Free Top 10 U.S. States with the Highest Public Pension Liabilities (2015-2025) Chart

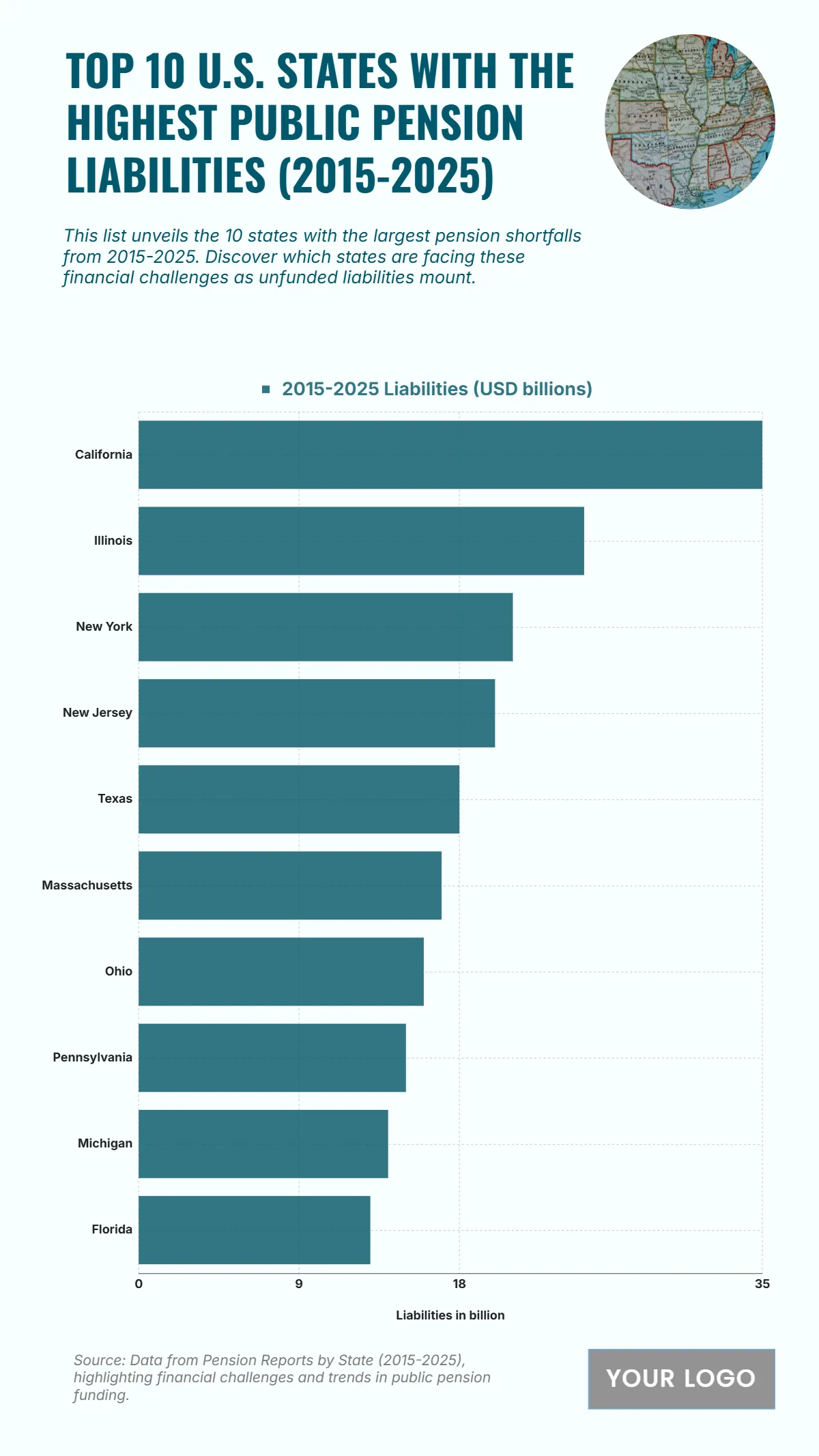

The chart titled “Top 10 U.S. States with the Highest Public Pension Liabilities (2015–2025)” highlights the states facing the largest unfunded pension obligations over the decade. California leads with liabilities nearing USD 34 billion, reflecting its vast public workforce and long-term funding challenges. Illinois follows with around USD 28 billion, driven by persistent shortfalls in pension contributions. New York ranks third with approximately USD 24 billion, while New Jersey and Texas report liabilities of about USD 21 billion and USD 19 billion, respectively. Massachusetts and Ohio both maintain levels close to USD 17 billion. Pennsylvania, Michigan, and Florida round out the list, each carrying liabilities between USD 15 and 16 billion. Overall, the data underscores mounting fiscal pressures across major states, emphasizing the need for pension reforms and sustainable investment strategies to manage long-term retirement obligations through 2025.

| Labels |

2015–2025 Liabilities (USD billions) |

| California | 35 |

| Illinois | 25 |

| New York | 21 |

| New Jersey | 20 |

| Texas | 18 |

| Massachusetts | 17 |

| Ohio | 16 |

| Pennsylvania | 15 |

| Michigan | 14 |

| Florida | 13 |