8+ Fundraiser Receipt Templates

Many charities are always looking to receive funding for their activities. In exchange for funding, these organizations may also release receipts as a sign that they have received the money. In that case, these organizations may be in need of a Donation Receipt Template to certify the transaction.

Receipt Template Bundle

Construction Receipt Template Bundle

Organizations that donate to charity can use things like a Deposit Receipt Template in order to add the amount of the donation to their tax deductibles. Which is all the more reason why the receiving institution should issue receipts. Learn more about documents of this kind by browsing through out list of items and tips.

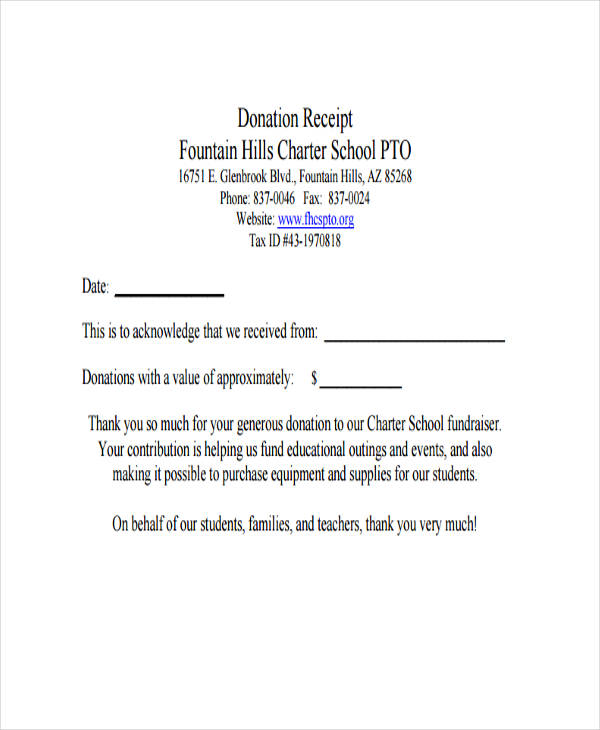

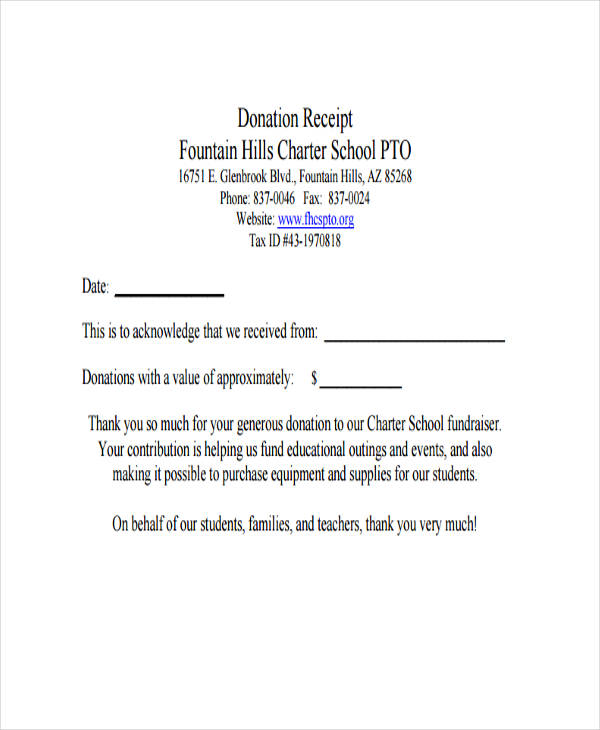

School Fundraiser Receipt

fhcspto.org

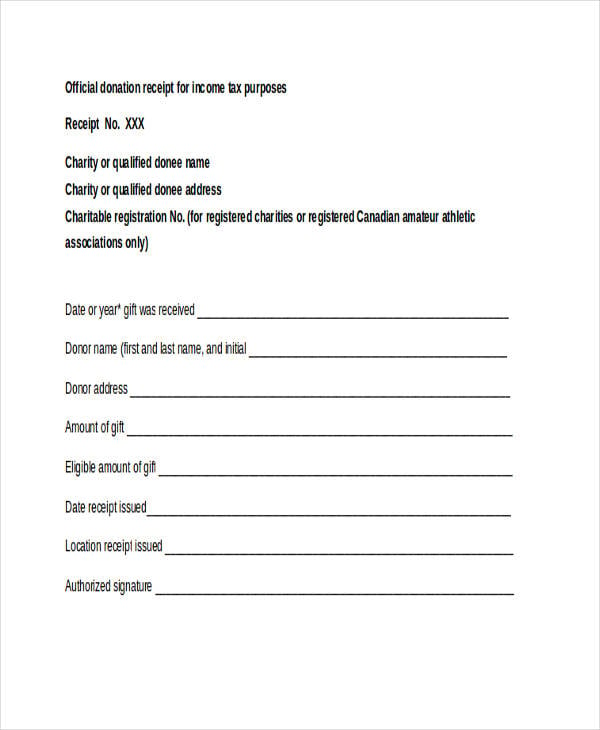

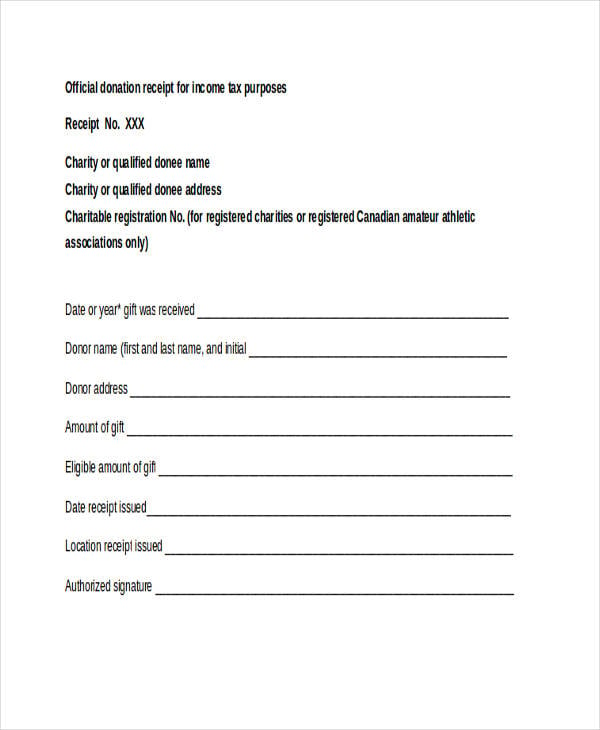

fhcspto.orgFundraiser Tax Receipt

cra-arc.gc.ca

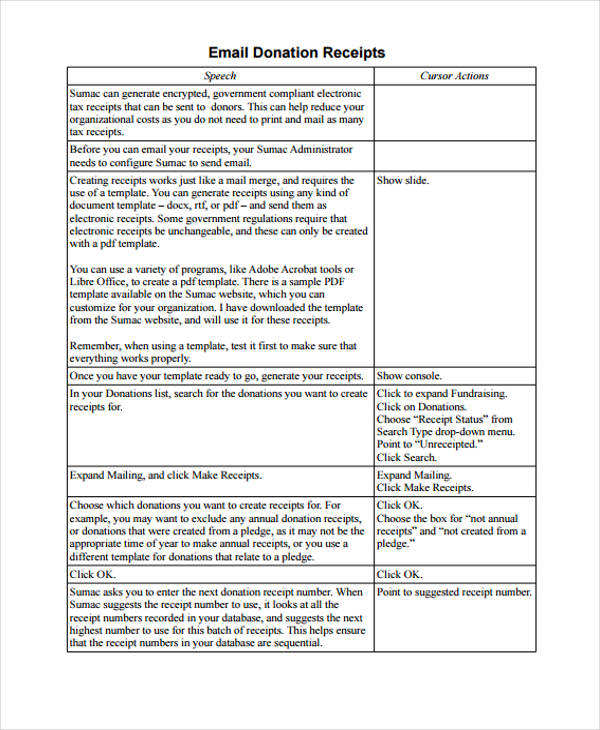

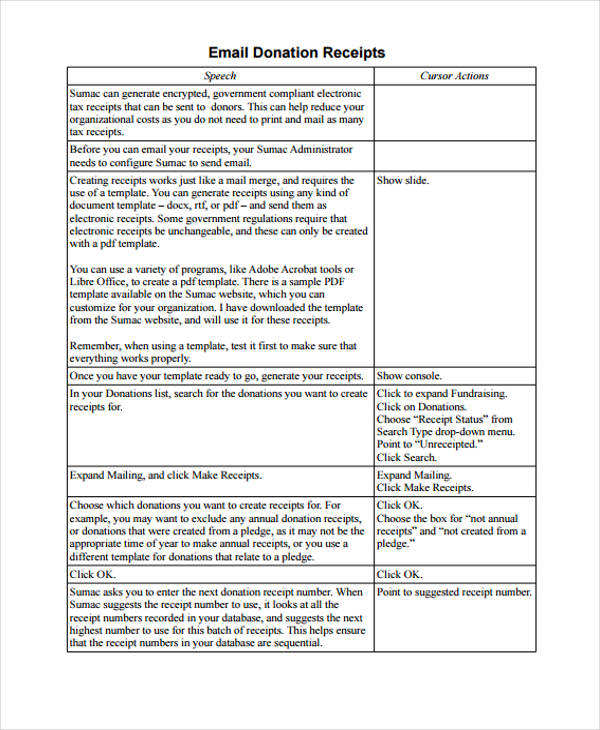

cra-arc.gc.caEmail Donation Receipt

sumac.com

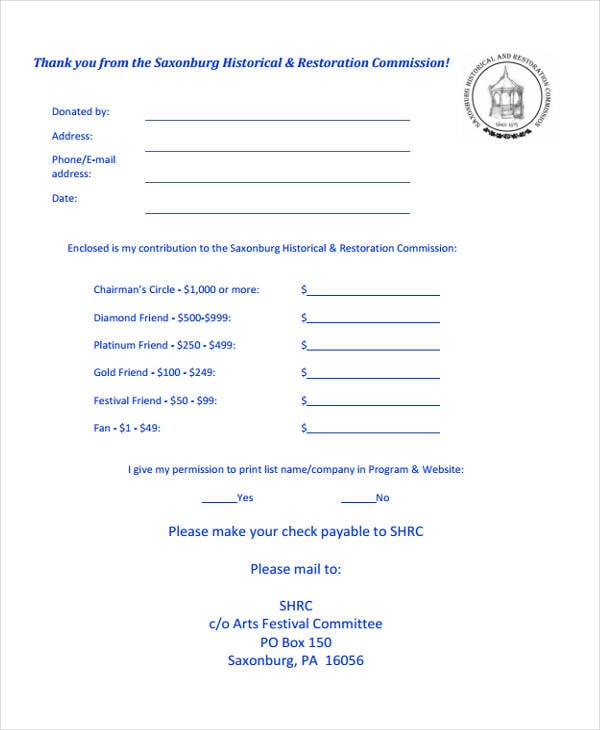

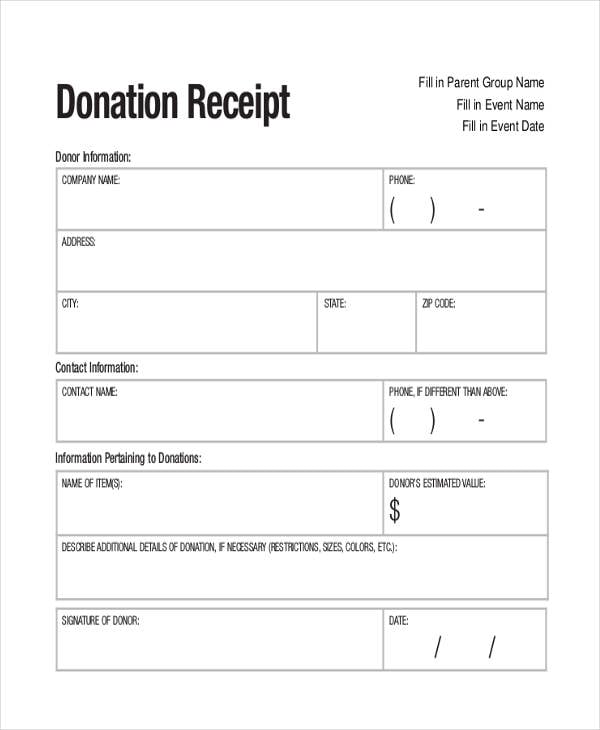

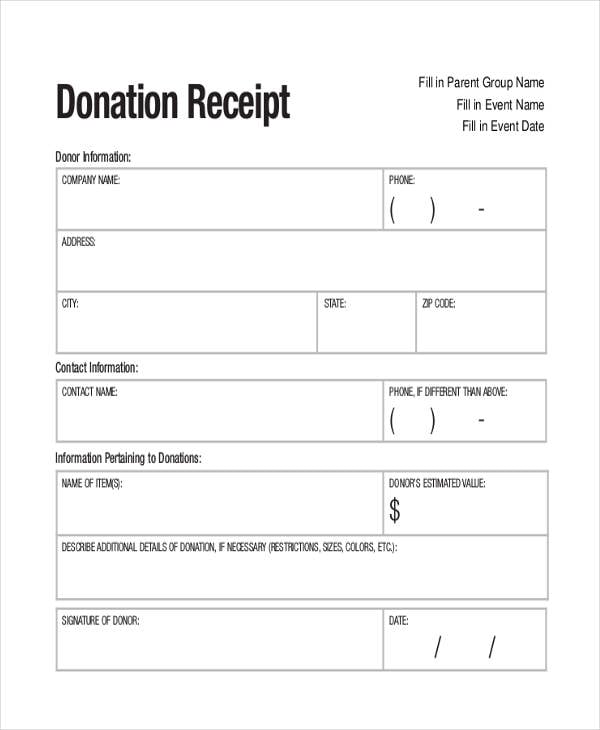

sumac.comPrintable Fundraiser Receipt

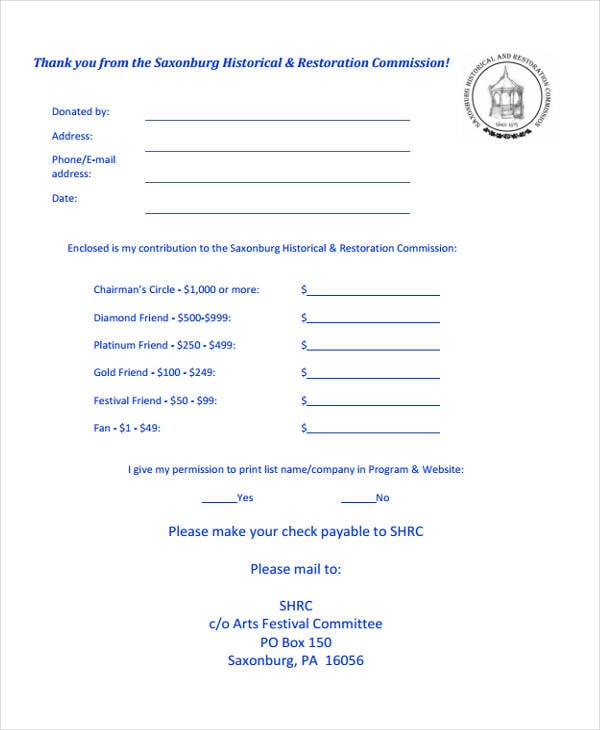

visitsaxonburgpa.com

visitsaxonburgpa.comNon-Profit Fundraiser Receipt

ptotoday.com

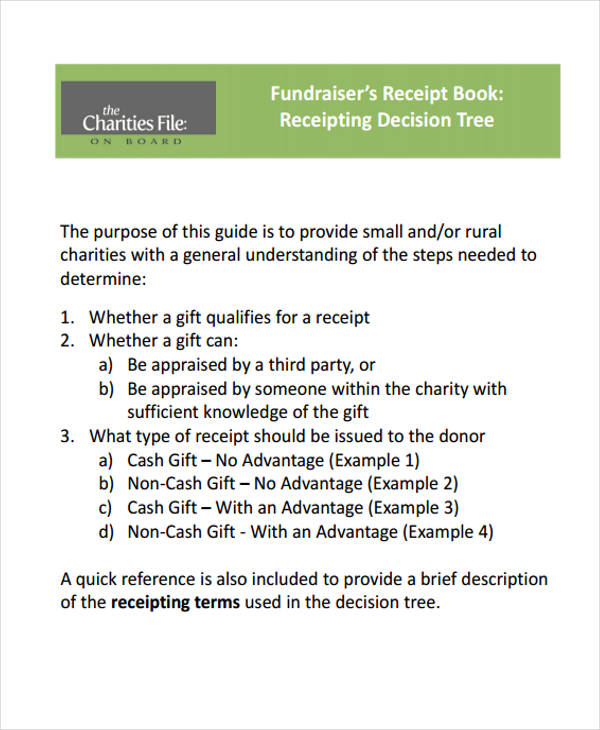

ptotoday.comWhy Do We Need Fundraiser Receipts?

In most business transactions, the job is to provide a record of the transaction. For that, you could use basic Receipt Templates as a framework to make the receipts proper. But fundraisers need their own receipts, for reasons including:

- Record-keeping, as the receipt is a way for the donor to keep track of the money they spend on the recipient.

- Tax returns, as you can receive tax deductions for donating money or other things to charities.

- Accounting, as the organization can keep their own copies of receipts of transactions so that they can assess how much money they receive via donations.

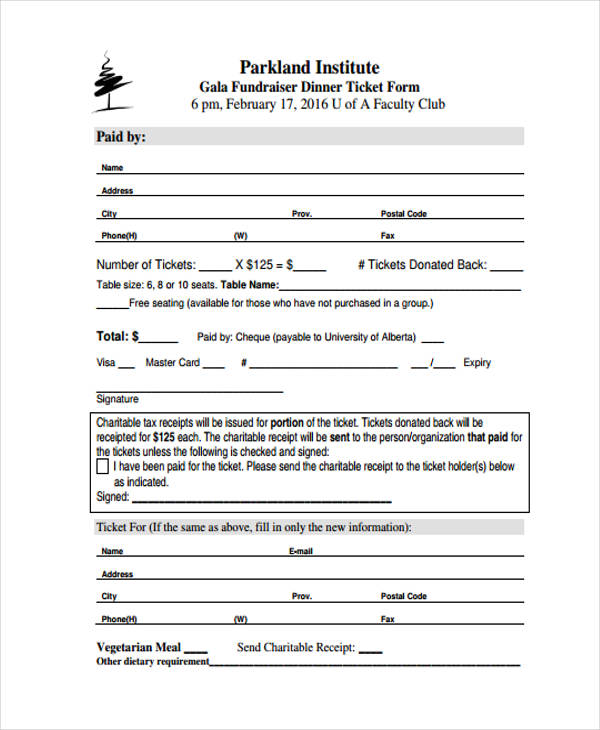

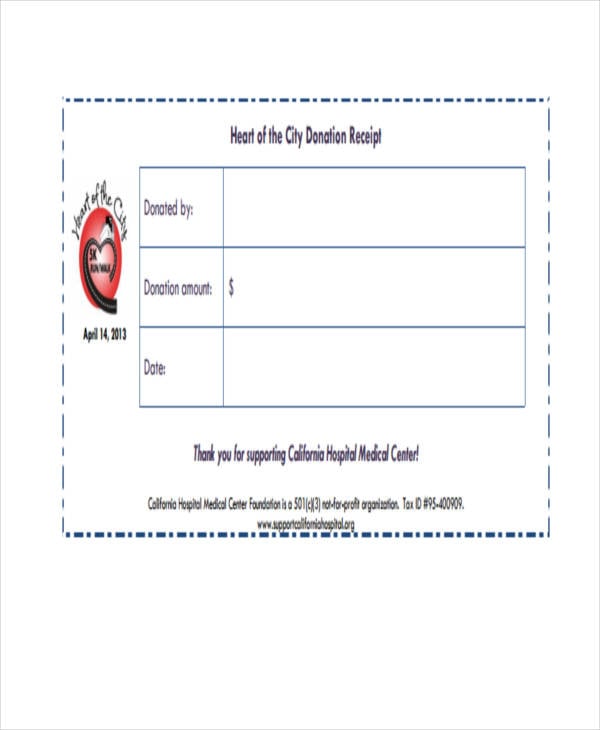

What Can You Find in a Fundraiser Receipt?

Like other kinds of certificates, you can find some certain elements that have to be included in fundraiser receipts. As in other receipts, like a Tax Receipt Template, these elements have to be there for your receipts to be valid.

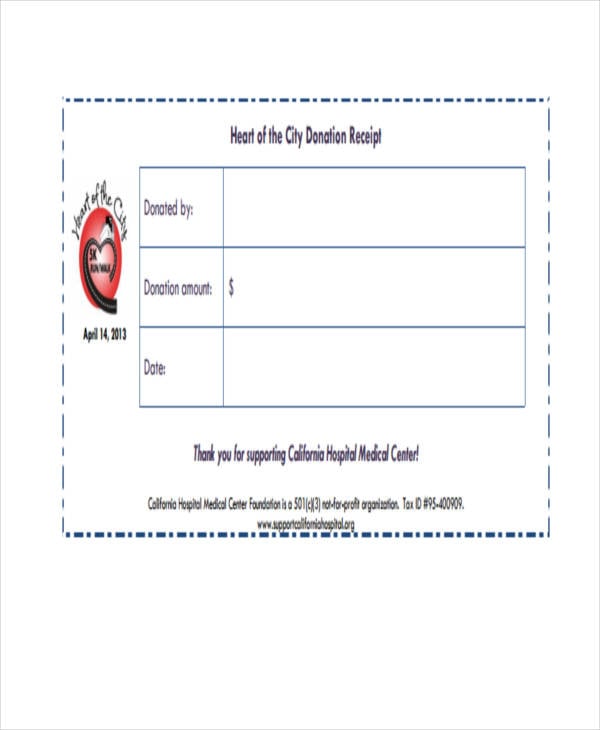

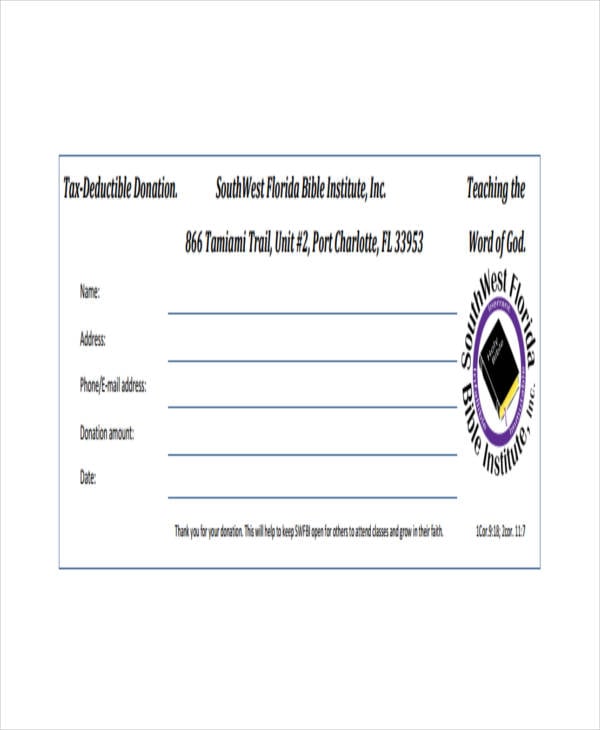

- Your fundraiser receipt should include the amount donated to the charity, as this would be necessary for both record-keeping and for tax rebates, if that is what you want.

- Your name and the charity’s should be included.

- The date of the transaction should also be on the receipts proper, so that it is clear when the transaction actually took place.

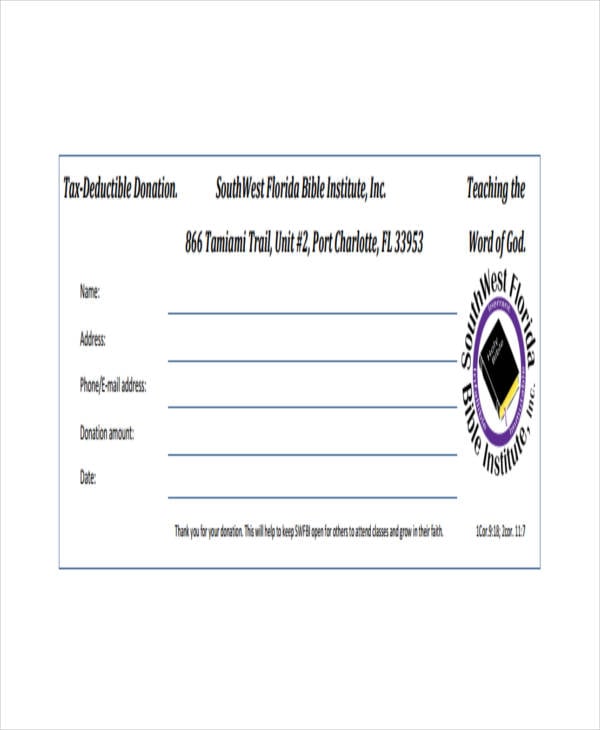

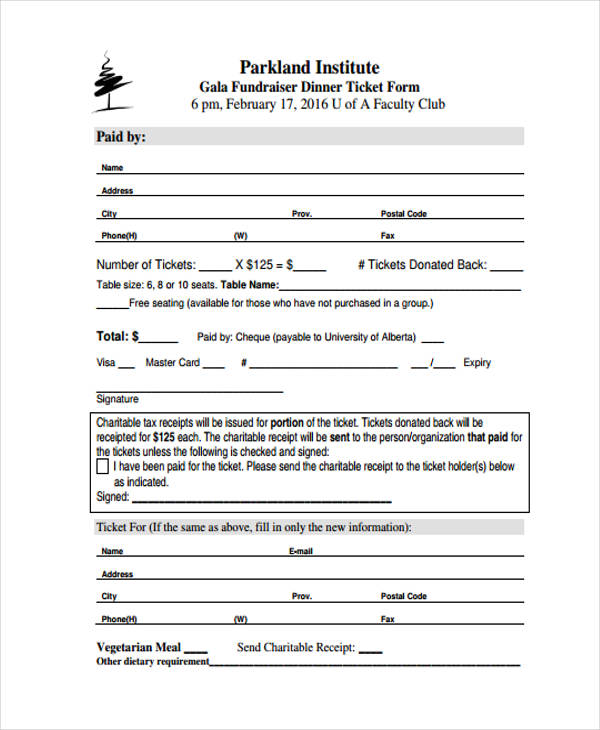

Institute Fundraiser

cloudfront.net

cloudfront.net

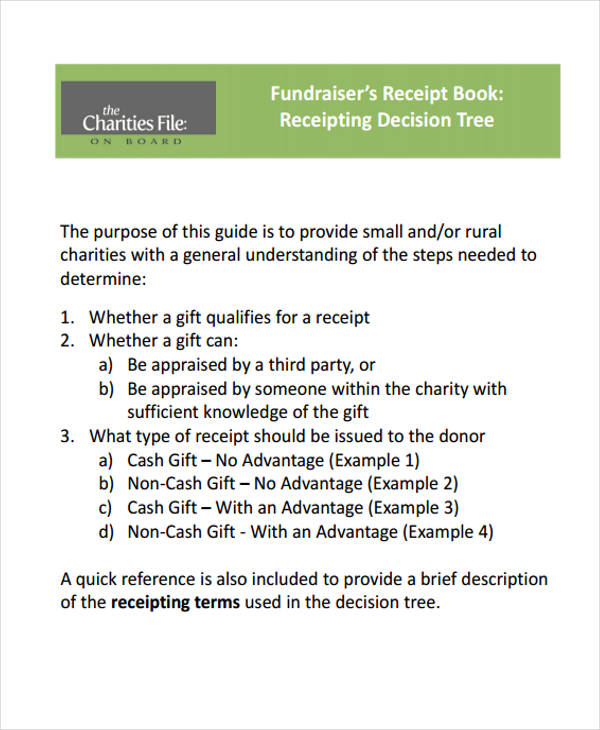

Fundraiser Receipt Book

capacitycanada.ca

capacitycanada.caTeam Fundraiser

kintera.org

kintera.orgClass Fundraiser Receipt

swfbi.org

swfbi.orgGuidelines for Fundraising Receipts

There are also some other things to consider for your fundraiser receipt templates. After all, there are some guidelines that would have to be followed for the eventual receipt (even Blank Receipt Templates) to work well, such as:

- For marketing purposes, you can include the charity’s name and logo. The receipt itself is an official document, and would need to carry the organization’s logo in order to represent it. The branding on the receipt can also be a subtle kind of advertising for anyone who sees it.

- You should also remember to include contact information, for the benefit of anyone who may want to donate to the charity. This includes those who have donated in the past, and any future donors, so they can get in touch with the organization easily.

- You may also want to insert space for donors to write their signatures. This can serve to make the receipt more official, as having the donors’ signatures can lend documents like these more weight.

Now that you have learned the value of the receipt, it doesn’t mean you need to keep every single one you get for buying donuts. They are essential, however, for substantial transactions, which is why we have placed these templates at your disposal.

More in Receipt Templates

| 27+ Receipt Formats in Word | 7+ Charity Donation Receipt Templates in PDF | DOC |

| 8+ Charity Auction Receipt Templates in DOC | PDF | 6+ Nanny Receipt Templates in PDF |

| 17+ Donation Receipt Letter Templates in Google Docs | Google Sheets | Excel | Word| Numbers | Pages | PDF | 7+ Order Receipt Templates in Google Docs | Google Sheets | XLS | Word | Numbers | Pages | PDF |

| 8+ School Receipt Templates in Google Docs | PDF | Word | XLS | Pages | 6+ Monthly Receipt Templates in Google Docs | Word | Pages | PDF | XLS |

| 5+ Taxi Receipt Templates in Google Docs | Word | Pages | PDF | 10+ Car Receipt Templates |

| 13+ Construction Receipt Templates | 9+ Restaurant Receipt Templates in Google docs | Google Sheets | XLS | Word | Pages | Numbers | PDF |

| 5+ House Rent Receipt Templates | 10+ Best Rent Receipt Templates |

| How to Create a Cash Receipt [5+ Templates to Download] | 8+ Best Cleaning Service Invoice Templates |

| 8+ Best Sales Receipt Templates | How to Create a Car Receipt [5+ Templates to Download] |

| How to Make a Medical Receipt [5+ Templates to Download] | 12+ Receipt Templates in Apple Pages |

| 10+ Receipt Templates in Apple Numbers | 10+ Receipt Templates in Excel |

| 7+ Sample Cash Receipt Templates | How to Make/Create a Receipt in Google Sheets [Templates + Examples] 2023 |

| 10+ Sales Receipt Templates | 10+ Sample Rent Receipt Templates |

| 10+ Receipt Templates in PDF | 17+ Receipt Templates in Google Doc |

| 10+ Receipt for Goods and Services Template | 10+ Medical Bill Receipt Template |

| 9+ Sample Construction Receipt Templates | 10+ Receipt Templates in Word |

| 8+ Sales Service Receipt Templates | 10+ Blank Sales Receipt Template |

| 9+ Hotel Receipt Templates | 4+ Restaurant Bill Receipt Templates |

| 10+ Daycare Receipt Templates | 8+ Petty Cash Receipt Template - PDF |

| 6+ Tuition Receipt Templates - PDF, Word | 10+ Delivery Receipt Templates - Google Docs | Google Sheets | MS Excel | MS Word | Numbers | Pages |

| 5+ Lorry Receipt Format Templates - PDF | 6+ Hospital Receipt Templates - PDF, Word |

| 17+ Money/Cash Receipt Templates - PDF, Word | 10+ Child Care Receipt Templates - PDF |

| 17+ Professional Receipt Templates - PDF | 29+ Free Business Receipt Templates - PDF, Word |

| 6+ Goods and Services Receipt - PDF, DOC | 7+ Credit Card Receipt Templates - PDF, Word |

| 13+ Simple Sales Receipt Templates - PDF, Word | 10+ Landlord Rent Receipt Templates - PDF |

| 14+ Simple Receipt Templates - PDF, Word | 10+ Rent Receipt Templates - PDF |

| 35 + Bill of Lading Templates in MS Word, Google Docs | 10 Blank Bill of Lading Templates |

| What is a Bill of Lading? | How to Set Up The Payment Information In The Receipt Template |

| 7 Repair Receipt Templates - Samples, Examples | How to Differentiate Receipts from Invoices |

| 6 Loan Receipt Templates in PDF | 9+ Lease Receipt Templates - Sample, Example |

| What Is Acknowledgement Receipt? | 8+ Fundraiser Receipt Templates - Word, PDF |

| How to Organize Your Business Receipts | 14+ Acknowledgement Receipt Templates - Word, PDF |

| 9+ Transfer Receipt Templates | 6+ Transport Receipt Templates - Samples, Examples |

| 9+ Bill Receipt Templates - Samples, Examples | 8+ Transfer Receipt Templates - Samples, Examples |

| 17+ Loan Receipt Templates - Sample, Example | 7+ Repair Receipt Templates - Word, PDF, Excel |

| 6+ Company Receipt Templates - Samples, Examples | 6+ Company Receipt Templates - Word, PDF |

| 5+ Order Receipt Templates - Samples and Examples | Real Estate Deposit Receipt Definition and Examples |

| Define Constructive Receipt of Income | 8+ Fundraiser Receipt Templates |

| 7+ Purchase Receipt Templates | 45+ Printable Receipt Templates |

| 5+ Photography Receipt Templates - Samples, Examples | 39+ Receipt Formats |

| 20+ Receipt Templates in PDF | 8+ Work Receipt Templates -Word, PDF |

| 8+ Expense Receipt Templates - Word, PDF | 6+ Photography Receipt Templates |

| 14+ School Receipt Templates - Samples, Examples | 15+ Salary Receipt Templates -Sample, Example |

| 6+ Catering Receipt Templates -Sample, Example | 7+ Lease Receipt Templates - Word, PDF |

| 5+ Gift Receipt Templates - Sample, Example | 17+ Transport Receipt Templates |

| 14+ Bill Receipt Templates | 8+ Purchase Receipt Templates |

| 21+ Receipt Templates | 15+ Acknowledgement Receipt Templates |

| 6+ Work Receipt Templates - Samples, Examples | 4+ Expense Receipt Templates - Samples, Examples |

| 9+ Cash Receipt Templates | 6+ Salary Receipt Templates |

| 8+ Order Receipt Templates - Word, PDF | 19+ Cash Receipt Templates - Sample, Example |

fhcspto.org

fhcspto.org cra-arc.gc.ca

cra-arc.gc.ca sumac.com

sumac.com visitsaxonburgpa.com

visitsaxonburgpa.com ptotoday.com

ptotoday.com cloudfront.net

cloudfront.net capacitycanada.ca

capacitycanada.ca kintera.org

kintera.org swfbi.org

swfbi.org