Bring Your Vision to Life with Bank Letter Templates from Template.net

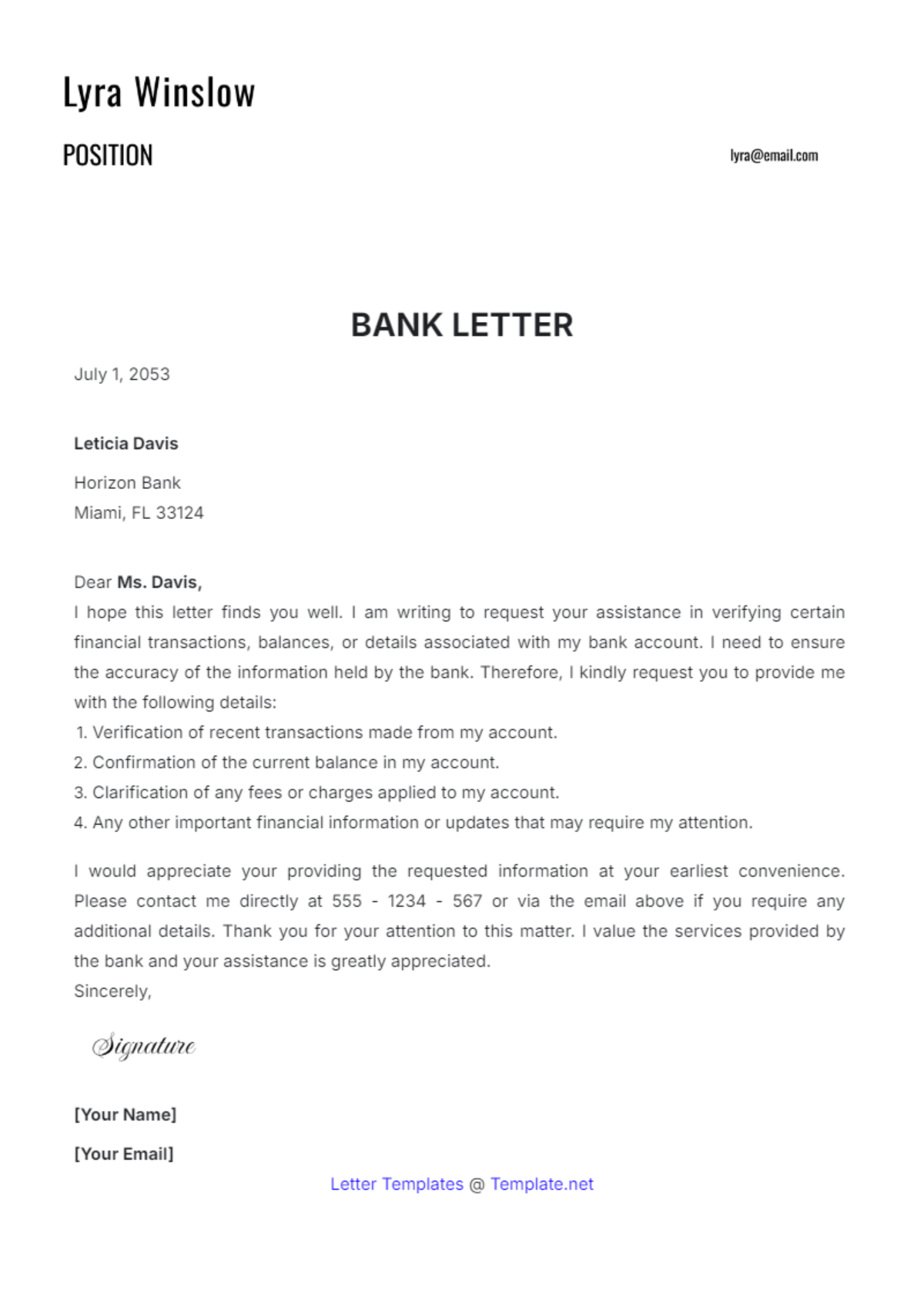

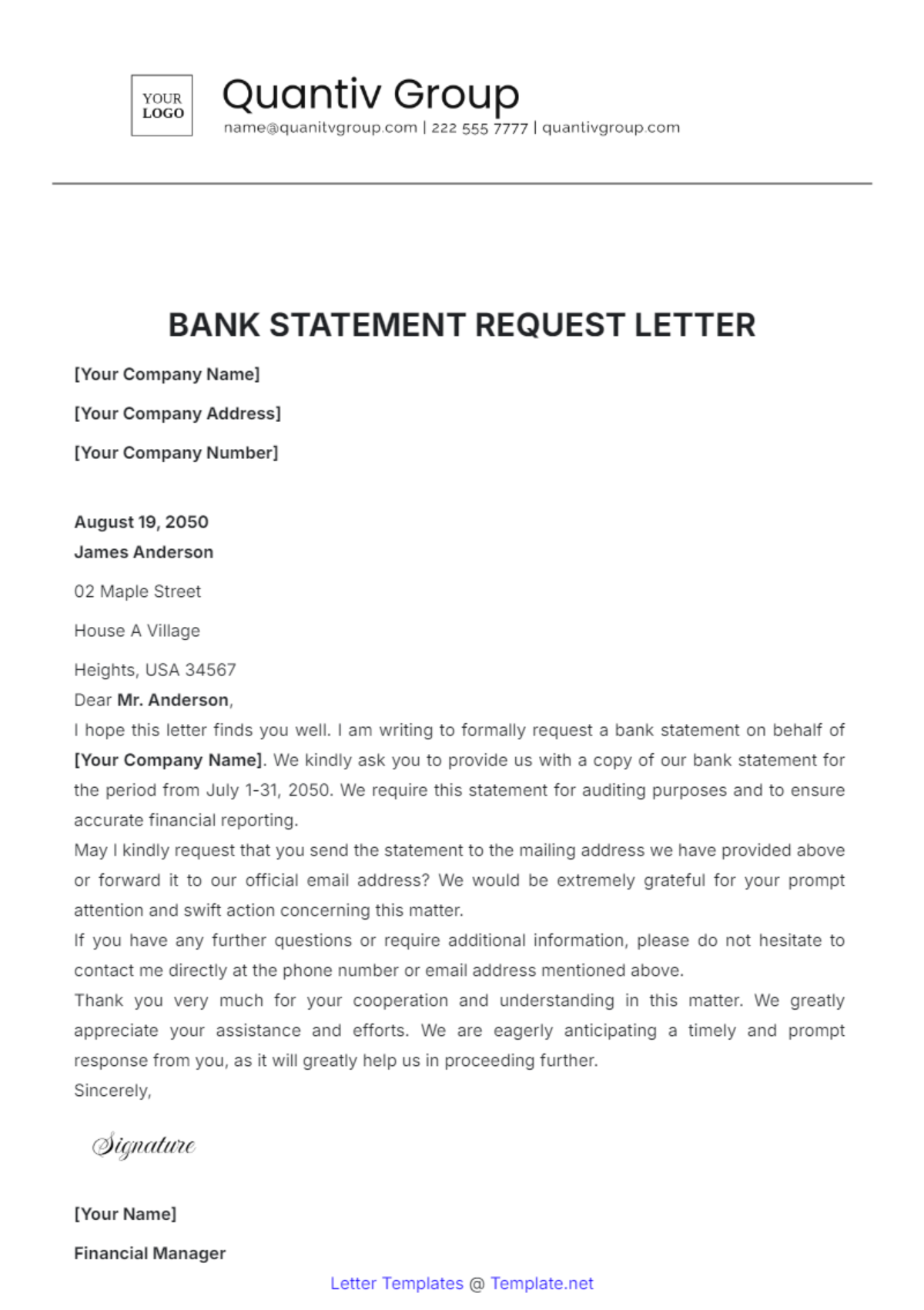

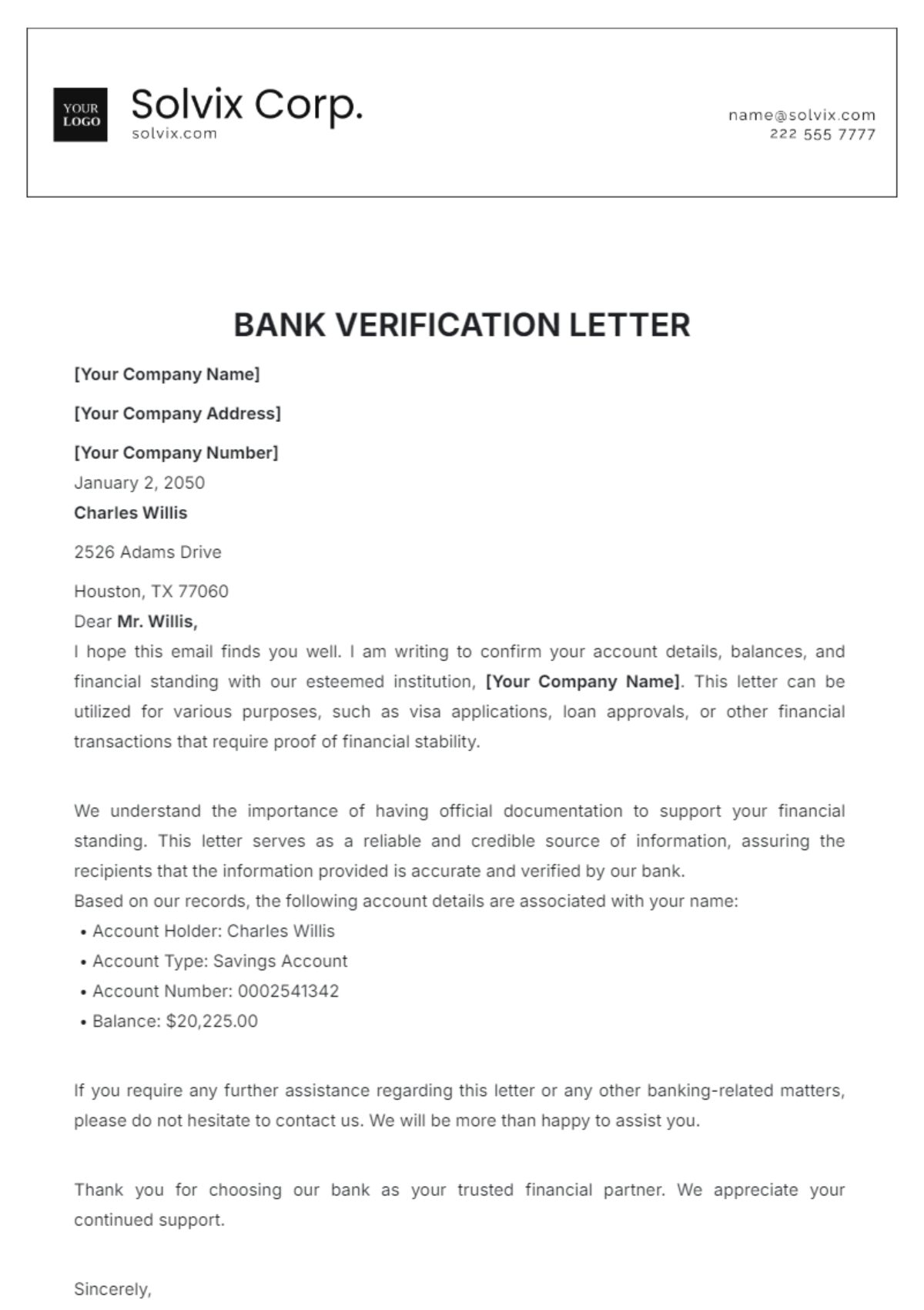

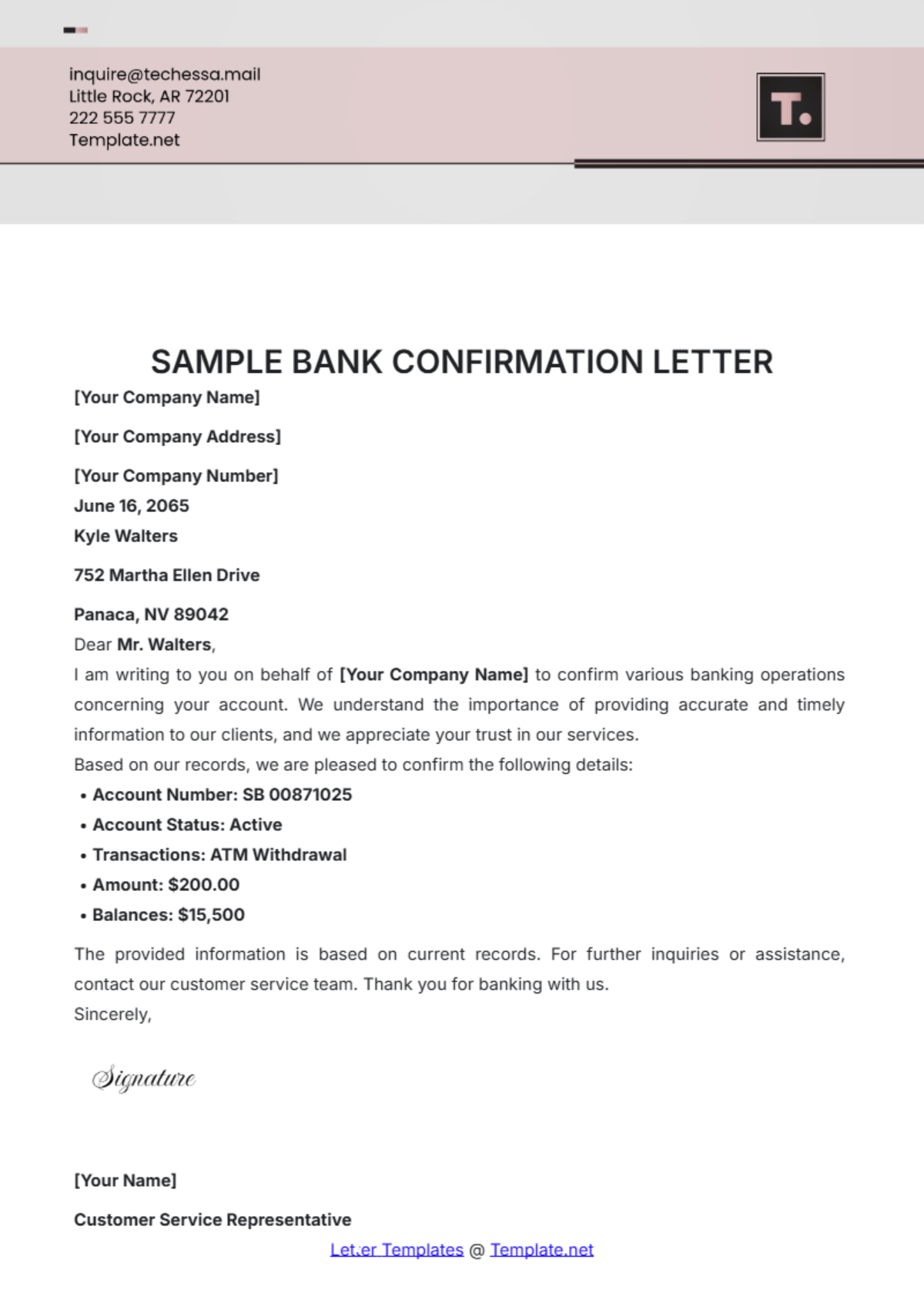

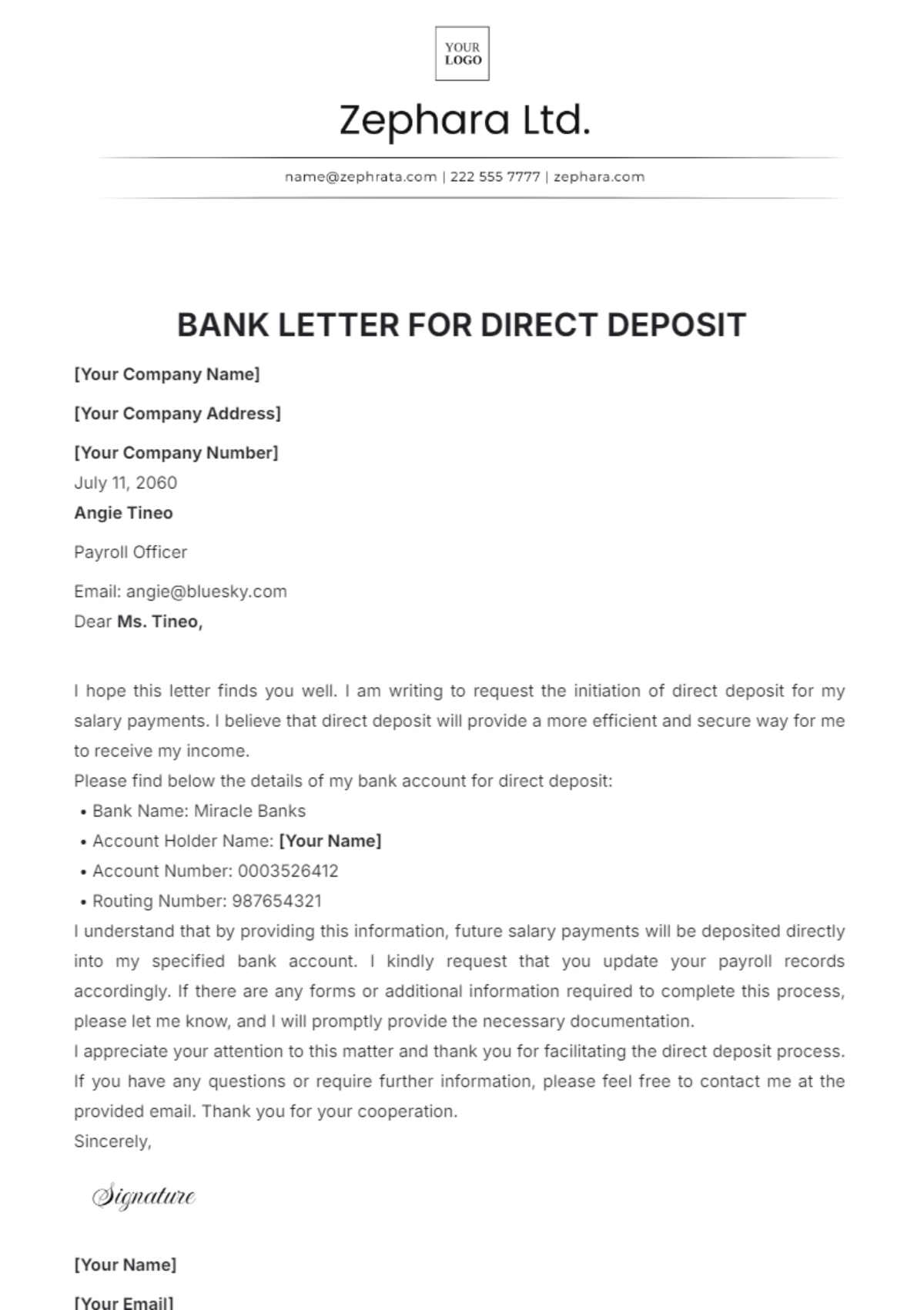

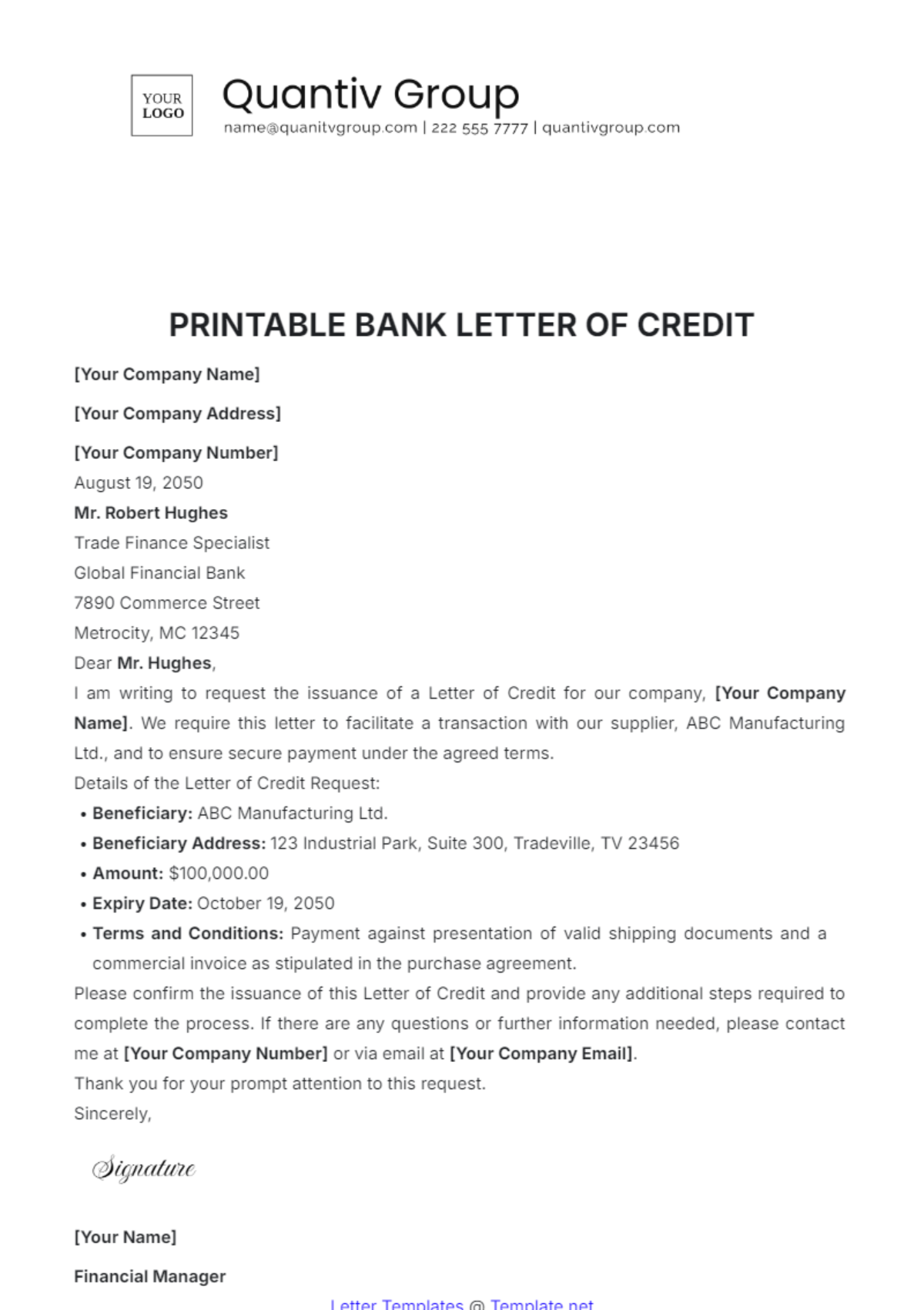

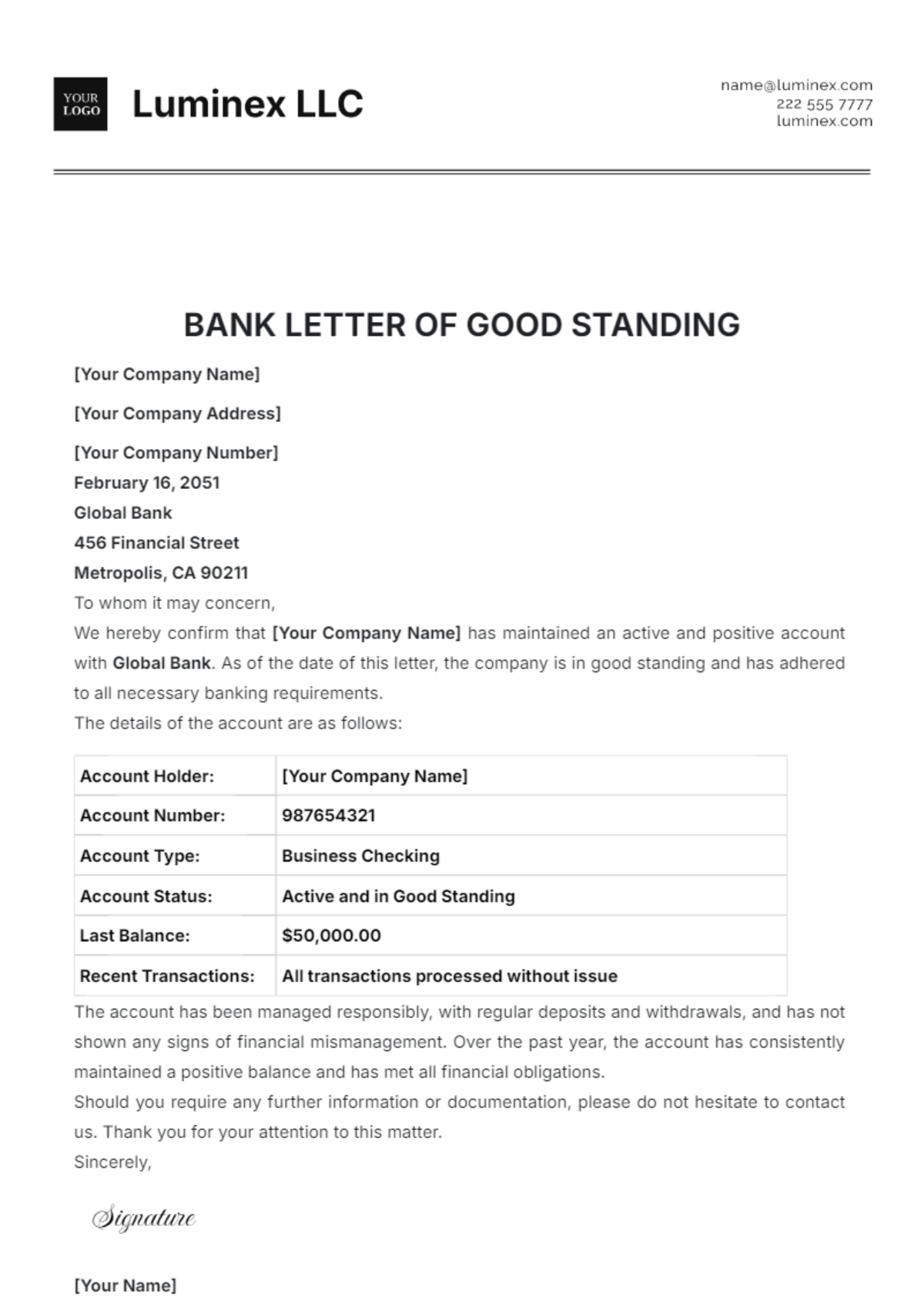

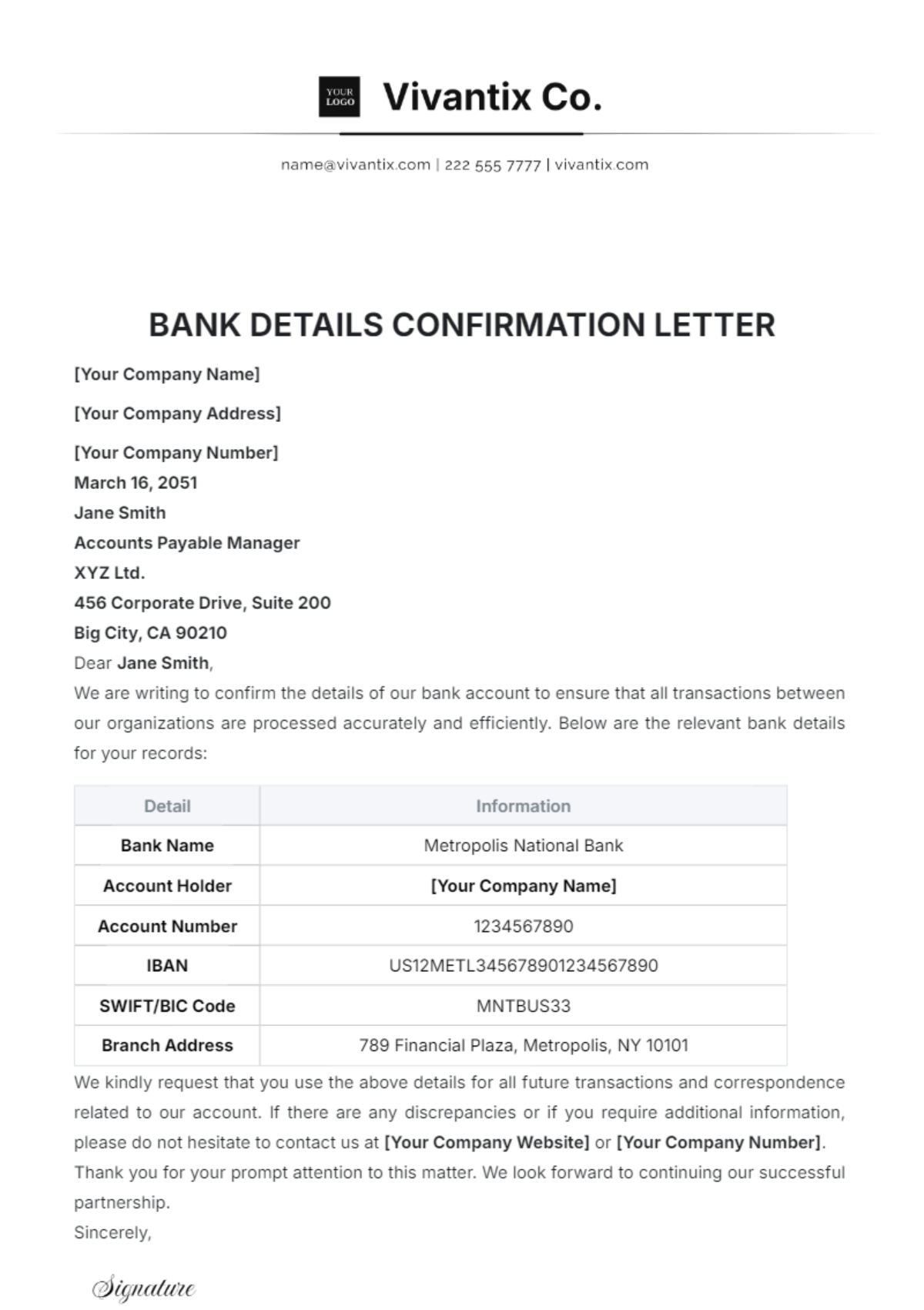

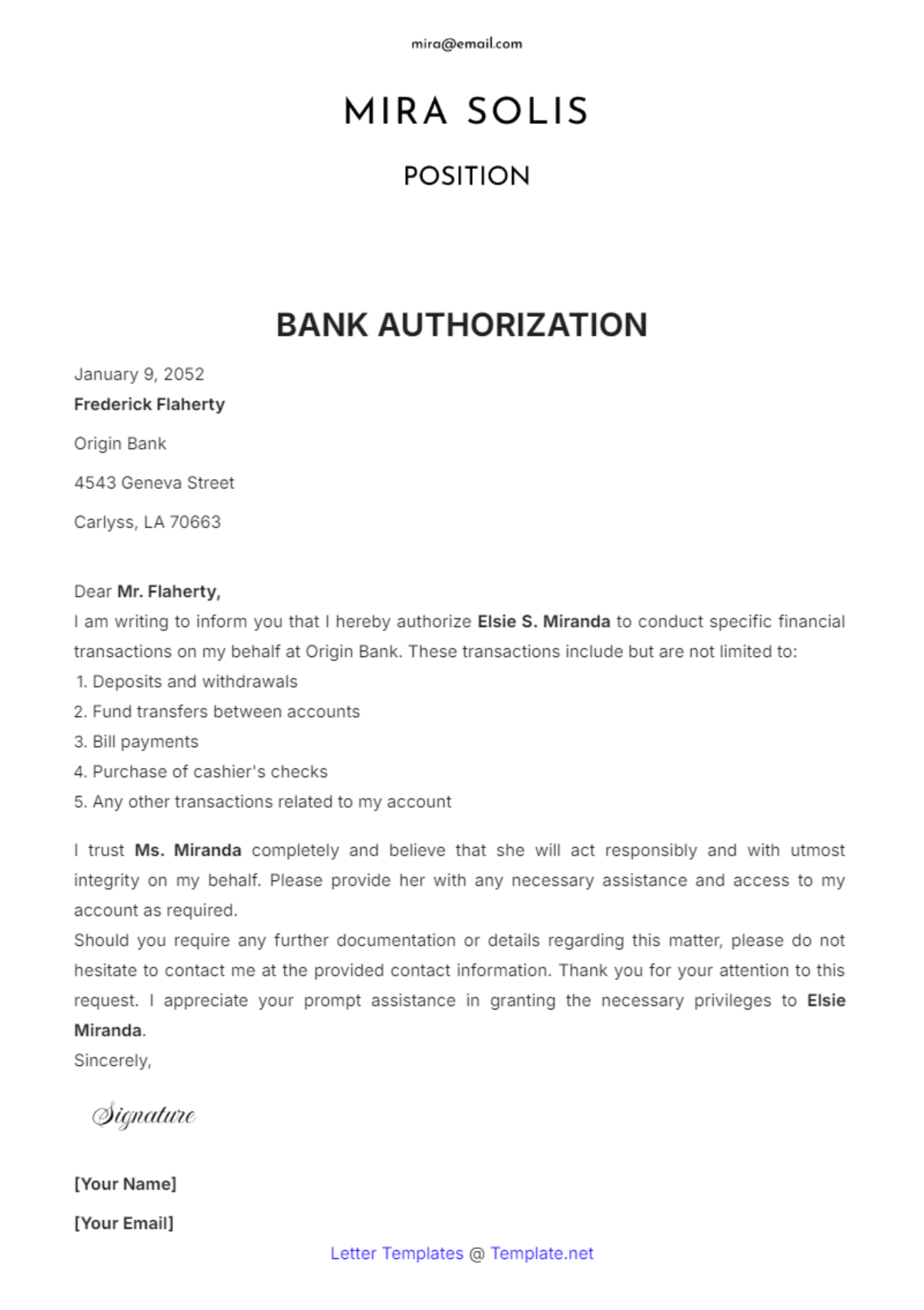

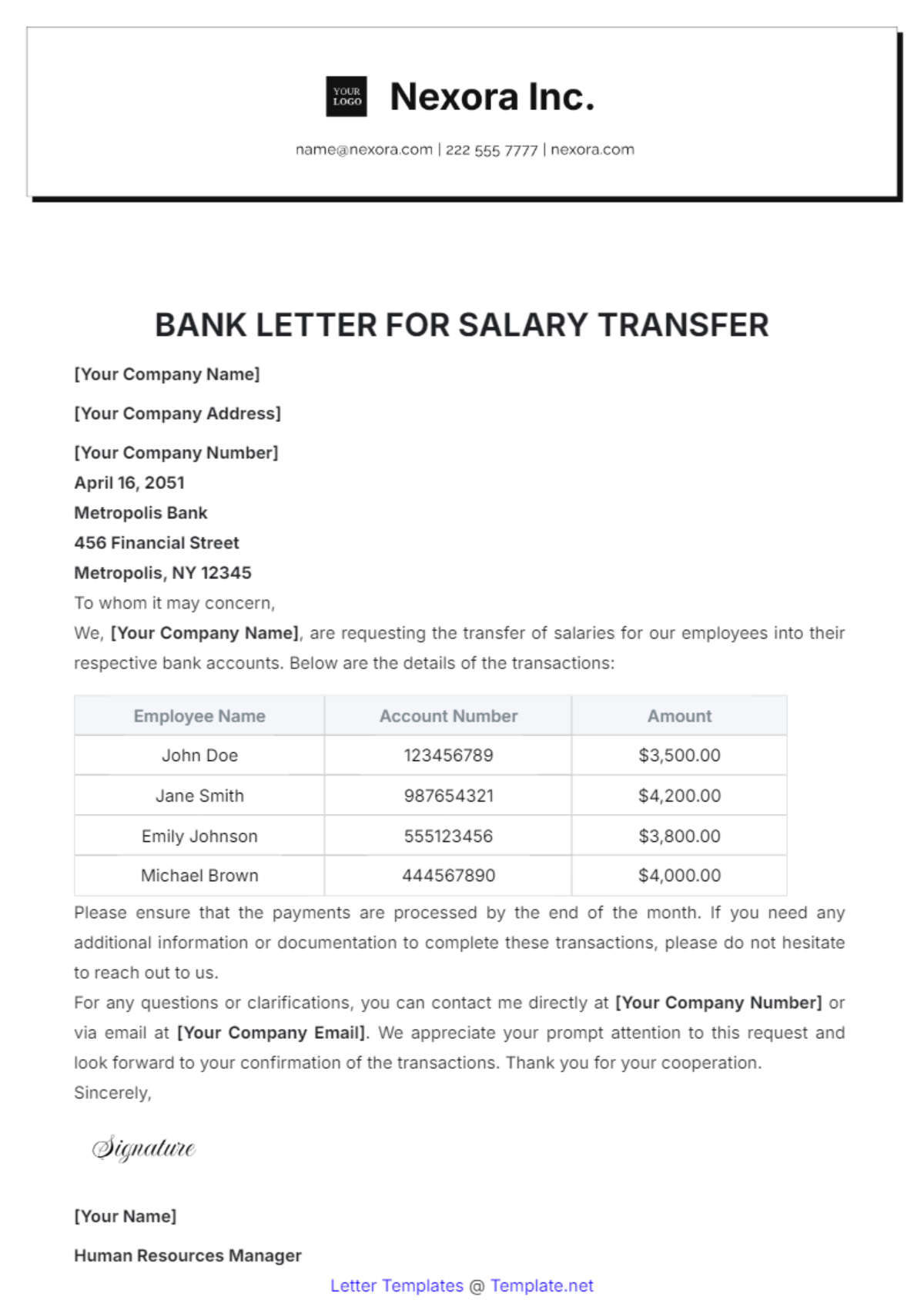

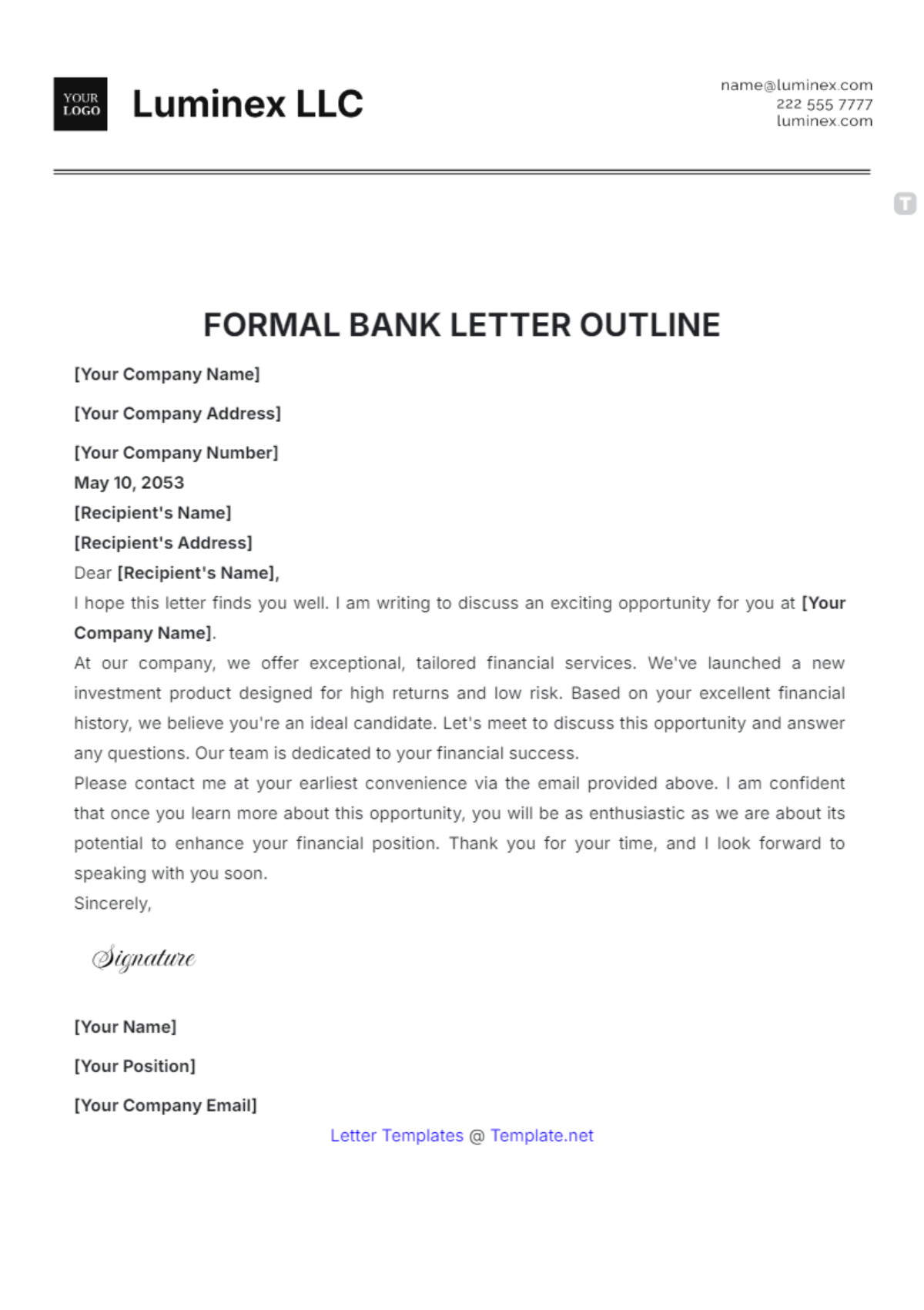

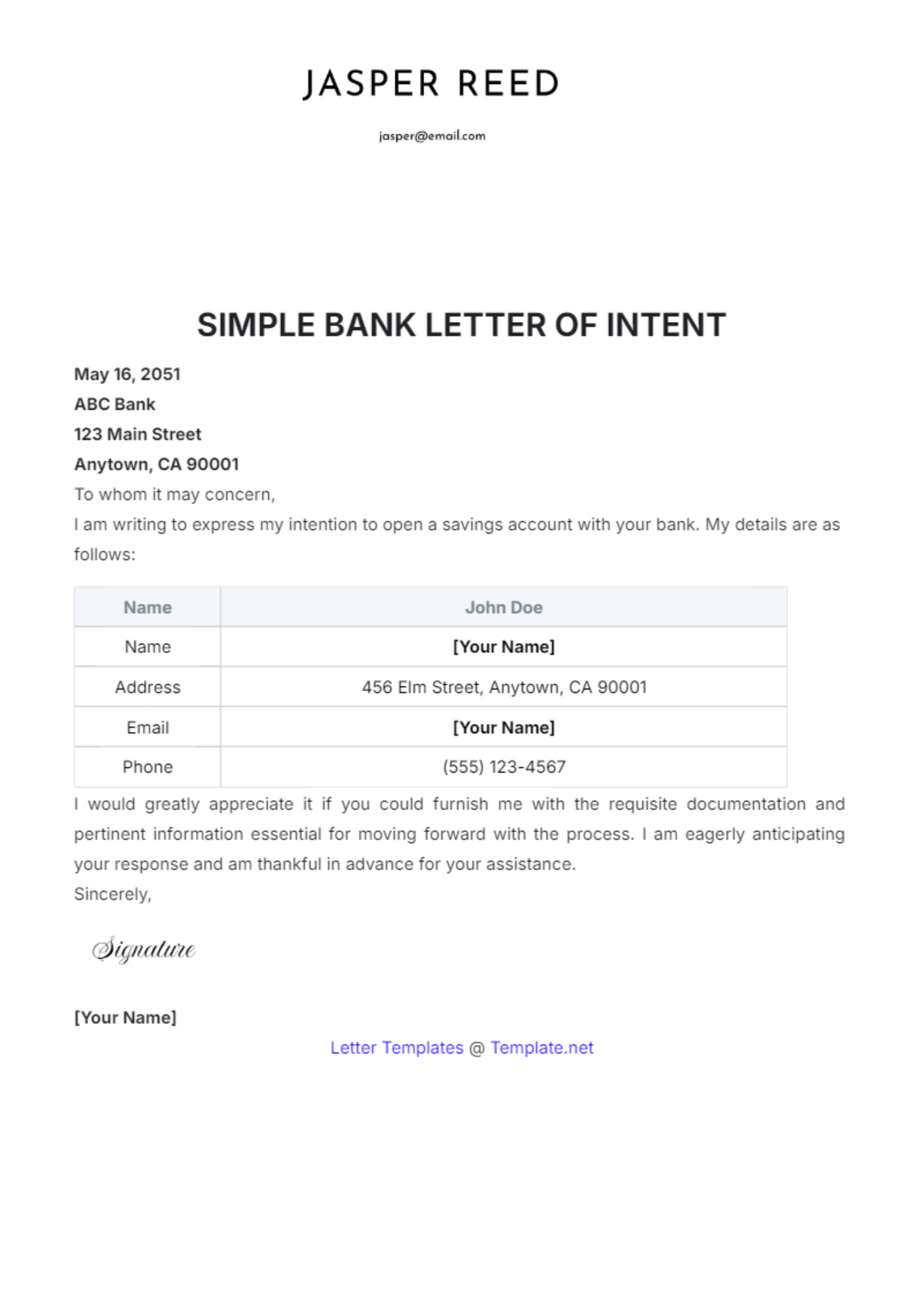

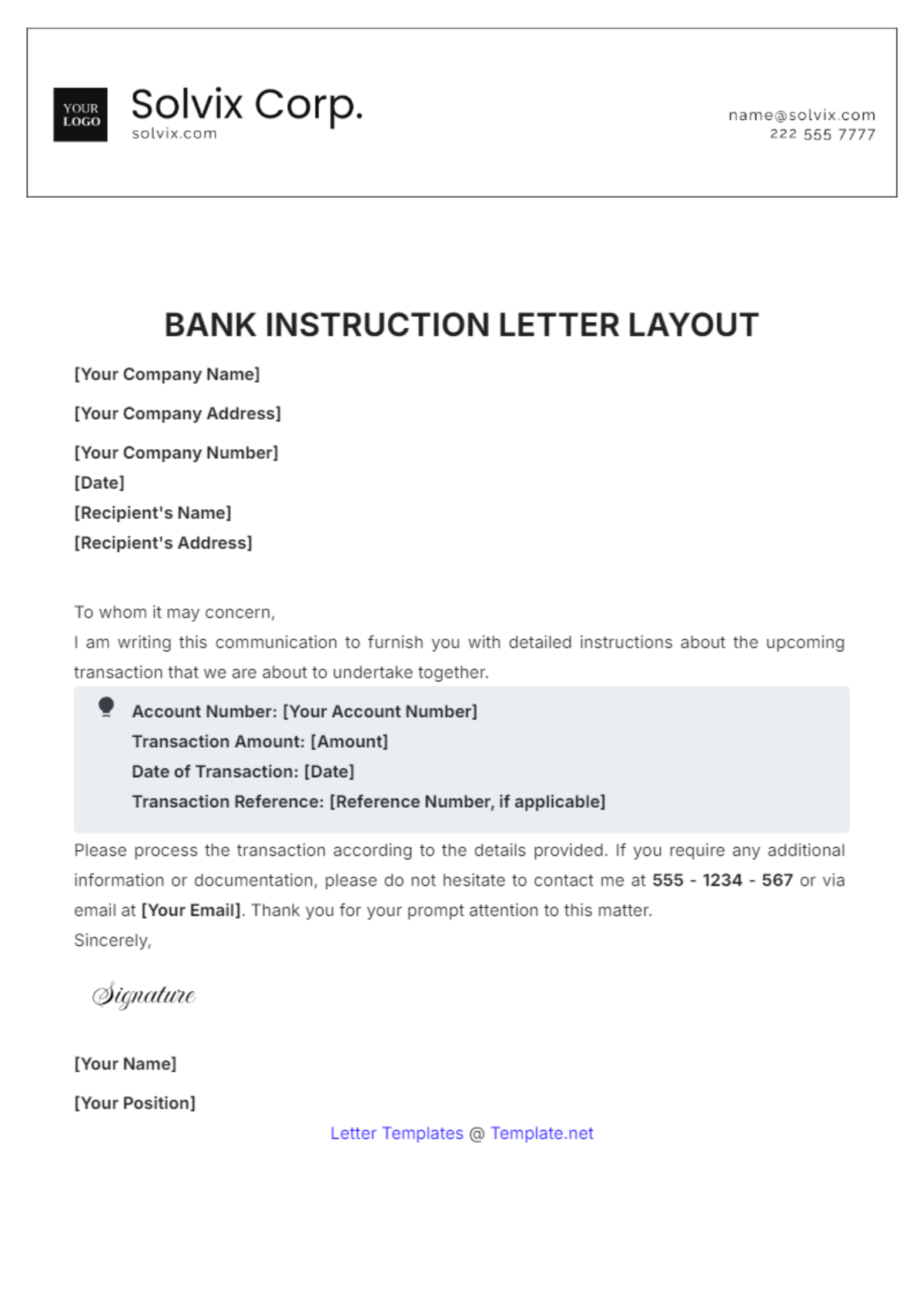

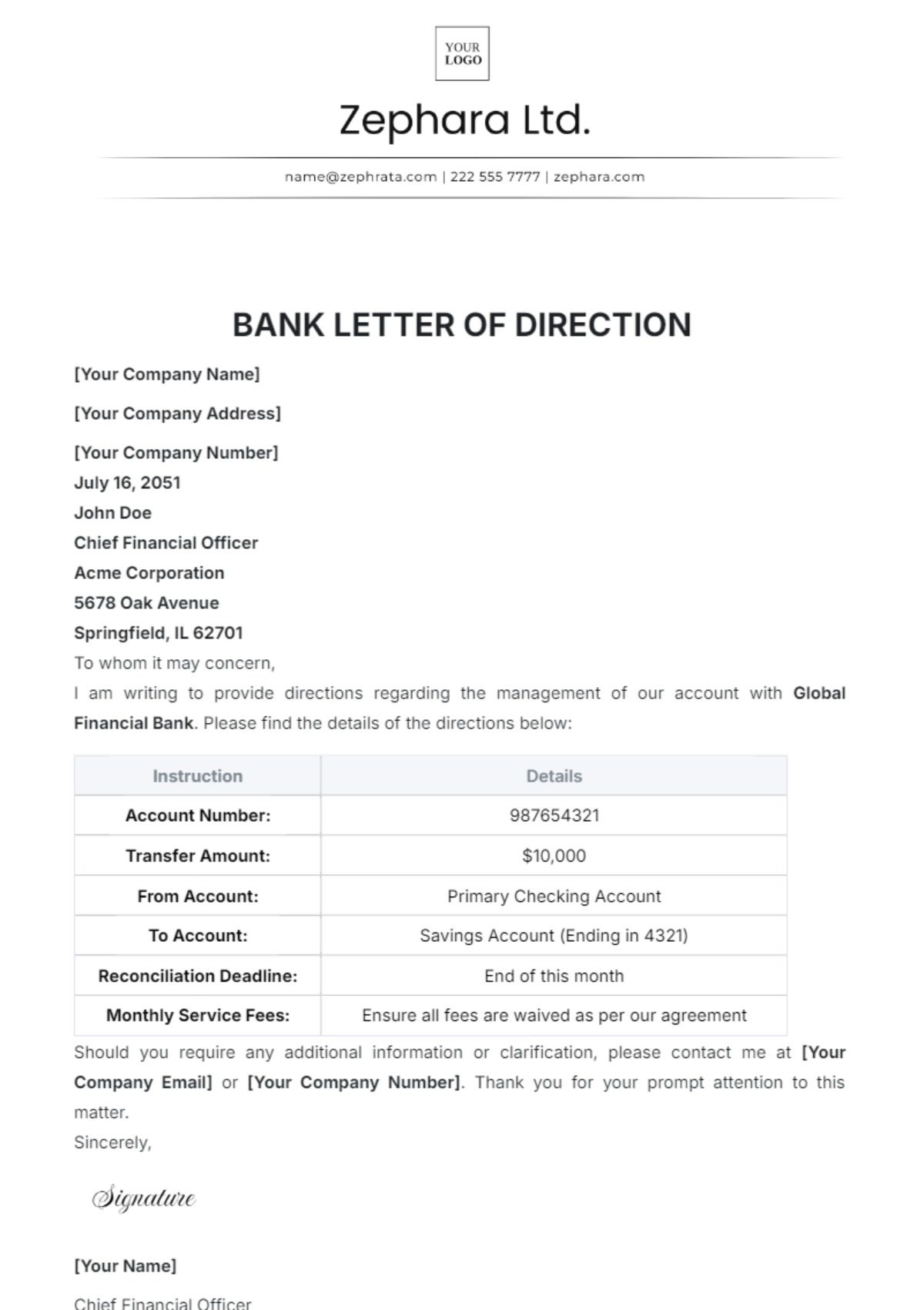

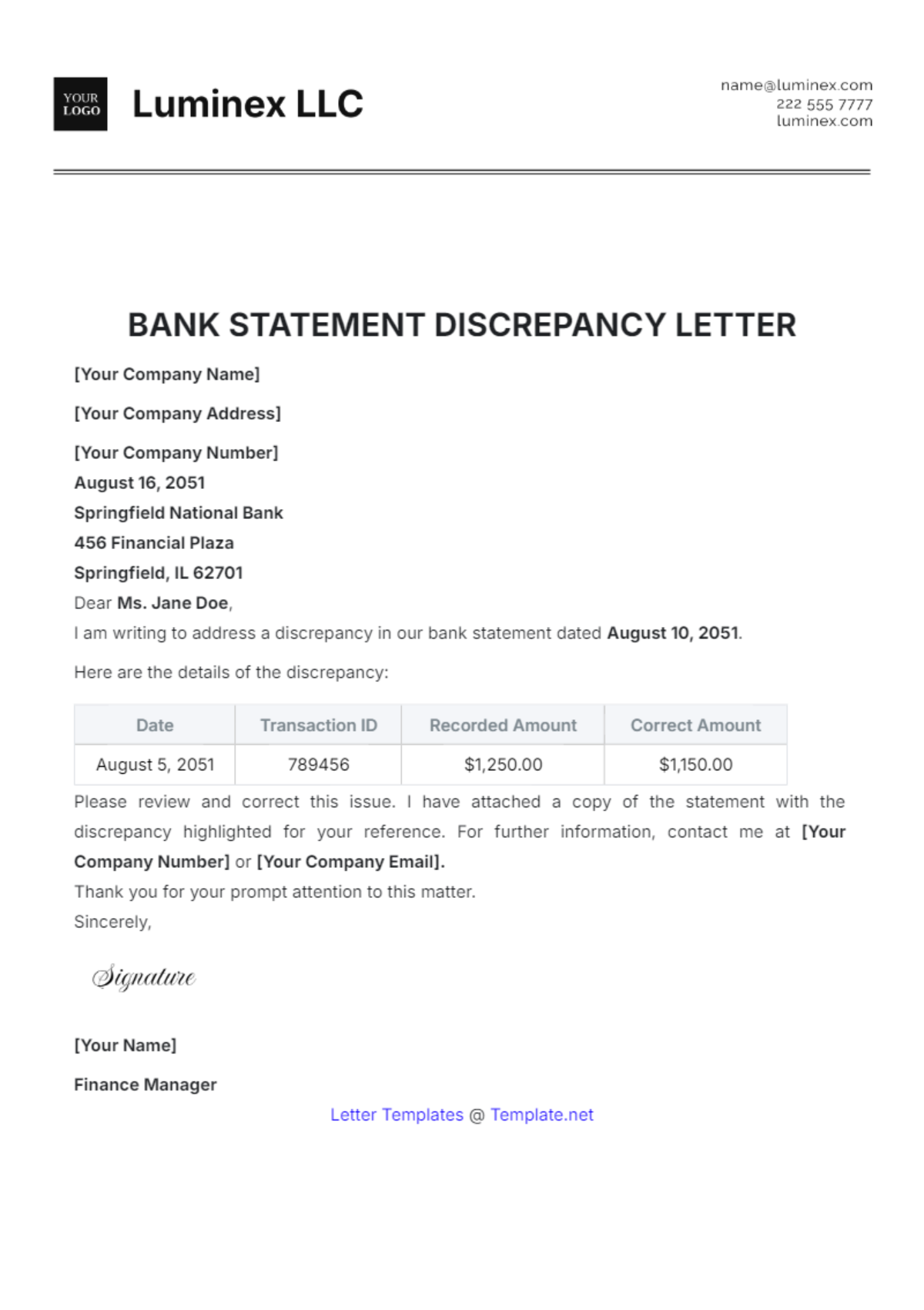

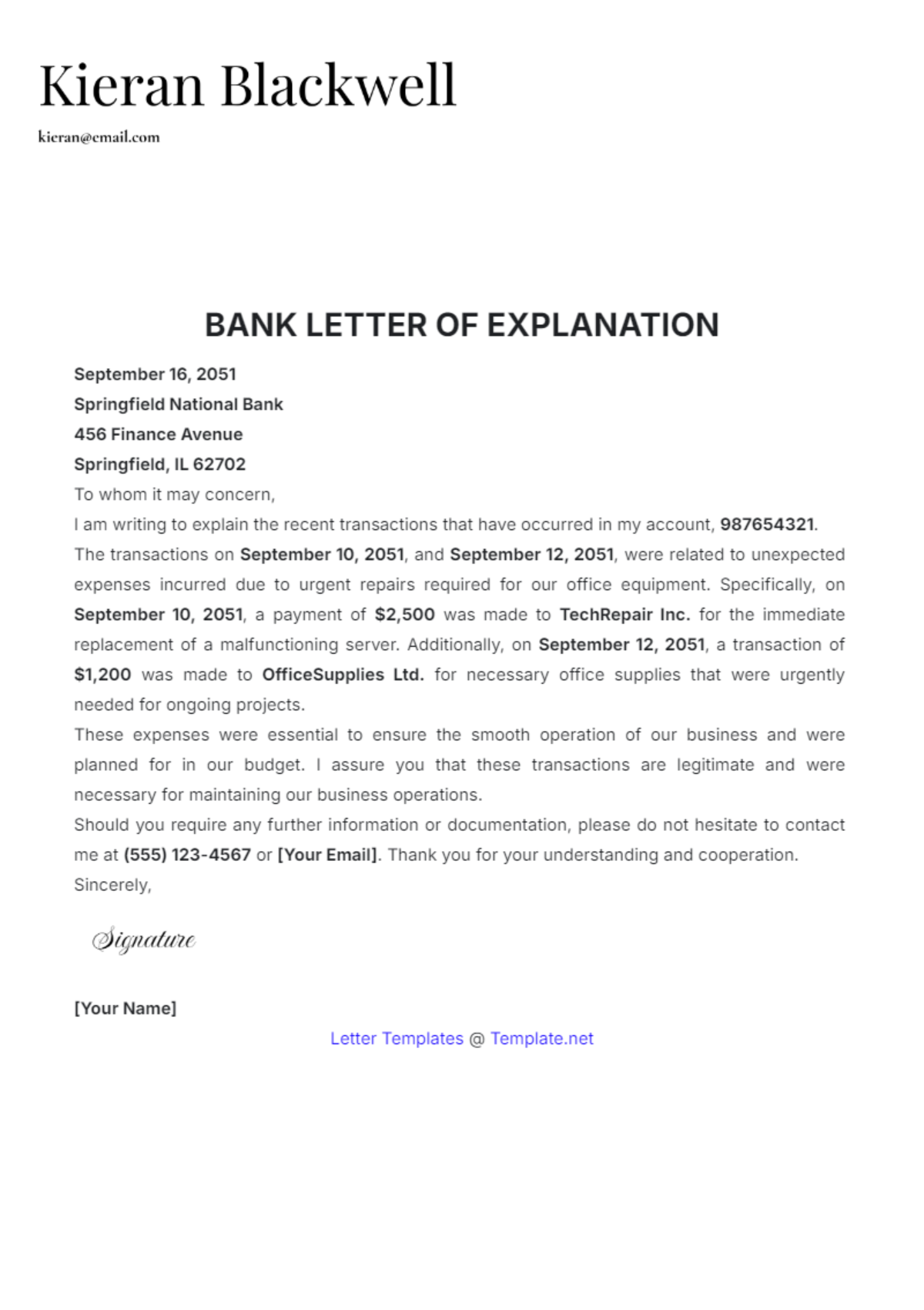

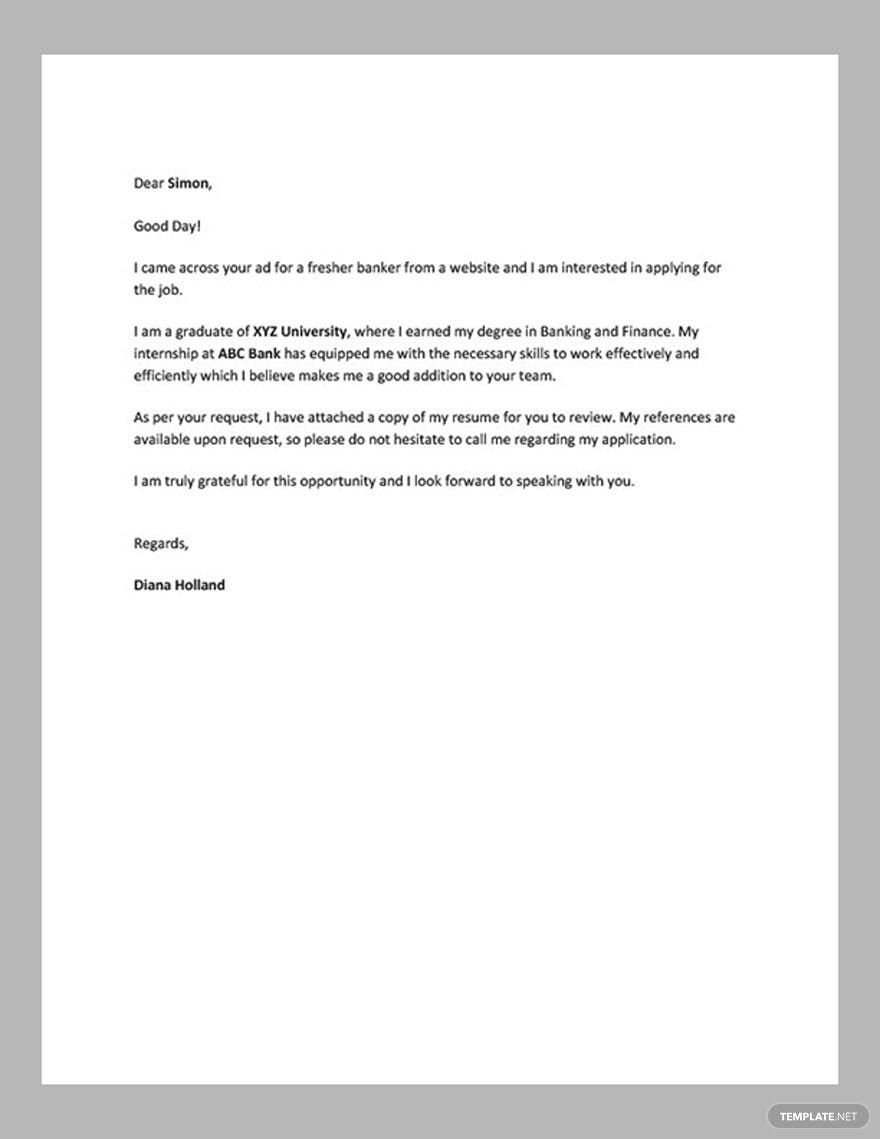

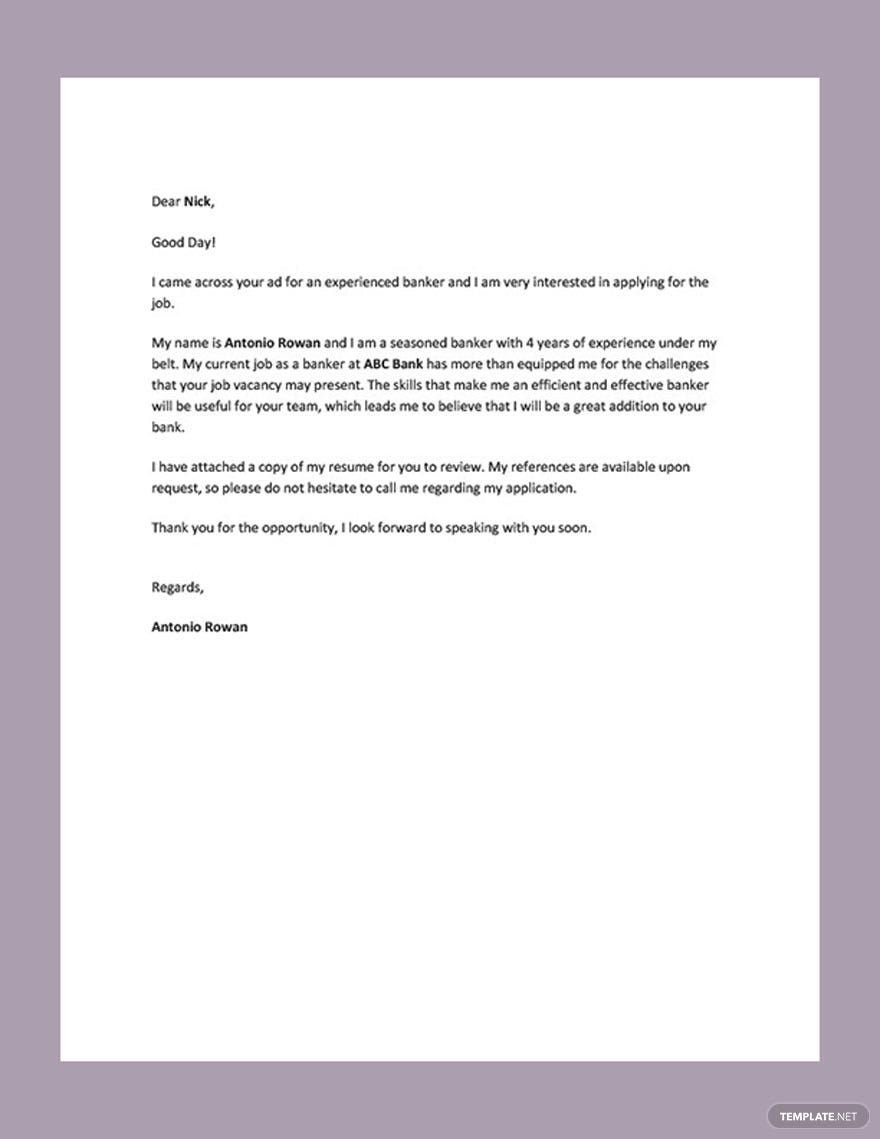

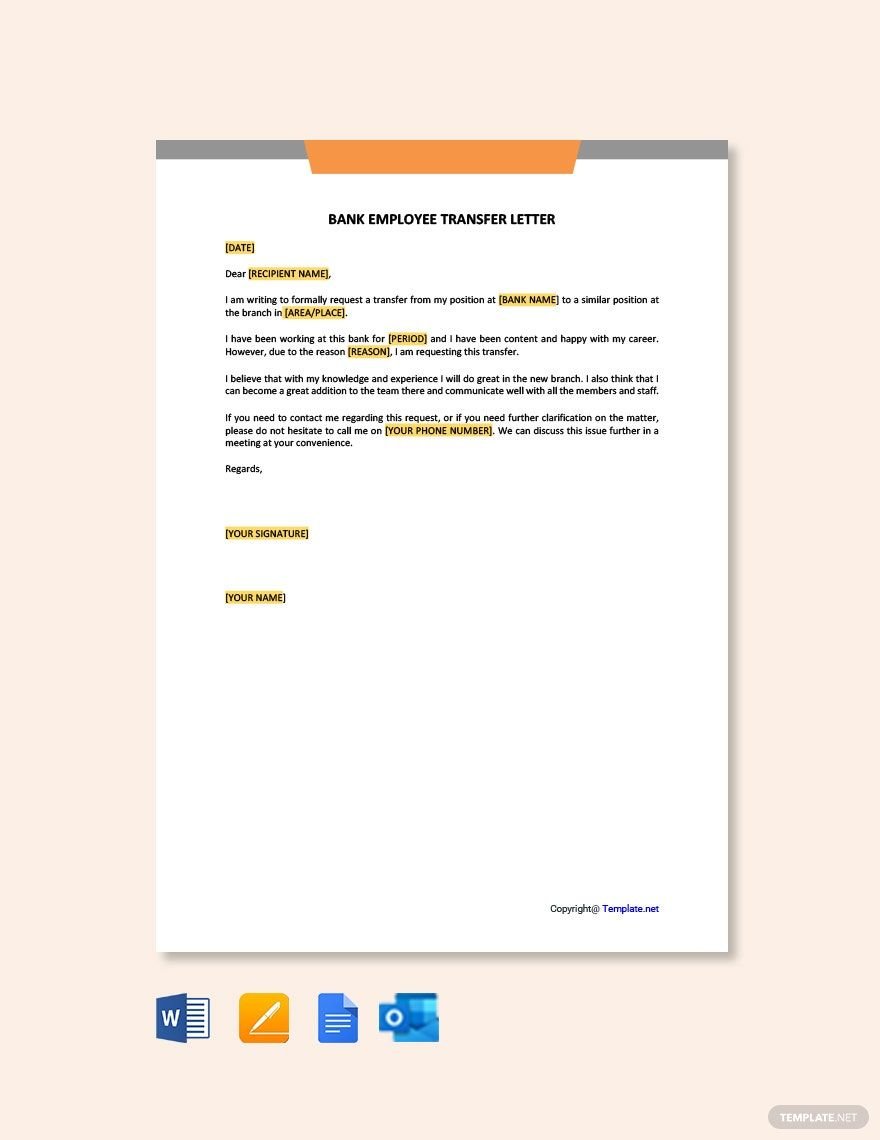

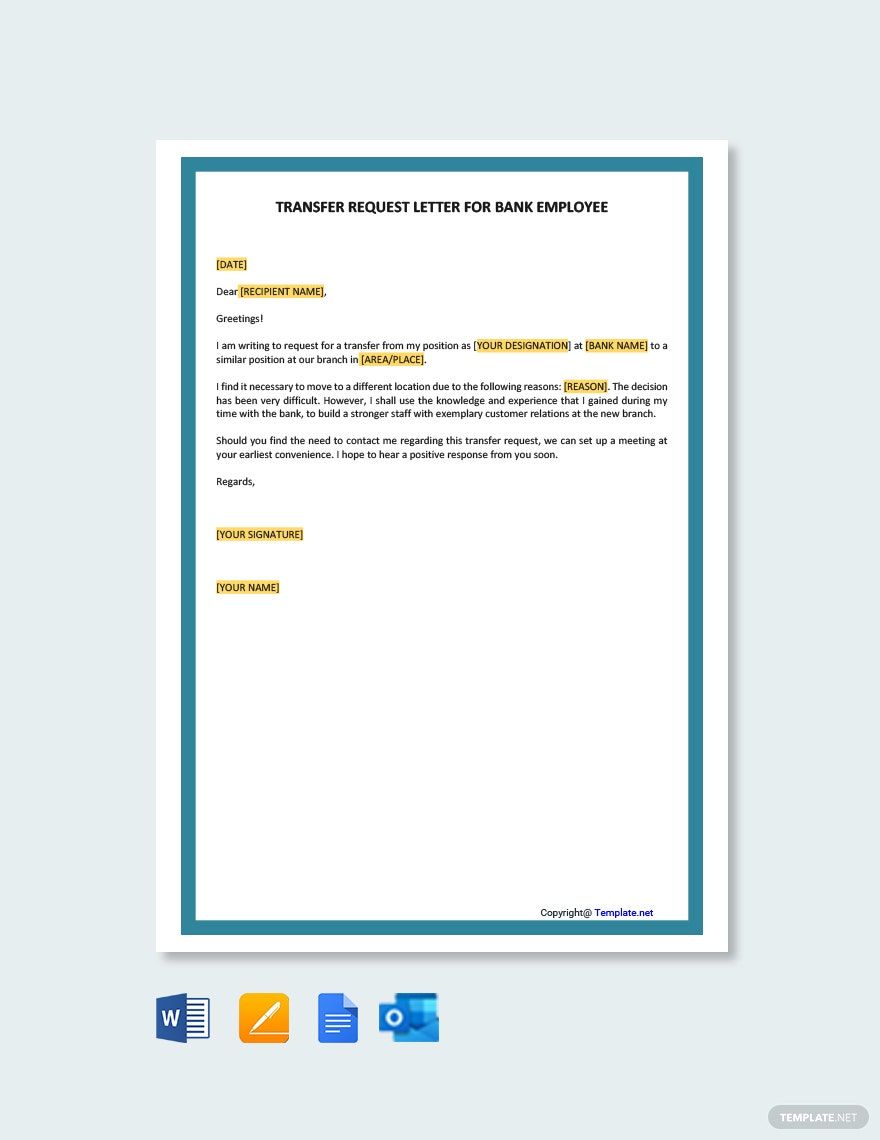

Keep your professional communications seamless, polished, and effective with Template.net's Bank Letter Templates. Designed for business professionals, financial institutions, and corporate entities, these templates empower you to engage your audience, enhance clarity, and maintain a consistent brand voice effortlessly. Utilize these ready-made templates to announce policy changes, promote new financial products, or invite stakeholders to an investment event. Each template includes essential fields like date, recipient information, and a customizable closing signature to ensure your messages remain professional and personal. Plus, you don't need any advanced design skills to create an impeccable letter; our templates offer free, professional-grade designs that are easily adaptable for both print and digital formats, saving you time and resources.

Discover the many Bank Letter Template options we have on hand at Template.net. Select the perfect template that suits your needs, effortlessly swap in your brand assets, and tweak colors and fonts to match your organization's aesthetic. Add a touch of sophistication by dragging-and-dropping icons or graphics, and enhance engagement with subtle animated effects using our AI-powered text tools. With endless possibilities and a barrier-free platform, you can enjoy a smooth, creative process. Our library receives regularly updated templates, ensuring fresh and relevant designs are always at your fingertips. Once your letter is complete, download it for physical distribution, or share it digitally via a link, email, or export to multiple channels, making collaboration easy and efficient.