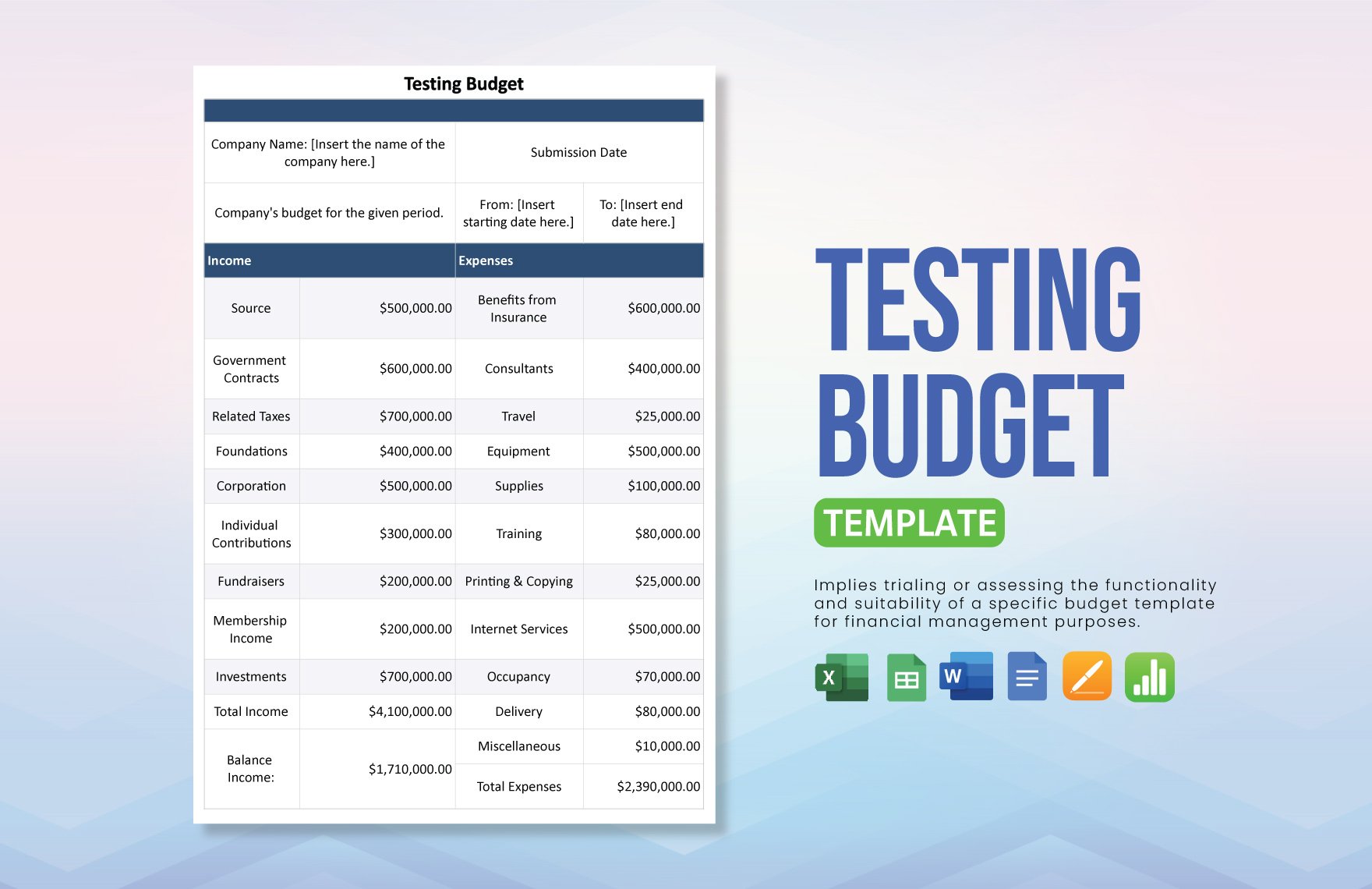

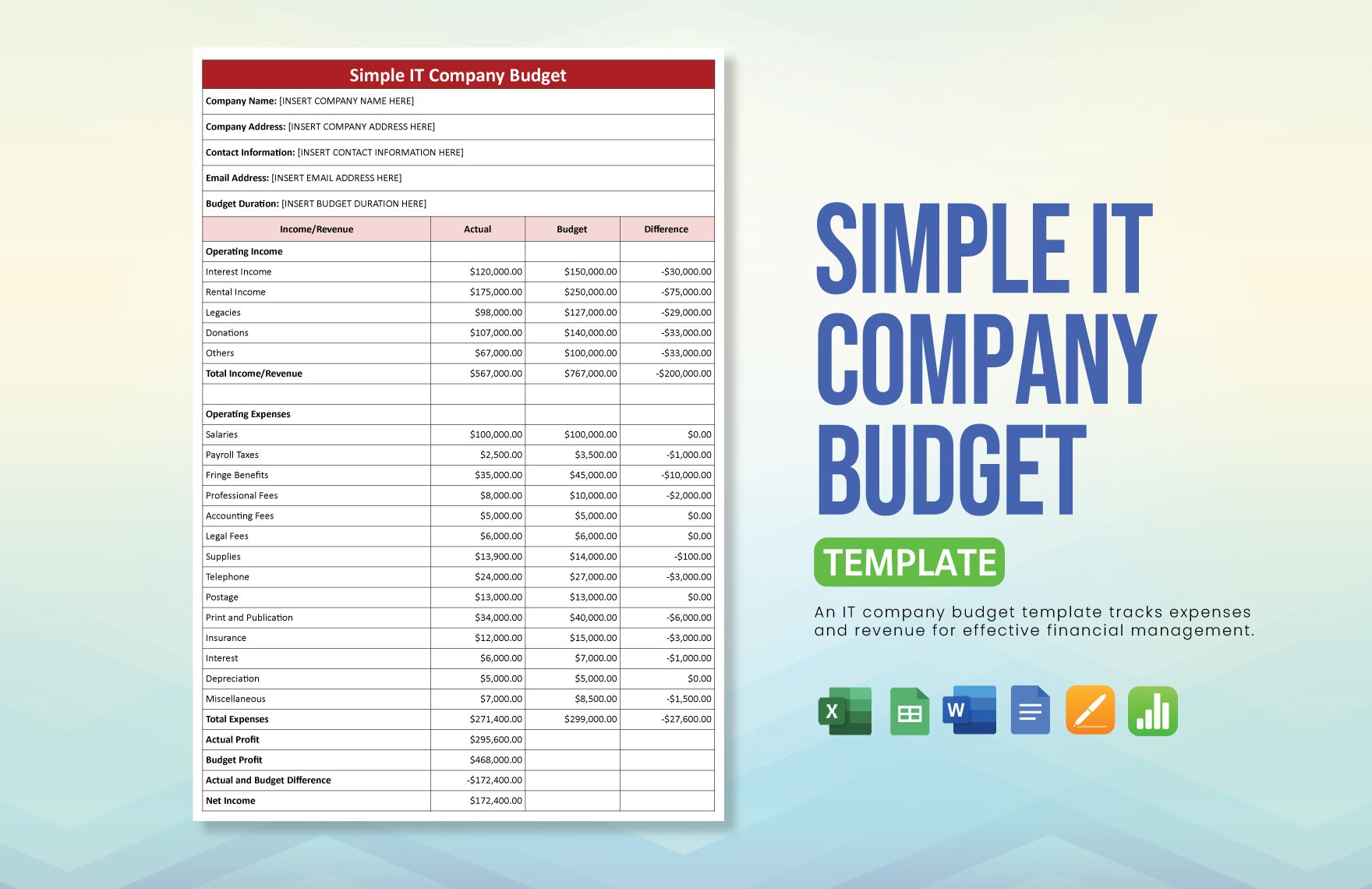

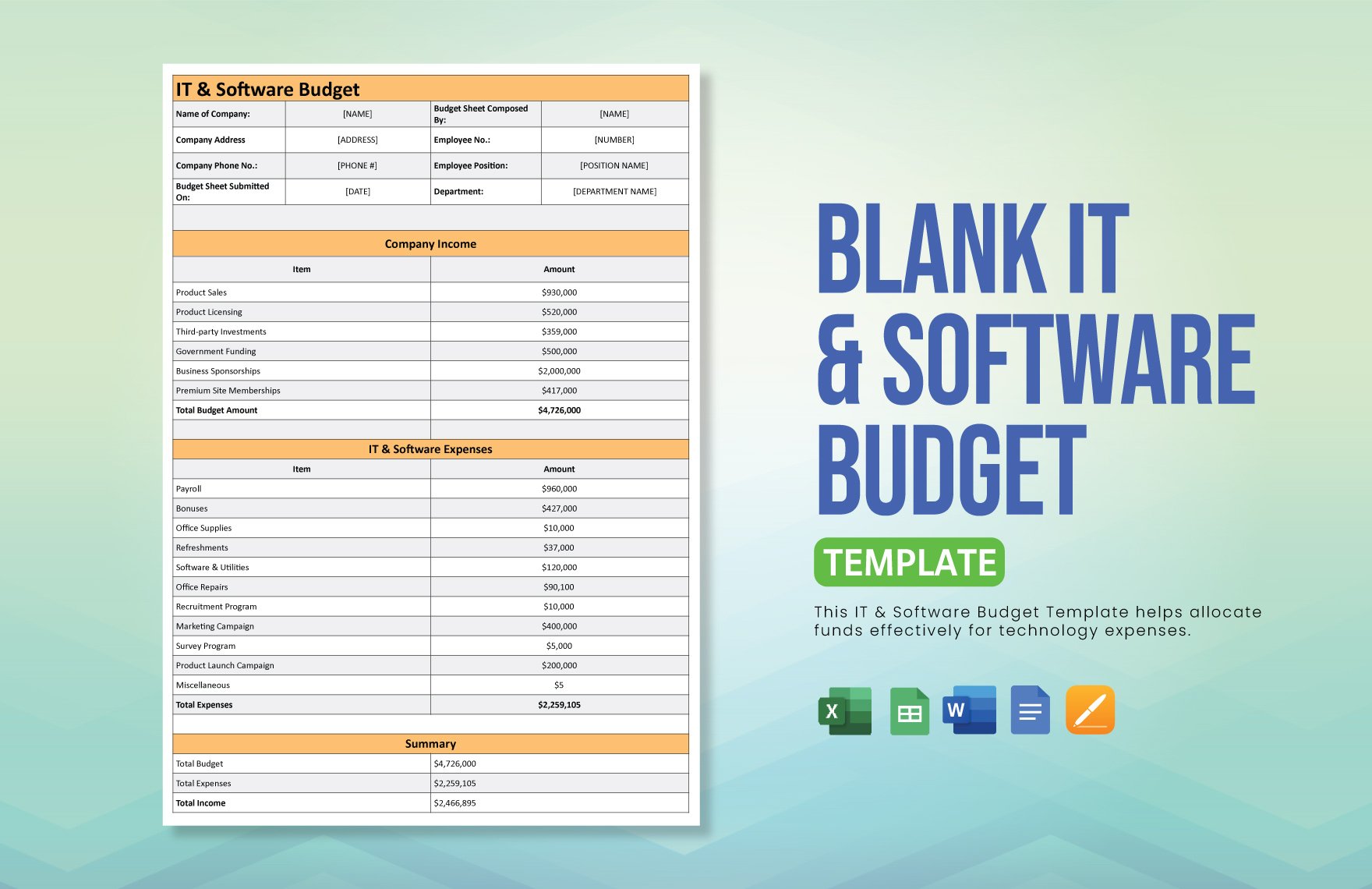

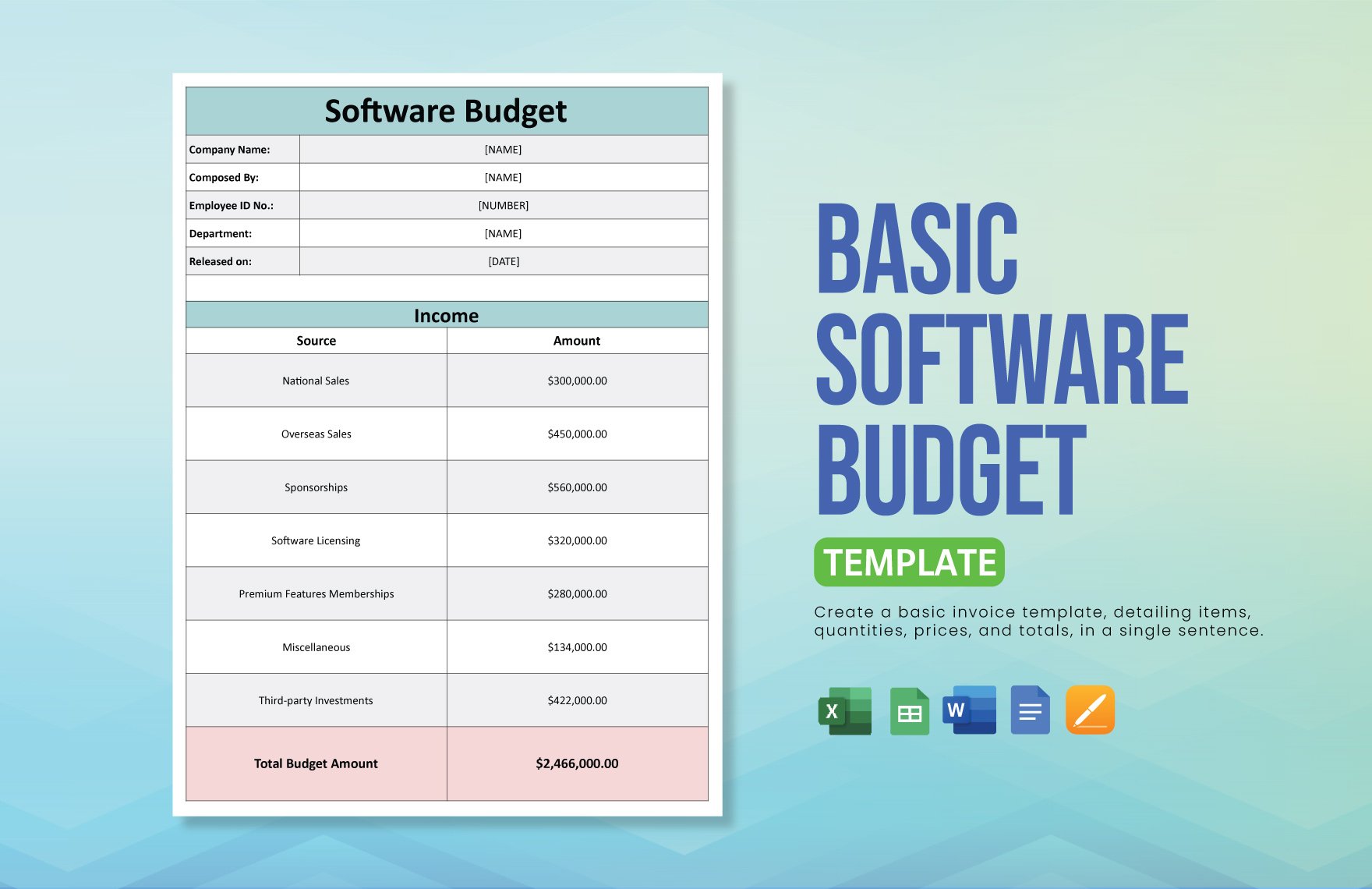

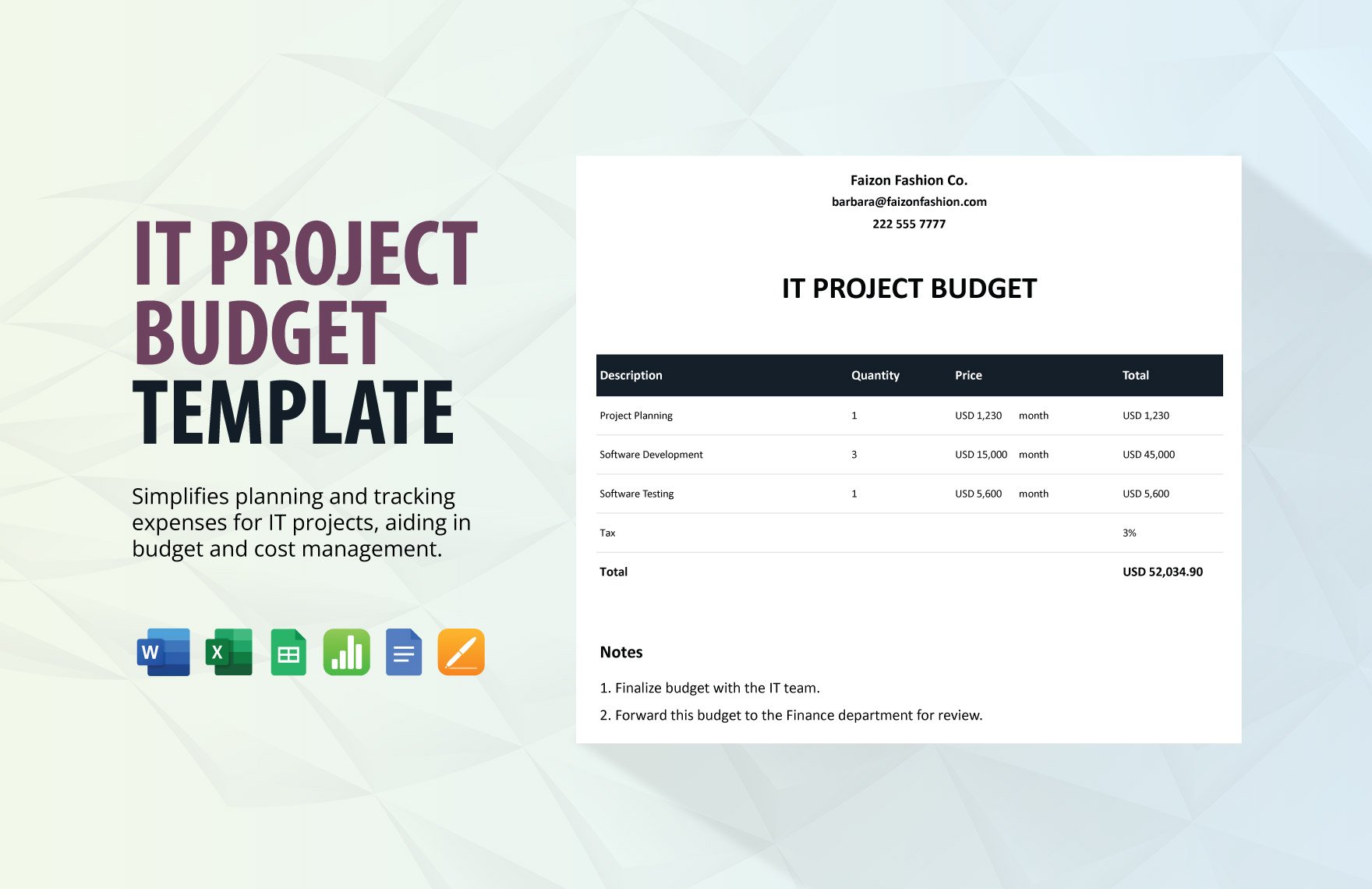

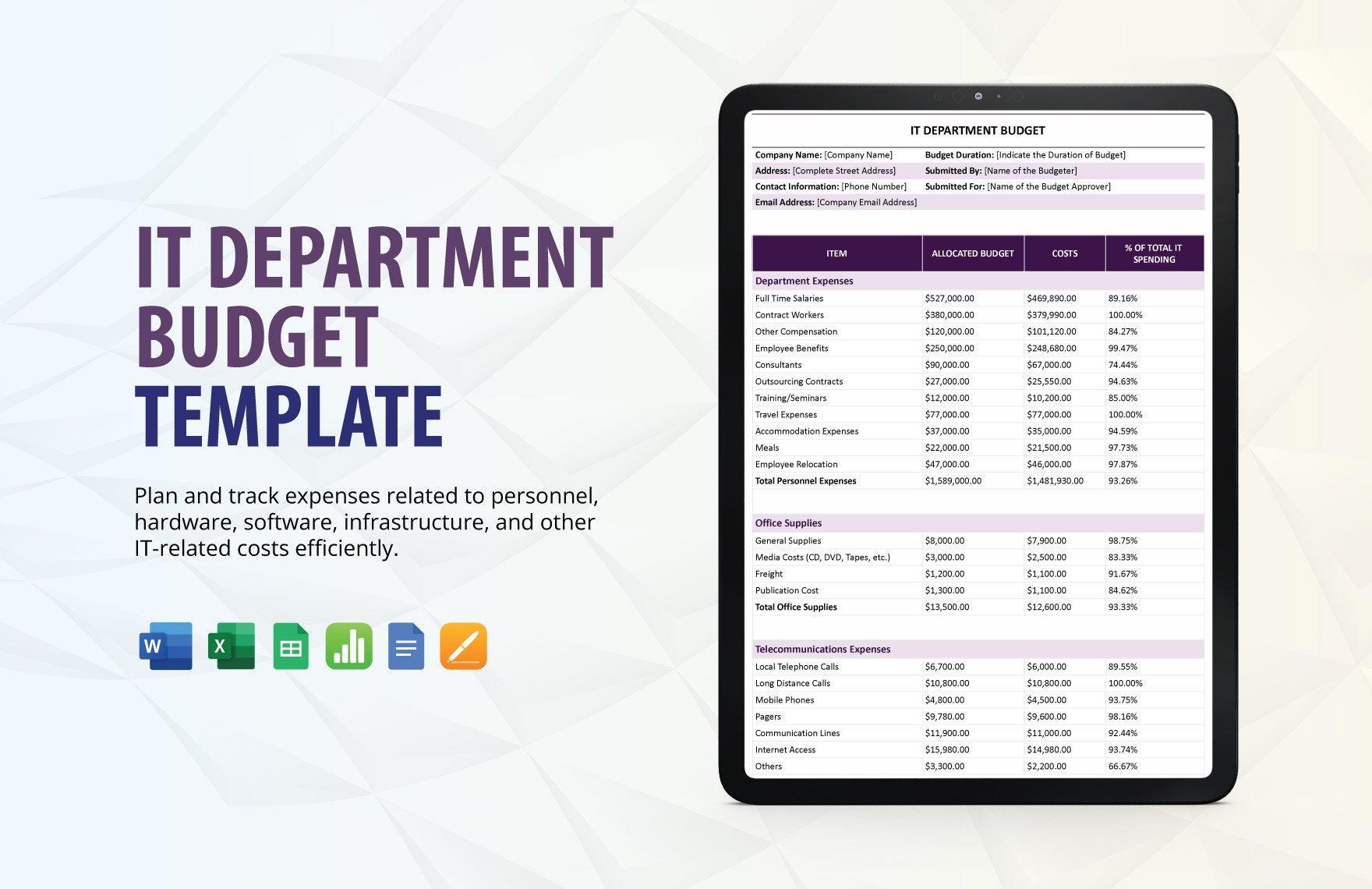

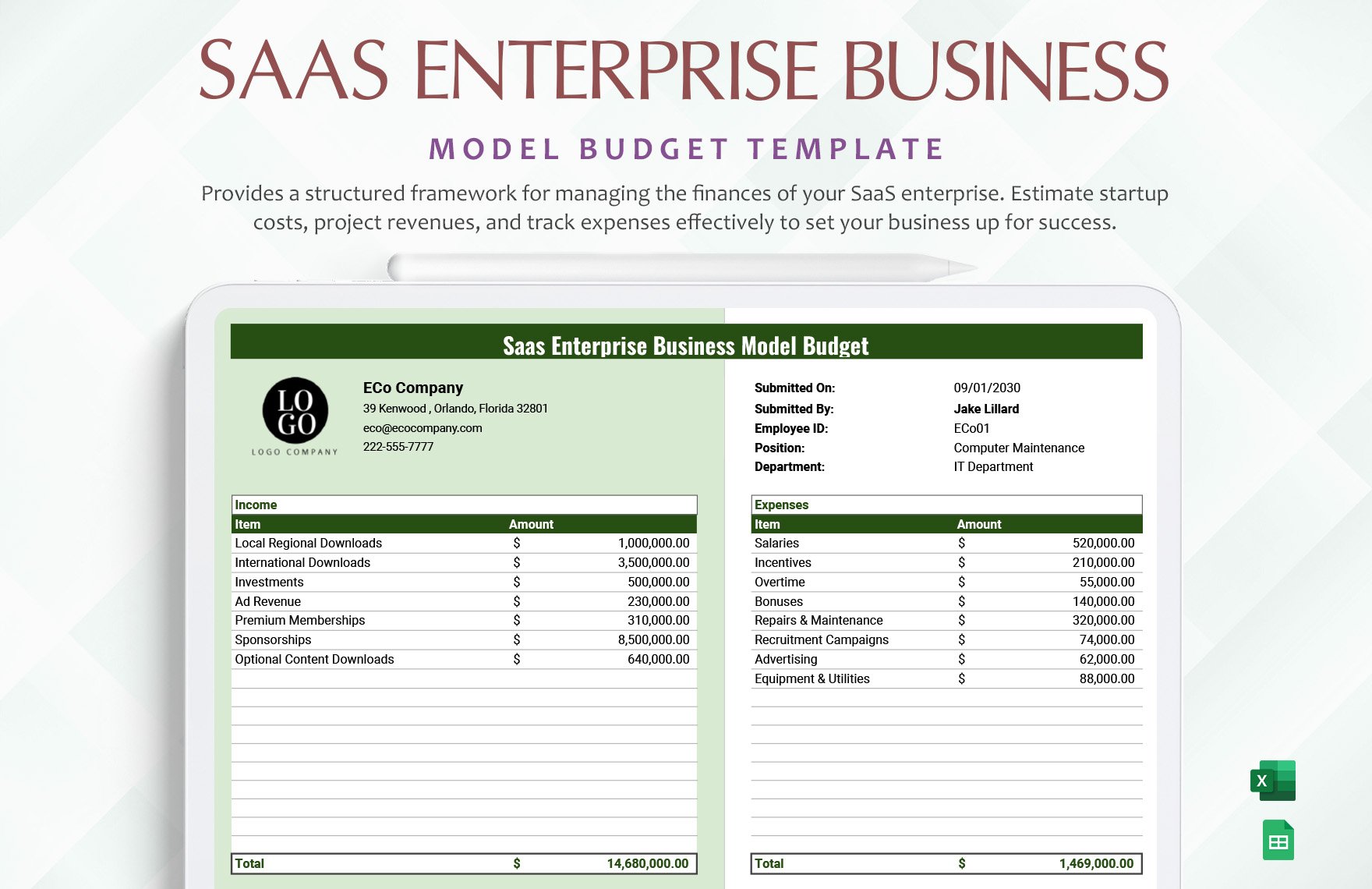

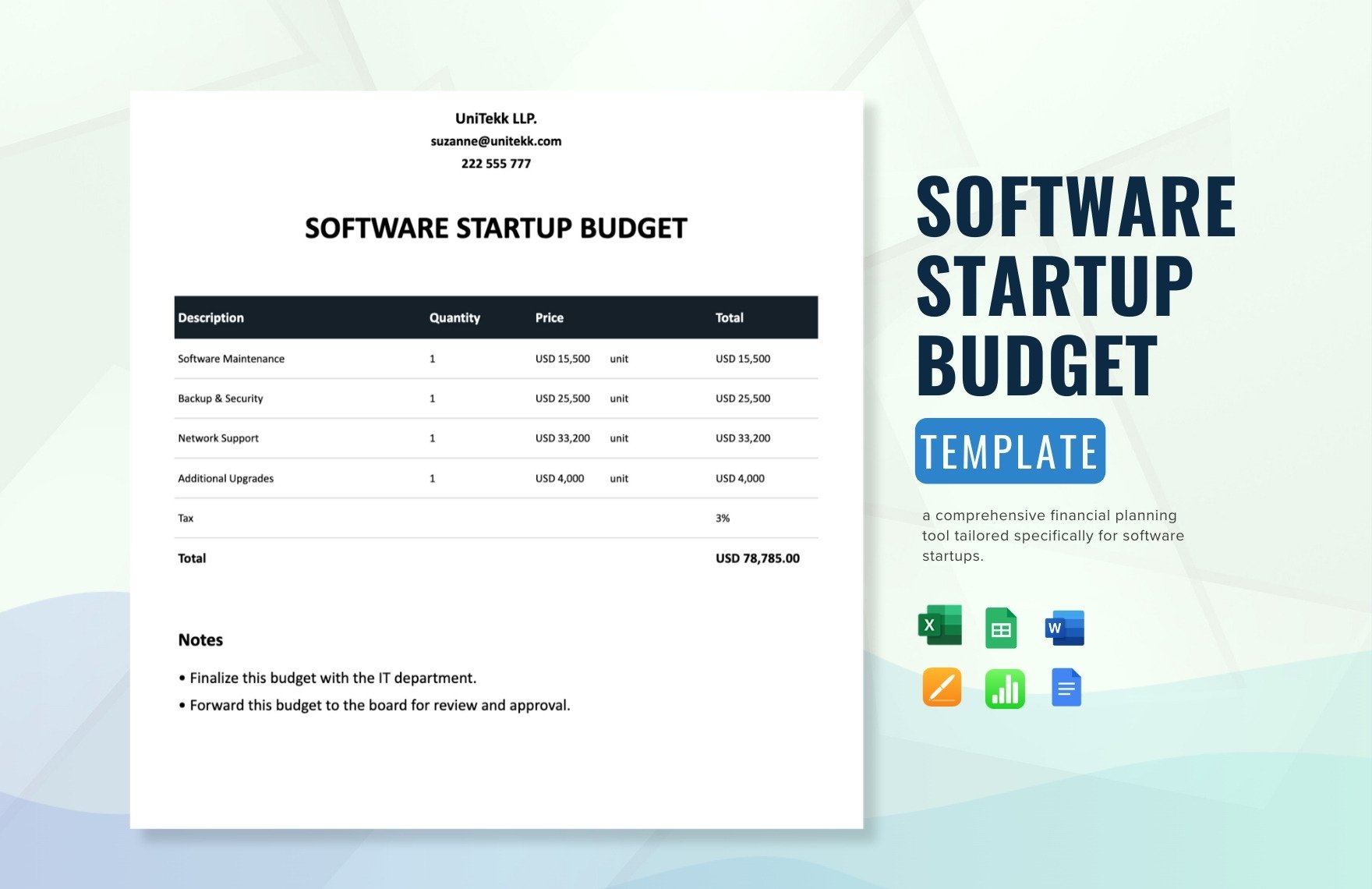

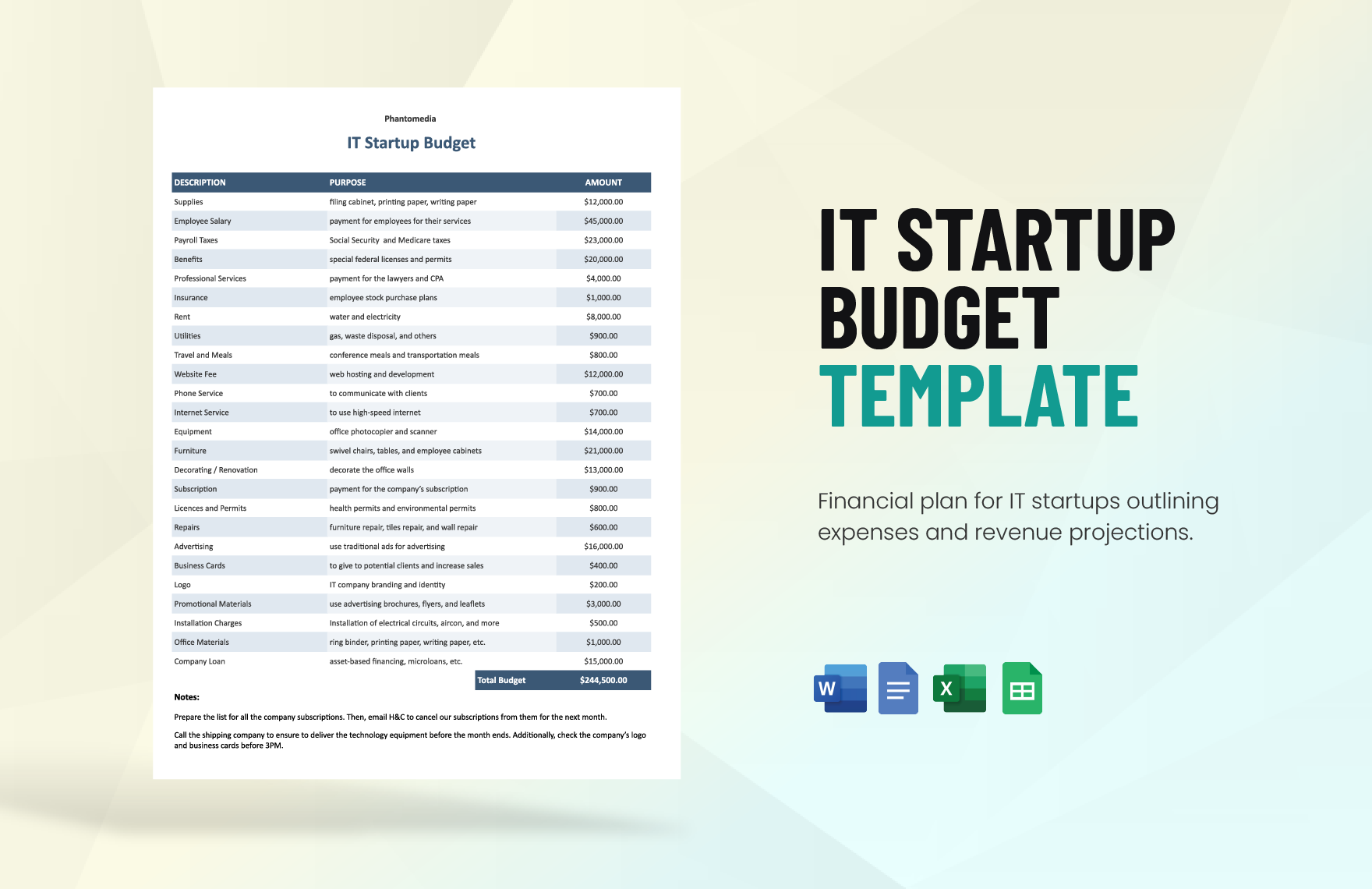

Not just software companies but any company should practice effective budgeting to make sure their resources are spent efficiently. In any situation, money should be spent wisely to allow the company to improve and expand. But to keep track of the established budget, you need to document it as comprehensive as possible. This also allows for easier compliance. Here, we have a collection of ready-made IT and Software Budget Templates available in MS Word, Apple Pages, and Google Docs that you can download and edit anytime, anywhere. Each template comes with suggestive content that's easily editable and 100% customizable for your convenience. Without hesitating, download a template now and start creating your software company's budget.

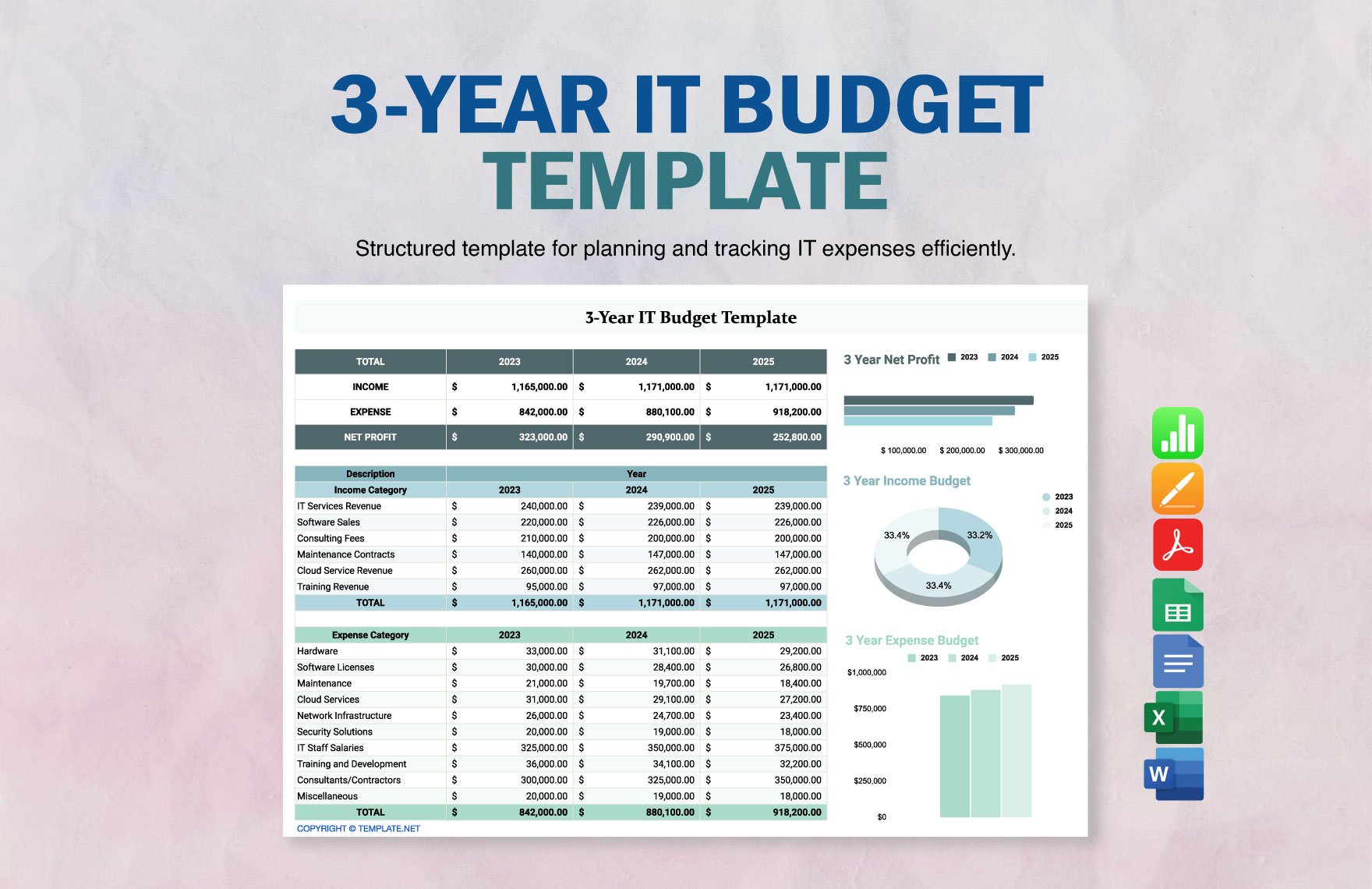

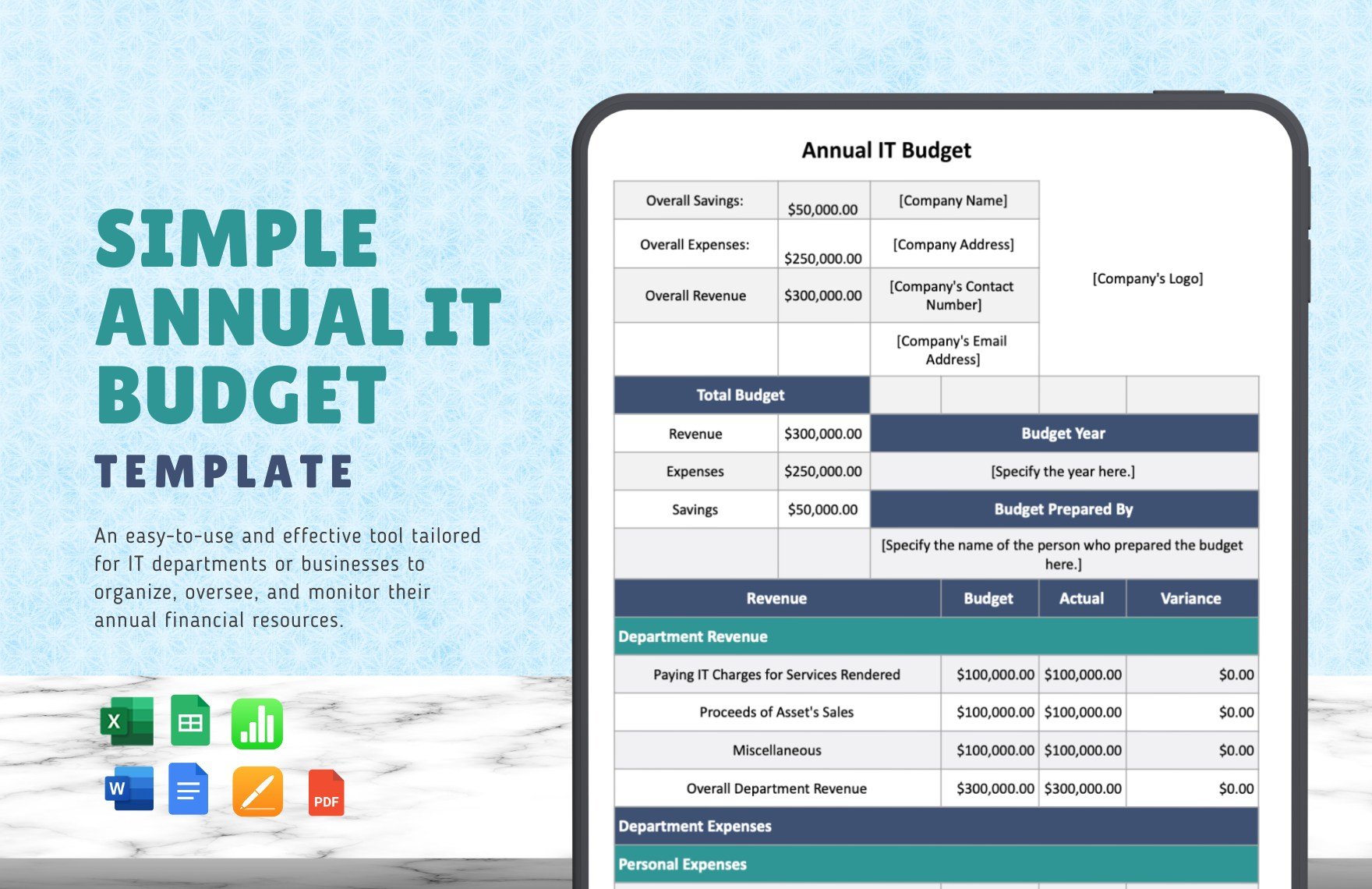

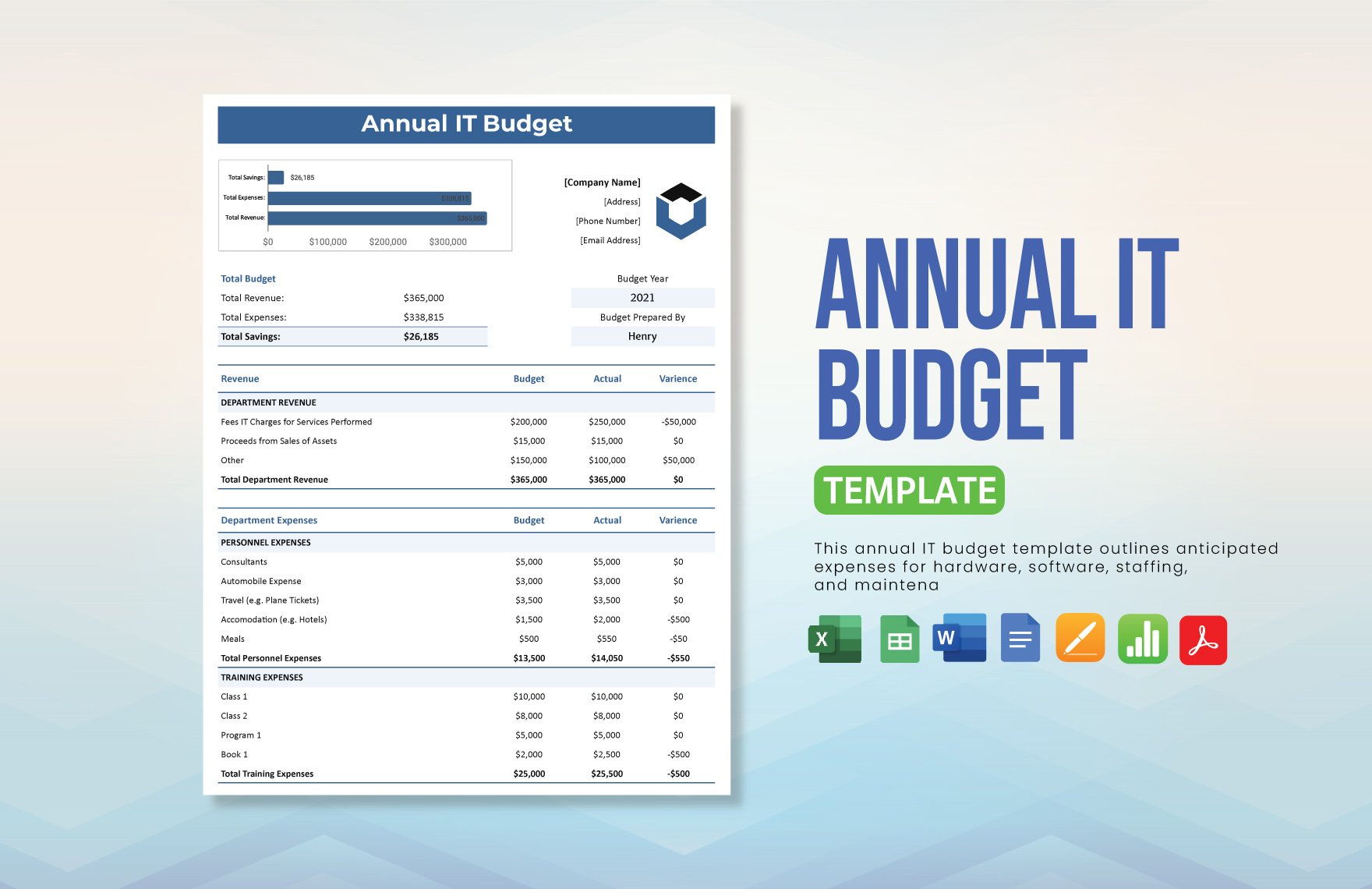

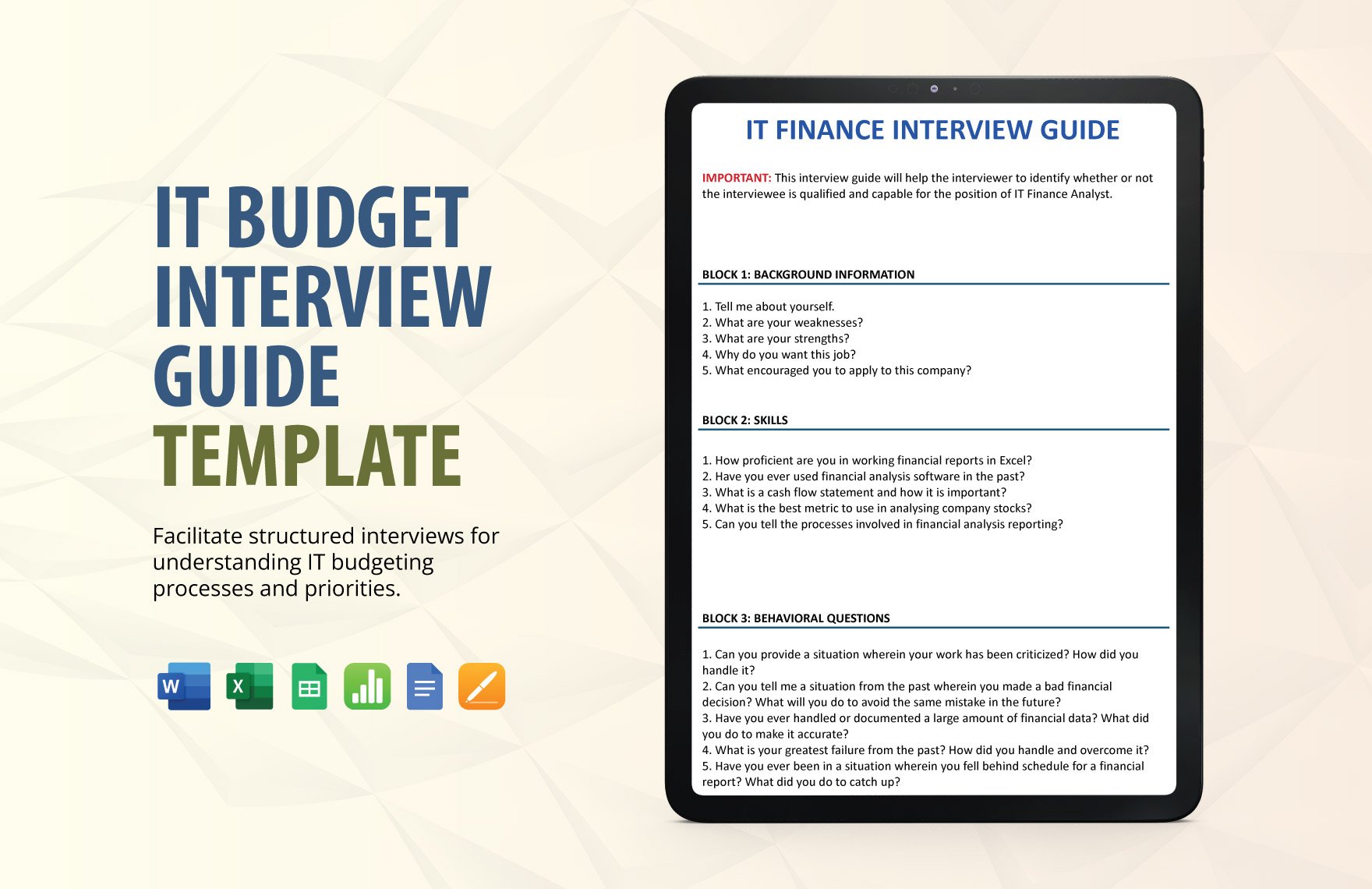

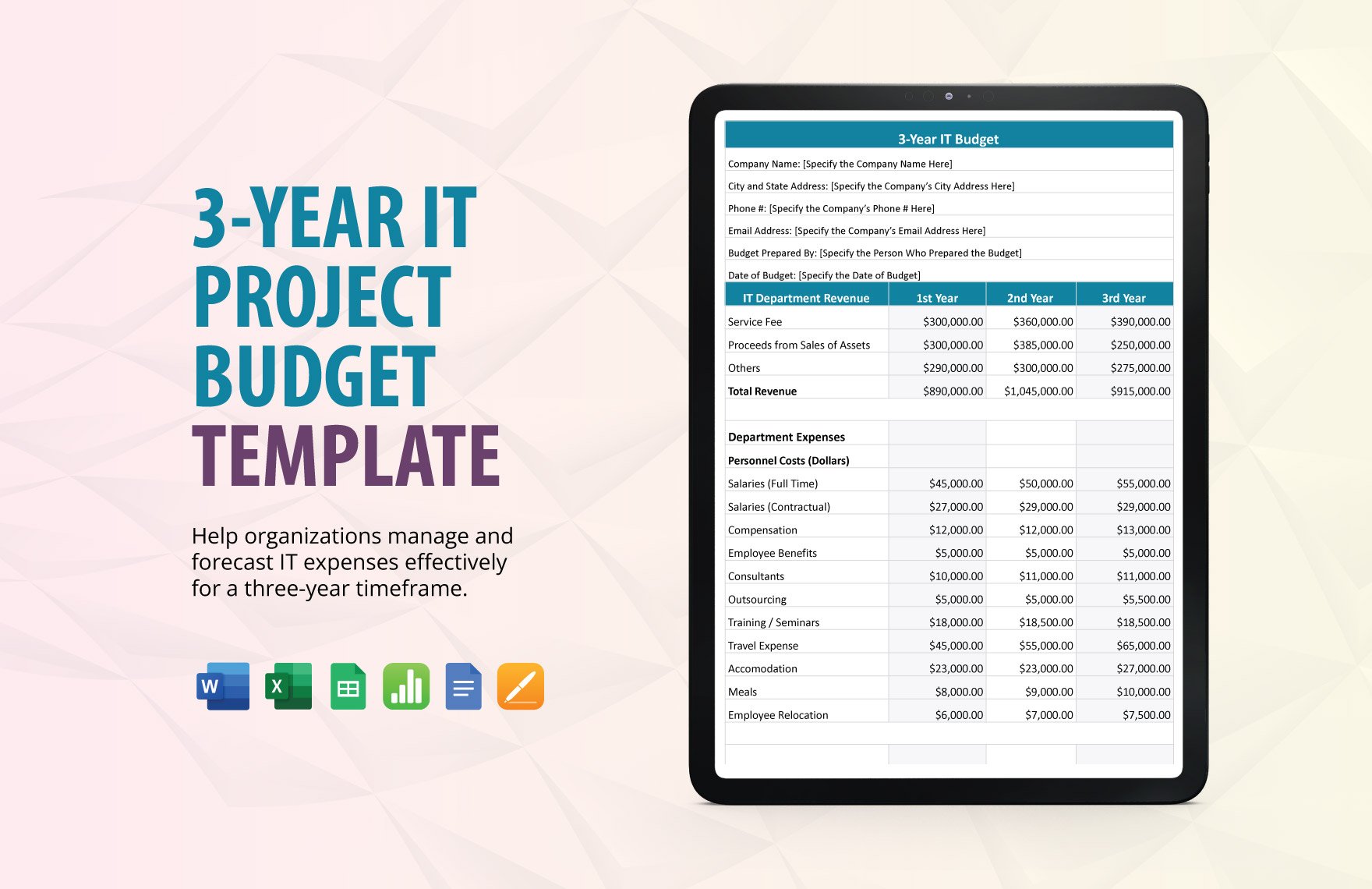

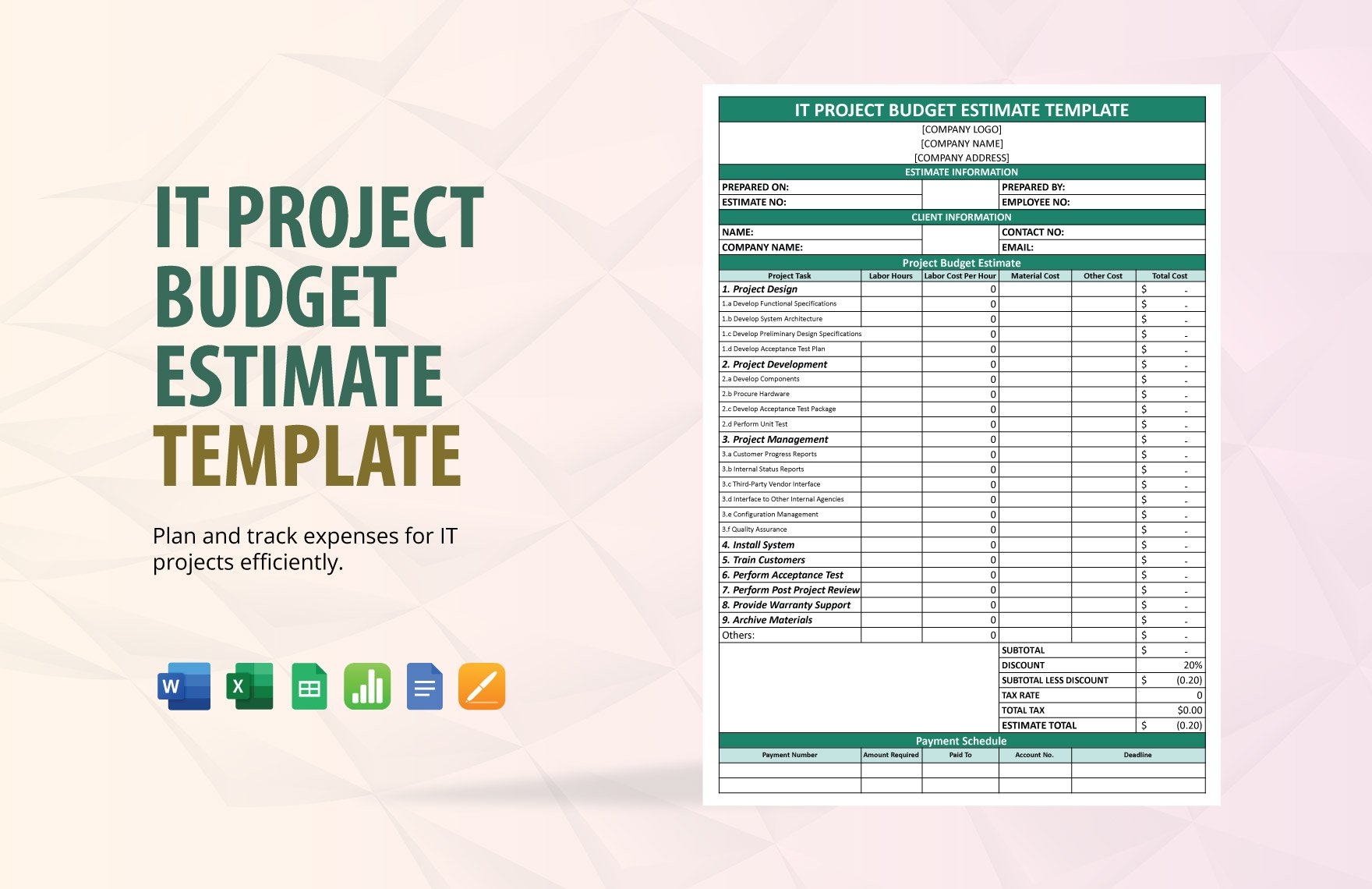

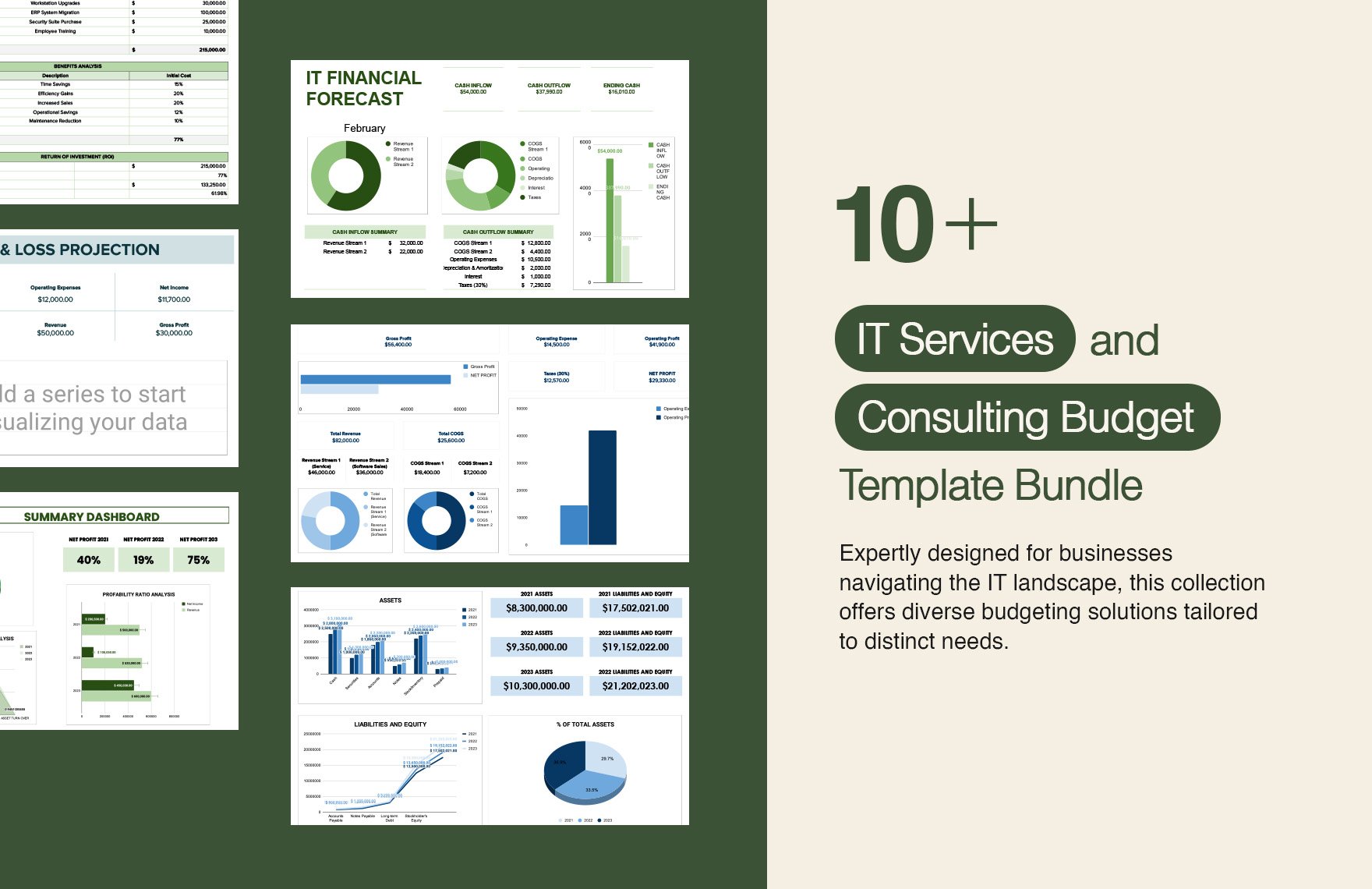

IT and Software Budget Templates

Conveniently Create IT/Software Budget With Template.net’s Free Templates. Ideal Templates for Your IT or Software Project Management. Aside From It, These Templates Are Also Usable for Construction and Personal Finance or Cost Management as They Are All Editable. Available in Excel Spreadsheet and Other Formats. Browse Our Collection and Download the One That Meets Your Specifications!