Free U.S. Top 5 States with the Largest Public Pension Shortfalls (2015-2025)

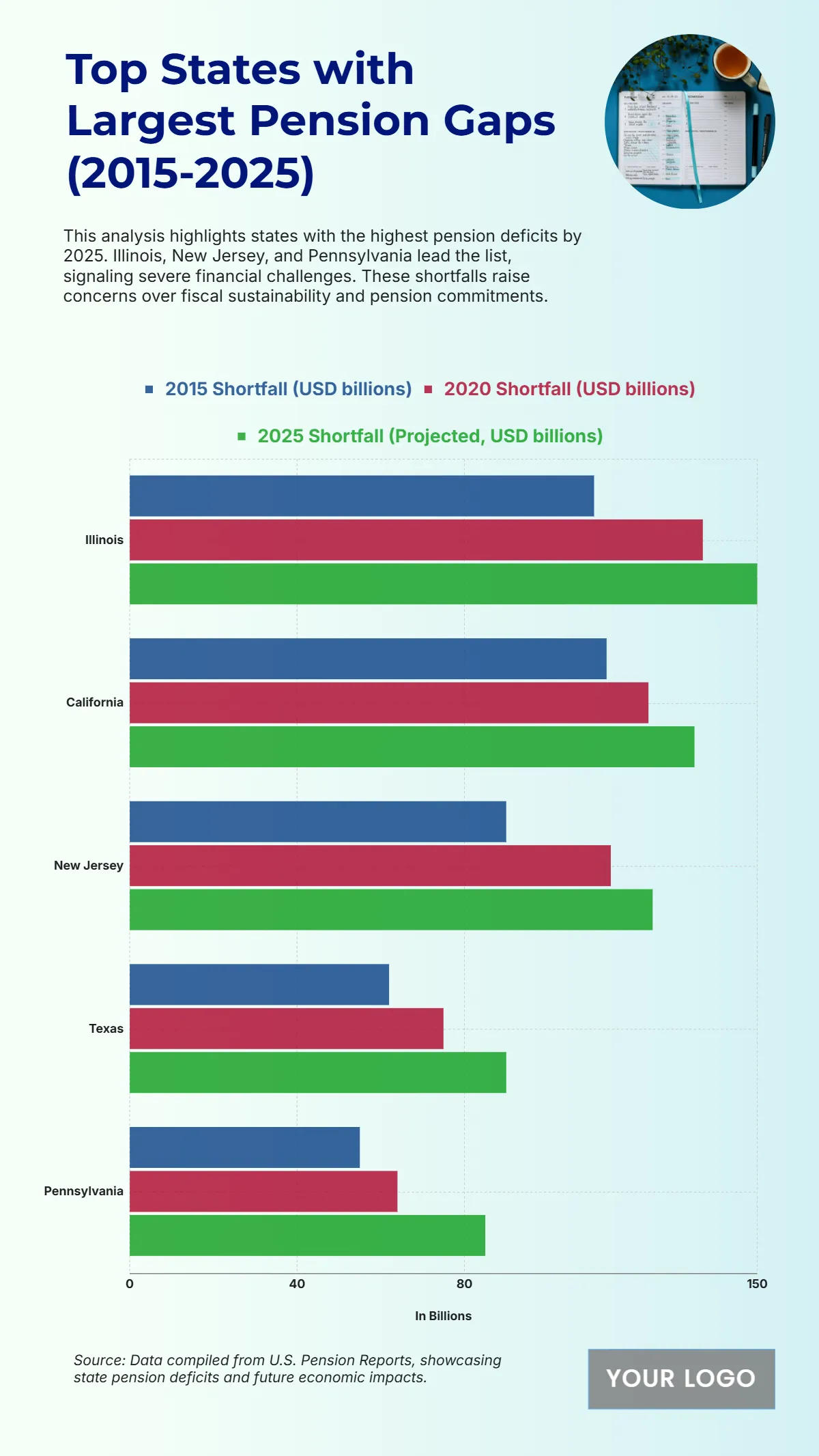

The chart illustrates the top U.S. states with the largest pension gaps from 2015 to 2025, highlighting significant financial shortfalls affecting state retirement systems. Illinois records the most substantial deficit, with pension shortfalls increasing from approximately $90 billion in 2015 to over $140 billion projected by 2025, signaling deep-rooted fiscal challenges. California follows closely, climbing from about $75 billion in 2015 to nearly $130 billion by 2025, driven by rising retiree benefits and unfunded obligations. New Jersey shows similar stress, with deficits expanding from around $60 billion to $120 billion, reflecting persistent underfunding issues. Texas presents a moderate yet growing shortfall, rising from $45 billion to roughly $95 billion, while Pennsylvania exhibits a consistent increase from $40 billion in 2015 to just under $90 billion by 2025. Overall, the data underscores a troubling upward trend in state pension liabilities, emphasizing the need for sustainable funding reforms and stronger fiscal management to ensure long-term pension stability across the United States.

| Labels | 2015 Shortfall (USD billions) | 2020 Shortfall (USD billions) |

2025 Shortfall (Projected, USD billions) |

| Illinois | 111 | 137 | 150 |

| California | 114 | 124 | 135 |

| New Jersey | 90 | 115 | 125 |

| Texas | 62 | 75 | 90 |

| Pennsylvania | 55 | 64 | 85 |