7+ Credit Card Receipt Templates – PDF, Word

If you’re going to make a transaction, then you expect to receive a receipt at the end so that you can acquire details such as how much you bought a product or service for, the date in which you bought it, the amount you’ve paid, how you made the payment, etc. You may also like receipt templates.

Receipt Template Bundle

But what if the payment is made via credit card? You’ll need to gain more than just the basic information as payment receipts which contain credit card information are different compared to the rest. That’s why this article is going to focus on how you will go about in creating such a receipt, as well as helping you learn about its importance.

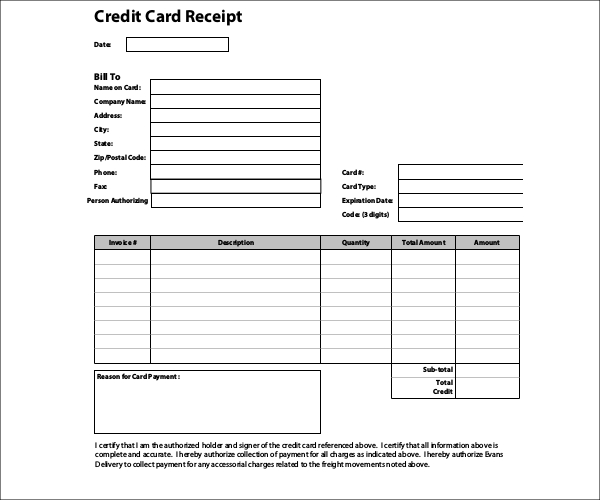

Sample Credit Card Receipt

static1.squarespace.com

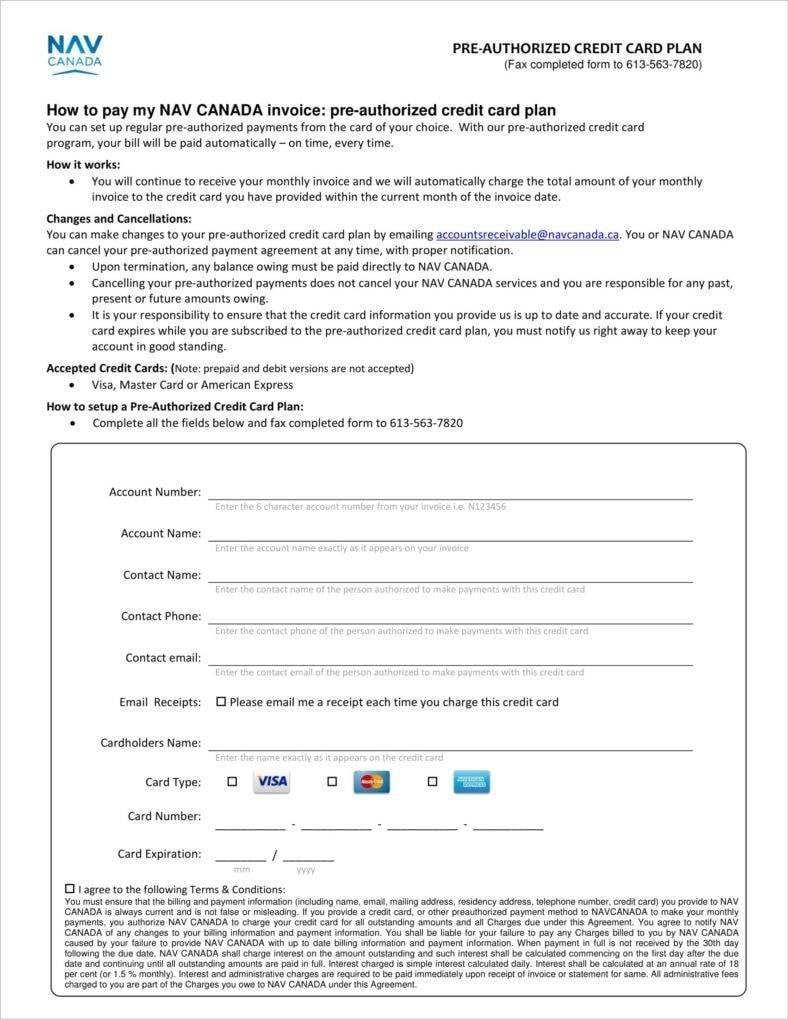

Credit Card Receipt Form

navcanada.ca

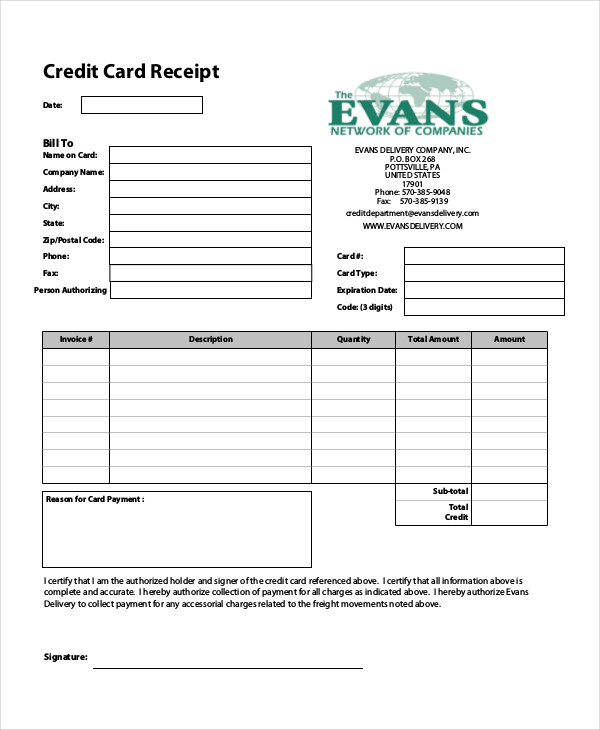

Example Credit Card Receipt

static1.squarespace.com

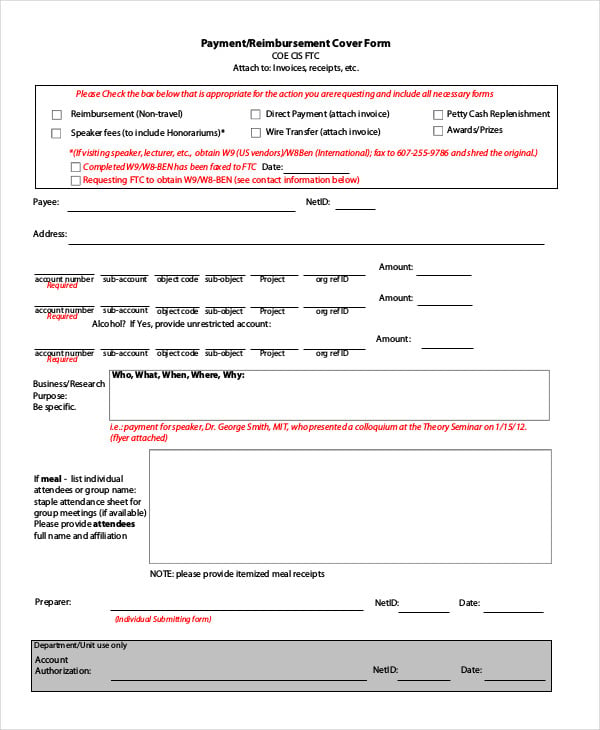

Credit Card Payment Receipt Template

cee.cornell.edu

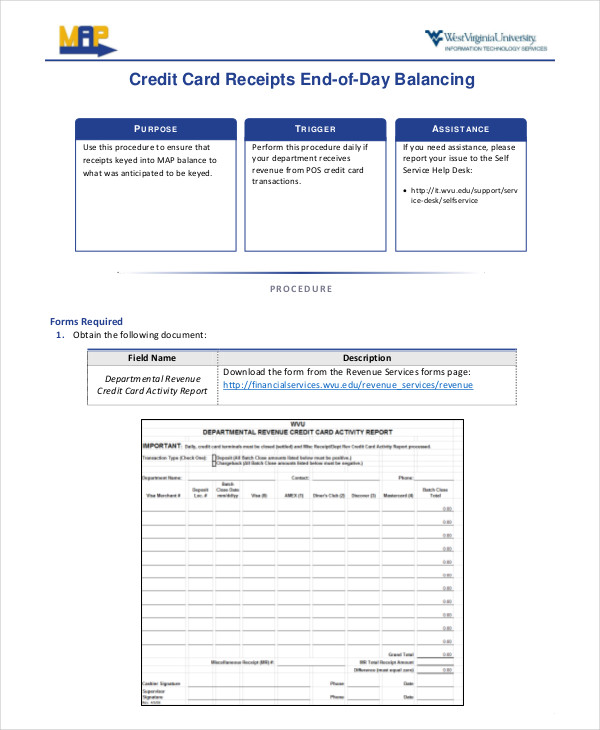

End-of-Day Credit Card Receipt Form

it.wvu.edu

Information that A Credit Card Receipt Should Have

No matter what type of receipt you’re intending to make, you need to be able to give sufficient information regarding the transaction that both parties can benefit and make use of. The information that each receipt requires differs based on factors such as the type of transaction, method of payment, environment (physical or virtual), etc. You may also like receipt formats.

So how about if you’re making one for a credit card receipt? You’re going to have to learn what it should contain so that those who pay via credit card will feel safe knowing that you’re able to provide them with all the details regarding how the transaction took place through the use of their cards. You may also see blank receipt templates.

Here is a list of all the information that a credit card receipt should contain:

1. The Merchant Details

This is basically all of the important information regarding the company who will be receiving payment via credit card. So what this section of the receipt should contain is the name of the merchant, the country or state where he/she is located, contact details, and/or the point of banking location. You may also like receipt sample templates.

The reason as to why all of this has to be included in the credit card receipt is because there’s always that possibility that a customer would want to contact the merchant regarding the payment details. By knowing the merchant’s contact details or where the merchant is situated in, the customer may either call to learn more about the transaction or go straight to the establishment itself if in the event he/she wishes to do something such as file a customer complaint regarding the transaction.

2. The Date of Transaction

This is just as important as the amount of money that was taken from the buyer’s credit card. By placing the date on the credit card receipt, both the merchant and the buyer can verify as to when the transaction took place. This is very important for the business as there’s a possibility that the buyer will be paying for a product via installments. Going through the credit card receipt can tell just how much charged as well as when the buyer will need to make his/her next payment.

Also, remember that there’s a specific date format that every state or country uses. When you’re typing down the date of the transaction, it’s best that you follow how the rest of the other companies within your area does it. While you could always go with the standard mm/dd/yyyy format, it’s best that you stick with what everyone within your area is used to as you don’t want anyone to be confused. You may also like business receipt templates.

3. Description of the Products and Services Sold

This is where you place the information regarding whatever product or service was purchased through the customer’s credit card. So this should include an accurate description of the goods or services such as how much they were priced and the applicable taxes. You need to make sure that all of that is included in the receipt because having all of that information will help in identifying the transaction. Because let’s say that you need to pull up the details regarding a customers’ credit card purchase on a particular date. While there are a ton of receipts made during that specific date, you can make things much easier on yourself by knowing what was purchased and searching that in your company’s system. You may also like blank receipt samples.

In the event that there is no currency is identified on the receipt, the transaction is considered to have taken place in the currency that is legal tender at the point of sale. Basically, if the merchant sees that there isn’t any specified type of currency within the receipt, then the kind of currency will be used will depend on the country of where the merchant is situated in. If the merchant decides to offer multiple currencies, then the sample sales receipt will need to contain the following information:

- The transaction amount in the original transaction currency

- The currency symbol of both the original and converted transaction amount

- The converted transaction amount in the currency that has been chosen and agreed to by both the merchant and the cardholder (basically the total number of the sale)

- The method by which the currency agreed to by the cardholder was converted from the amount in the merchant’s local currency.

Be sure that you don’t leave any of that out as it’s all very important.

4. An Imprint of the Card

There has to be a legible imprint of the card on the credit card receipt. The merchant may also electronically record the customer’s card information and the merchant location. If in the event that the transaction has been completed even without a card imprint or electronically derived card information, then the merchant will have to note legibly in the receipt regarding all the details that will identify the cardholder, the merchant, and the card issuer.

So this section of the receipt will need to have the name and address of the merchant, the complete name and trade of the card issuer as it appears on the credit card, the account number, the security code, the credit card’s expiration date, the name of the cardholder and the name of the company. If the transaction is completed without obtaining a card imprint or electronically derived card information, then it’s considered that the merchant has been able to verify the true identity of the customer as the person who owns the credit card. You may also like free receipt templates.

Mail orders, telephone orders, pre-authorized orders and e-commerce orders, may be completed without a card imprint.

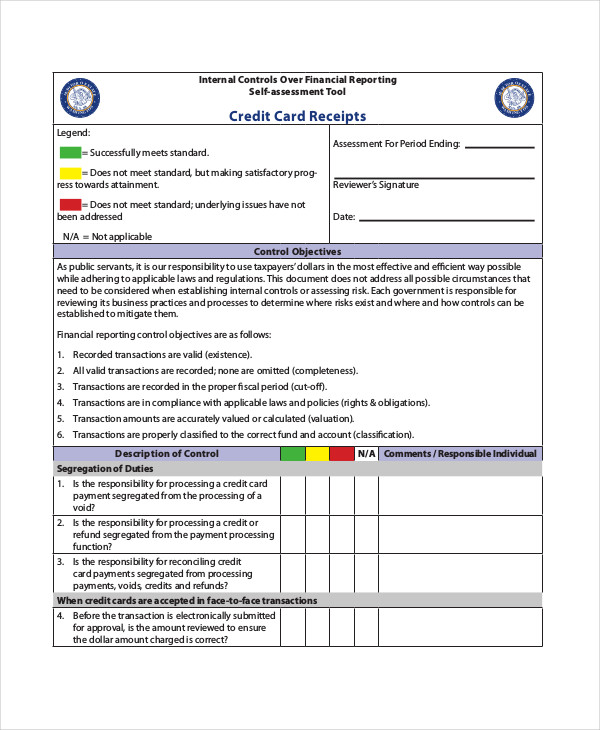

Credit Card Financial Receipt Example

sao.wa.gov

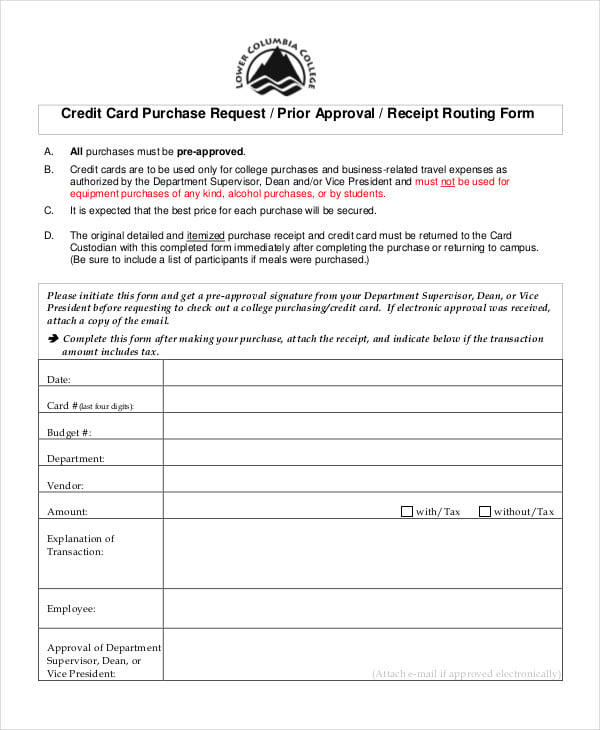

Credit Card Purchase Receipt Form

lcc.ctc.edu

Sample Credit Card Receipt Template in Word

professor.rice.edu

5. The Signature of the Cardholder

This is very important as you can think of it in the same way as signing a contract agreement where the signature basically shows proof that the person signing has gone through the terms, as well as understanding and agreeing with them. You’ll want the cardholder to provide you with his/her signature face-to-face so that you can verify that he/she is indeed the person who owns the credit card. Although, you can always ask the customer to provide you with his/her personal identification number (PIN), wherein you don’t really need to obtain the customer’s signature.

Once the merchant has been able to obtain the signature, he/she must:

- Compare the signatures. Unless the cardholder uses a PIN, the merchant must compare the signature on the sales receipt with the signature that’s found on the credit card to see if they’re the same.

- The discrepancy between signatures.If the merchant sees that there are differences between the signatures, then he/she will need to contact the processing bank for further instructions.

- Signature not required. Transactions based on email orders, telephone orders, pre-authorized orders, electronic commerce orders, etc, can be completed without the need to obtain the cardholder’s signature. The merchant will need to place what type of order was made in the receipt to avoid any problems related to the buyer’s signature.

6. The Merchant’s Signature

Just as important as the cardholder’s signature, the merchant will need to provide his/her signature on It is recommended that only the last four digits of the primary account number be printed on the receipt. the receipt as this will ensure that the merchant has also agreed to the terms of the transaction. You may also like sample receipt templates.

7. The Primary Account Number

The primary account number (PAN) must be truncated on all cardholder-activated terminal sales receipts. Country or state laws require that all purchase via credit cards require this piece of information within the receipt. It is recommended that only the last four digits of the primary account number be printed on the receipt. he name and last four digits of the card’s account number will need to match with whatever is printed on the credit card receipt. You may also see free receipt templates.

8. Cardholder Identification

The merchant will need to provide accurate information of whatever is placed within the cardholder’s credit card into the receipt. This will include everything from the serial number, expiration date, the jurisdiction of the issue, customer name (in the event that the customer’s name is not similar to the one found in the card, and the customer address. You may also see receipt formats in a word.

9. Transaction Certificate

The transaction certificate is not required on the sales receipt. However, should the processing bank choose to record the receipt of a transaction certificate on the sales receipt, then the merchant will need to enter the complete transaction certificate into the receipt.

10. Prohibited Information

These are the things that every credit card receipt should not contain. So here are the following:

- The cardholder’s PIN, any part of the PIN, or any fill characters representing the PIN.

- The credit card’s verification code (CVC 2, CVV2 or CID). This would be the three-digit number that would be located on the back of a Visa, Mastercard and Discover cards, while this being a four-digit number that’s located in front of any American Express cards.

In the event that you would like to learn more about credit card receipts or anything related to this particular topic (such as how to fill up a credit card authorization form), then all you have to do is go through our site, find the articles that contain whatever information you need, and use the information you’re able to gather to help you and your company out.