12+ Business Loan Application Form Templates – PDF

Some businesses operate 24/7, but it is entirely possible for it to run out of money due to unforeseen circumstances. It may be due to inadequate capital or a sudden drop in demand. Business owners may have to borrow money from banks so they can have something to use and make up for the extra amount they lost. You may also see secure a loan for a start-up business.

A business loan allows the companies to have higher chances of success. Before a bank gives out a business loan to a company, it evaluates the company’s financial history, the level of risk and amount of debt it has. You may also see loan templates.

Bank Loan Application Form for Business Restaurant

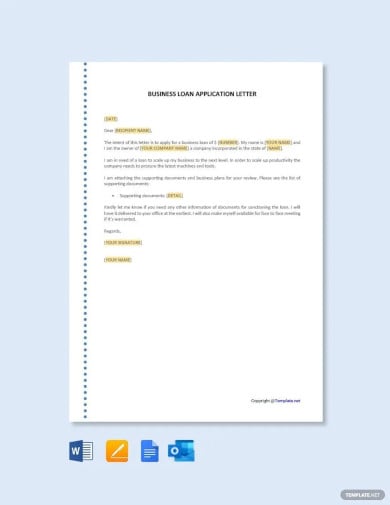

Business Loan Application Letter Form Template

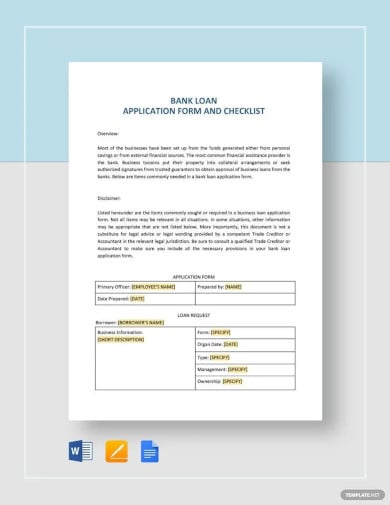

Free Business Loan Application Form

opusbank.com

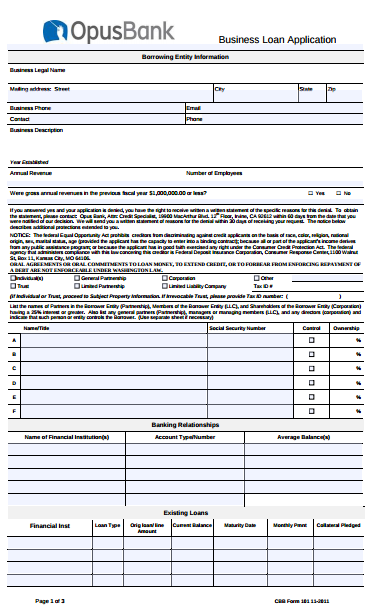

Free Business Loan Application Form

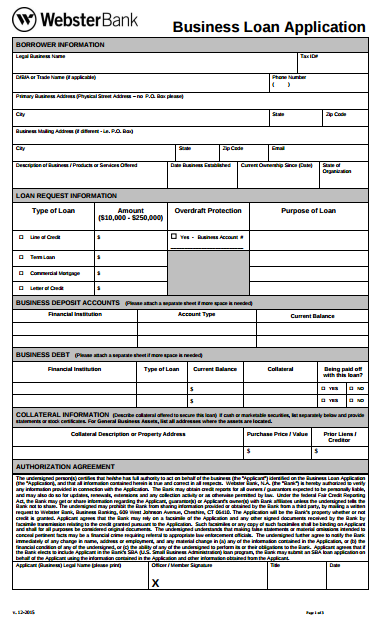

public.websteronline.com

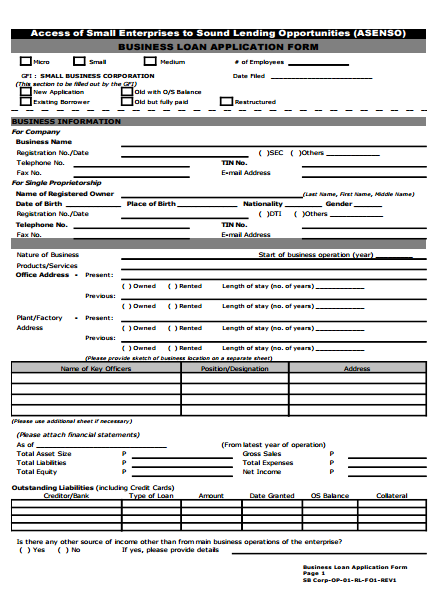

Free Simple Business Loan Application Form

sbgfc.org.ph

Things To Include In Business Loan Application

When applying a loan for your small business, expect a mountain of documents to prepare. Each document is important to the bank can give you a chance to borrow money from them. You have to prepare everything before making a transaction with the bank near you. Make sure it is complete so the bank won’t be suspicious of your intentions.

1. Cover page and cover letter

The cover page of your application should state your name and the name of your business, and the bank you submit the loan to. Your name falls under the heading “submitted by” and the bank falls under “submitted to”. The sample cover letteris the letter that you write requesting the bank for a loan.

The first paragraph is the intention of borrowing money from the bank. The second paragraph should give the banker a background about your business, while the last paragraph states your future plan of the business. Also, include a table of contents after the cover letter so bankers can easily find the needed parts of your business loan application.

2. History of the business

Give the bankers an extensive history of your business. Start from the very first day the business came to existence and how it was built. You can also state the reason why it was built. Include the target market of your business and a short list of what you offer.

3. The amount and use of business loan

This part states the amount of money that you intend to borrow from the bank and how it will be used. This applies to all kinds of uses of the money. If you plan to renovate your store, state the materials you need and the price of each. Add up all the amount and give the banker an estimated amount of money that you want to borrow. If you are buying a new equipment to use in your store, state the price of each and the cost of shipping. Do not go beyond what you cannot afford to pay. You may also see loan application letters.

4. Management people

Bankers should know the employees you hired to oversee the daily operations of your business. Give full details of these employees to the bankers. It should also include yourself and the outside consultants that you collaborate with every now and then. Give a background of the employee’s job and tell the banker why he is fit to do such job. You may also see application form templates.

5. Market information

This is the document that highlights the products that you sell to your customers. Give the bankers a breakdown of each product, the prices, and the target market of your business. Tell the bankers about the success of your business in your chosen target market. Inform the banker about your future plans of the business and the new products and services coming along the way. You can also see more on Market Analysis Templates.

6. Financial history and projections

Your application should state the financial history of your business, profits and loss included. Bankers will have an idea about the financial situation of your business and will judge if you deserve to have the loan. You should also write the financial projections of your company within a span of time. The financial projections consist of three documents, namely the income statement, cash-flow statement, and balance sheet. This part should also attach the use of the loan.

7. Collateral

Bankers will surely look for a way of backup repayment in case you can’t pay the money you loaned. It may be your home equity or any of your personal property that will be at stake. Each collateral should have a clear description and its market value should be well-determined. You may also see a business proposal for a loan.

8. Personal financial statements and additional documents

Banks will assess your personal financial statements such as your tax returns and net worth. The additional documents that you attach in the application sample form include the photograph of your business location, a copy of the contract of the new equipment, and the contract of the lease agreement.

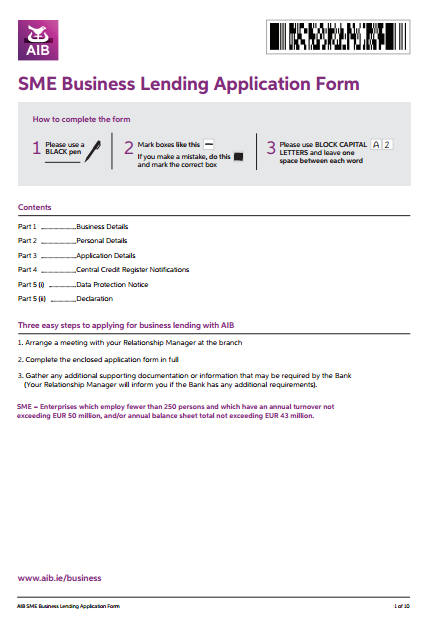

Free Business Lending Application Form

business.aib.ie

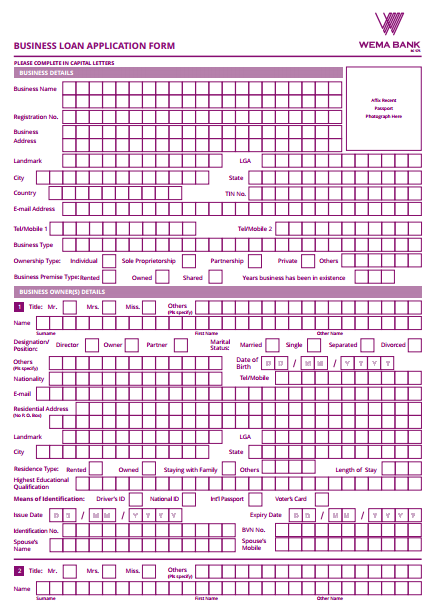

Free Bank Business Loan Application Form

wemabank.com

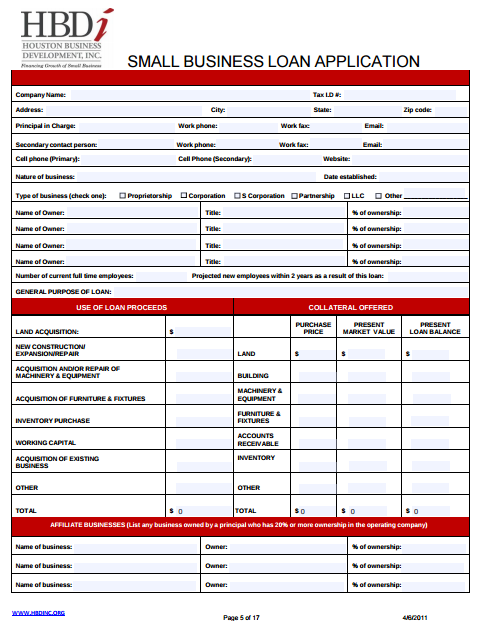

Free Small Business Loan Application

hbdinc.org

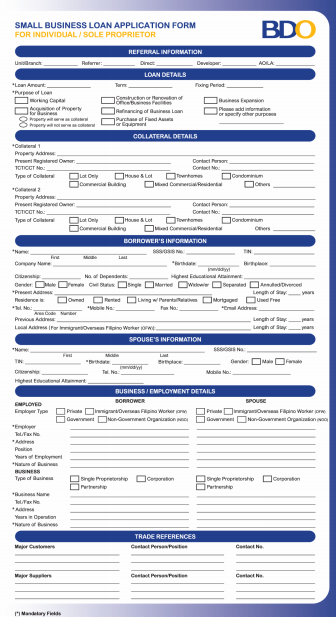

Free Small Business Loan Application Form

bdo.com.ph

Ups and Downs of Business Loans

Business loans help business owners grow and expand their business. At some point, they resort to getting loans for their business. However, it has some ups and downs business owners should take note of before getting that much-needed loan. You may also see Loan proposal Templates.

1. Lower interest rates

Compared to other simple forms of loans, business loans have lower bank interest rates. This makes it easy for business owners to repay the loan when they get enough money. You may also see Employment Application Forms.

2. Convenient payment options

In getting a business loan, several payment options are offered to those who want to borrow money. It is commonly paid per business cash flow to avoid additional financial difficulties. It gives business owners more time to gain the income they need to pay the loan. You can also see more on Cash Flow Analysis Templates.

3. Flexibility

A business loan is flexible in its own nature. It can be long term or short term, depending on the funding requirements needed. This makes it easier for business owners to get the loan they need. You can also see more on Loan Agreement Templates.

4. Affordable

Business loans are one of the most affordable of its kind. Its affordability is based on tenure, the borrower’s credentials, the dynamics of the business and the financial situation of the business. You may also see application templates.

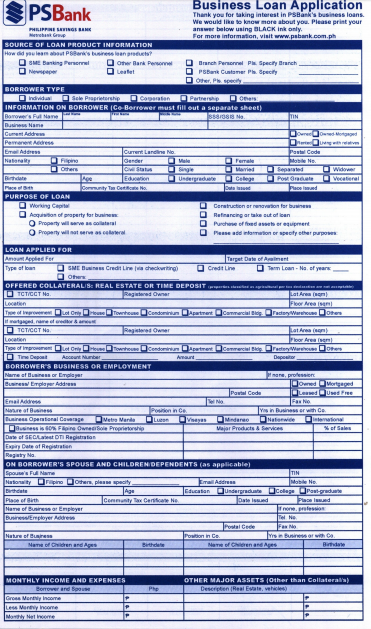

Free PS Bank Business Loan Application Form

psbank.com.ph

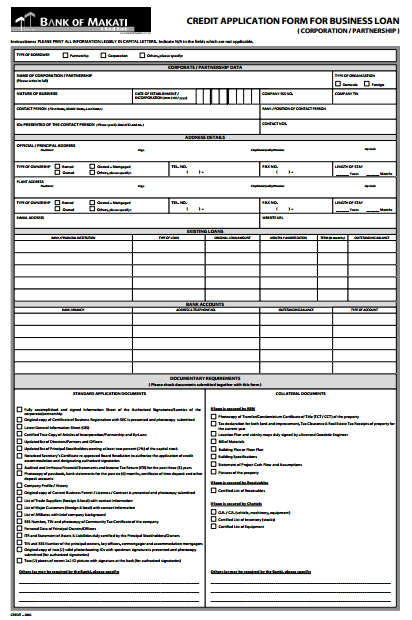

Free Credit Application Form for Business Loan

bankofmakati.com.ph

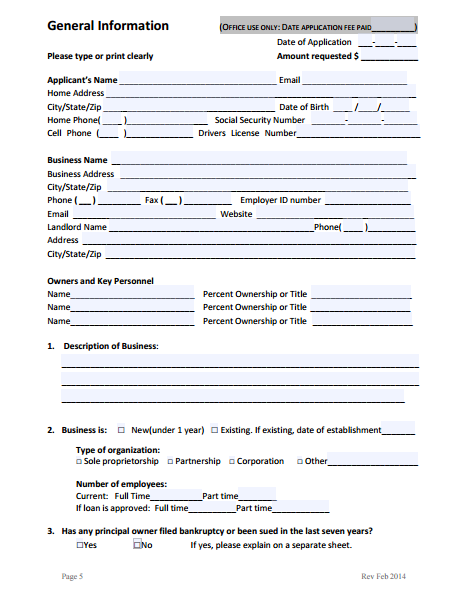

Free Universal Small Business Loan Application

greatlakeswbc.org

5. Granting loans to existing businesses only

Banks grant business loans to businesses which have existed for a long time. They can assess its profitability and ability to pay over startups, which are risky in nature. It might fail big time and be unable to pay the loan. You may also see Loan Application Letter Templates.

6. High risk of losing the collateral

If business owners are unable to pay the loan, there is a very big chance of losing the collateral. Once the collateral is lost, it can never be regained. You may also see membership application templates.

7. Not granting the entire amount

Some banks do not grant the entire amount of the loan. They only give 70 to 80 percent of the actual amount that you want to borrow. It is difficult for the business owner. He has to look for other sources of money to make up for the remaining amount of the loan. You may also see Membership Application Templates.

Conclusion

Getting a loan is not a bad thing, as long as you use it for good purposes. Use every amount of the money you have to grow and expand your business in every way possible. You may also see free Rental Promotion Templates.