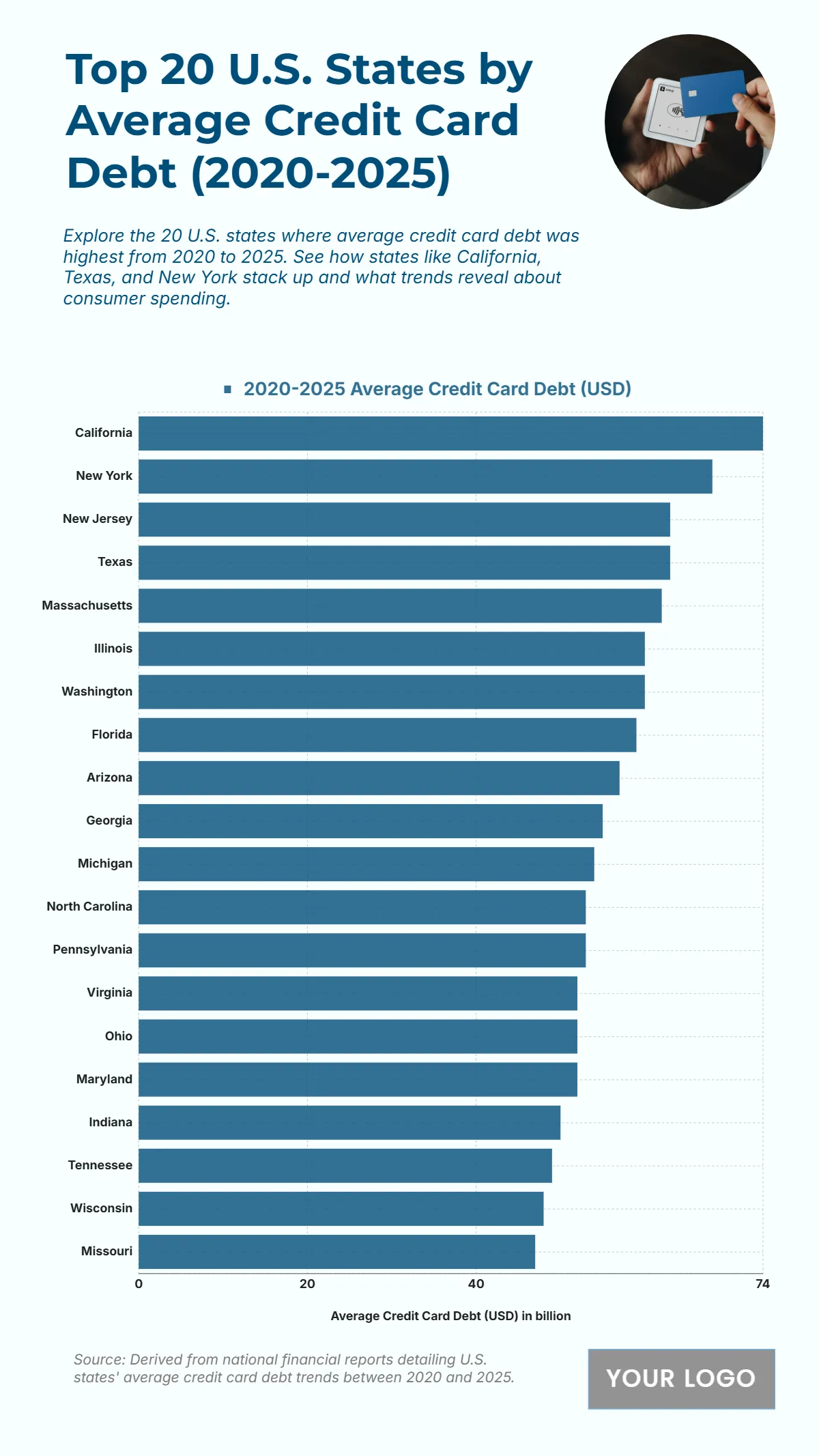

Free Top 20 U.S. States by Average Credit Card Debt (2020-2025) Chart

The chart shows significant credit card debt concentration between 2020 and 2025, with California holding the highest average at 74 billion USD, underscoring the state’s high consumer spending activity. New York follows at 68 billion USD, while New Jersey and Texas are tied at 63 billion USD, reflecting strong purchasing trends in these economically active states. Massachusetts comes next at 62 billion USD, slightly ahead of Illinois and Washington, both at 60 billion USD. Florida records 59 billion USD, followed by Arizona at 57 billion USD, and Georgia at 55 billion USD, highlighting broad geographic participation in credit use. Mid-range figures appear in states like Michigan (54), North Carolina (53), and Pennsylvania (53), while states such as Virginia, Ohio, and Maryland each hold 52 billion USD. Missouri, at the lower end, records 47 billion USD, indicating less consumer debt intensity compared to the leading states.

| Labels | 2020–2025 Average Credit Card Debt (USD) |

|---|---|

| California | 74 |

| New York | 68 |

| New Jersey | 63 |

| Texas | 63 |

| Massachusetts | 62 |

| Illinois | 60 |

| Washington | 60 |

| Florida | 59 |

| Arizona | 57 |

| Georgia | 55 |

| Michigan | 54 |

| North Carolina | 53 |

| Pennsylvania | 53 |

| Virginia | 52 |

| Ohio | 52 |

| Maryland | 52 |

| Indiana | 50 |

| Tennessee | 49 |

| Wisconsin | 48 |

| Missouri | 47 |