Free Top 20 U.S. States with the Highest Average Household Debt (2020-2025)

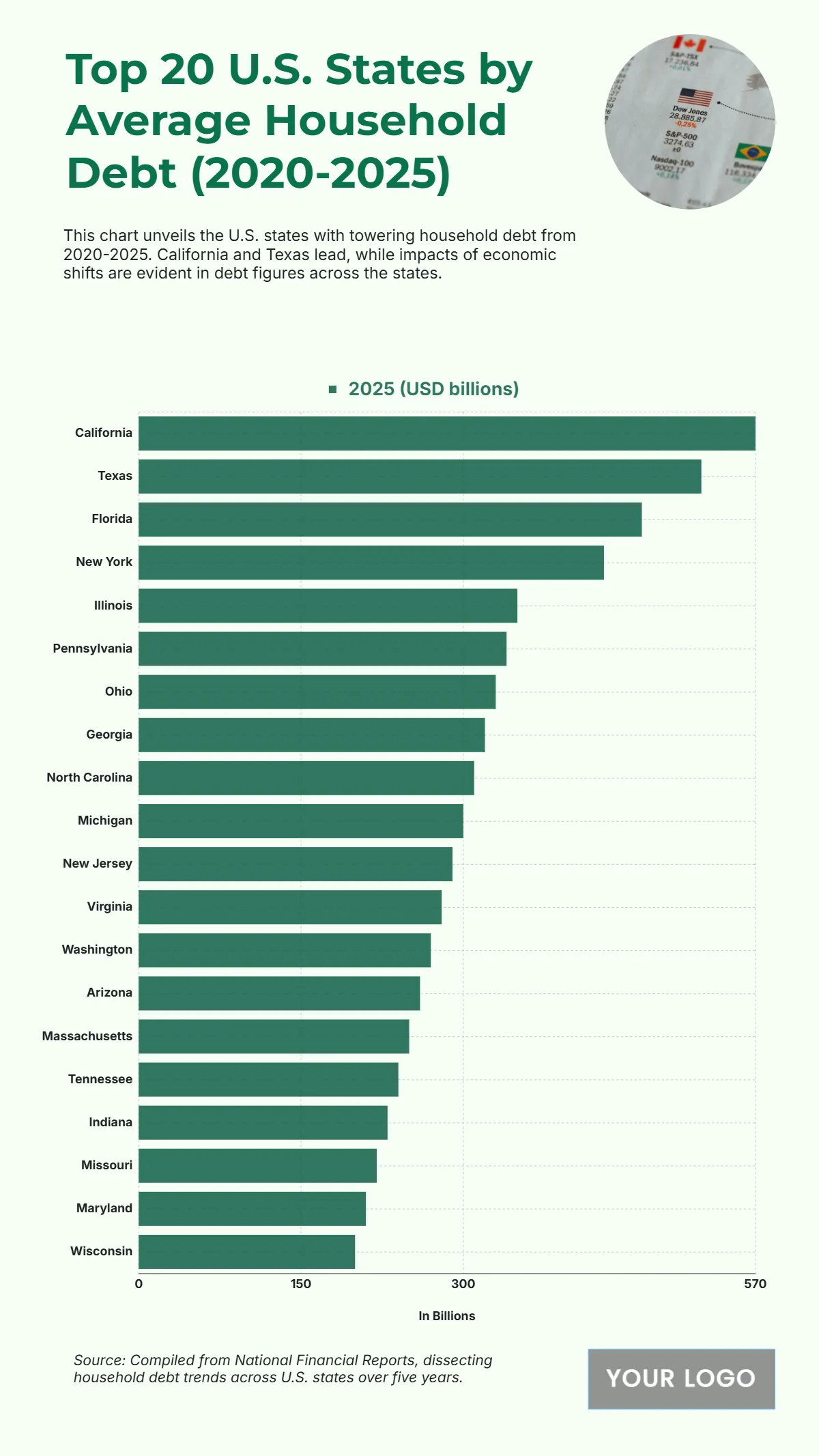

The chart presents the top 20 U.S. states by average household debt from 2020 to 2025, offering a clear view of how financial obligations vary across the nation. California leads significantly, with total household debt exceeding $550 billion in 2025, reflecting the state’s high cost of living, housing expenses, and credit activity. Texas follows closely, reaching around $500 billion, driven by rapid population growth and expanding mortgage markets. Florida and New York hold debt levels of roughly $430 billion and $400 billion, respectively, influenced by large urban centers and lifestyle-related expenditures. Mid-ranking states such as Illinois, Pennsylvania, Ohio, and Georgia range between $280 billion and $350 billion, reflecting steady financial obligations tied to consumer spending and housing markets. Meanwhile, North Carolina, Michigan, and New Jersey maintain household debt levels near $300 billion, signaling moderate but persistent borrowing patterns. The remaining states—from Virginia to Wisconsin—exhibit more stable debt totals under $250 billion, indicating a balance between income and liabilities. Overall, the chart underscores the correlation between population density, economic activity, and household debt accumulation across leading U.S. states from 2020 to 2025.

| Labels |

2025 (USD billions) |

| California | 570 |

| Texas | 520 |

| Florida | 465 |

| New York | 430 |

| Illinois | 350 |

| Pennsylvania | 340 |

| Ohio | 330 |

| Georgia | 320 |

| North Carolina | 310 |

| Michigan | 300 |

| New Jersey | 290 |

| Virginia | 280 |

| Washington | 270 |

| Arizona | 260 |

| Massachusetts | 250 |

| Tennessee | 240 |

| Indiana | 230 |

| Missouri | 220 |

| Maryland | 210 |

| Wisconsin | 200 |